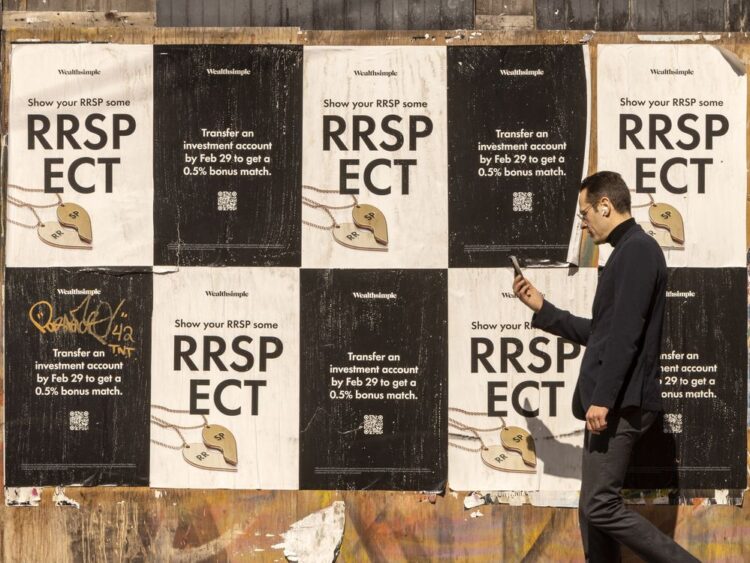

With the beginning of the 2026

registered retirement financial savings plan

(RRSP) season, I’m reminded of a gathering a few years in the past. I met with a consumer who was all for studying extra a couple of

also known as an “instant financing association.” The plan entails leveraging the money worth of a everlasting life insurance coverage coverage to supply instant entry to capital, usually for funding or enterprise functions.

The consumer cherished the idea, and requested me if I had any extra “nice” tax concepts for him. I began by saying that I assume he had absolutely maxed out his RRSP contributions, at which level he interrupted me, and mentioned, emphatically, “

.”

I used to be dumbfounded. Didn’t imagine in RRSPs? It’s not prefer it’s a faith. So, I requested him to make clear.

He went on to elucidate that, in his view, RRSPs had been “ineffective” as a result of while you withdraw the funds in retirement it’s a must to pay tax on the complete worth of the quantity withdrawn. And if try to be so unfortunate as to die with a big RRSP, or its successor a big

registered retirement earnings fund

(RRIF), then the federal government takes greater than half of it in most provinces (for values above $258,482 in 2026).

After I calmed down, I patiently tried to stroll the consumer by

why the RRSP must be a no brainer

for almost each Canadian, the one potential exception being taxpayers with restricted funds to contribute and who might choose a

tax-free financial savings account

(TFSA) over an RRSP.

Though the consumer was appropriate in that

you do pay tax on RRSP withdrawals

, it’s essential to remember that you additionally acquired a tax deduction while you contributed. In case your tax price is similar within the yr of contribution that it’s within the yr of withdrawal, an RRSP supplies a very tax-free price of return. In case your tax price is decrease within the yr of withdrawal, you’ll get an excellent higher after-tax price of return in your RRSP funding. In actual fact, even when your tax price is greater within the yr of withdrawal, as I’ve proven in my report

Simply do it: The case for tax-free investing

, given an extended sufficient interval of tax-free compounding, you might be nonetheless be forward of the sport with an RRSP over investing in a non-registered account.

For instance the hands-down benefit of an RRSP over non-registered investing, take into account the next instance. Let’s assume you earned $3,000 of employment earnings in 2025, have a 33.33 per cent marginal tax price, and your investments develop at 5 per cent over the course of the yr. If you happen to invested in an RRSP, you wouldn’t pay tax in your earnings so you’d have the complete $3,000 to take a position.

Development of 5 per cent would enhance the worth of your RRSP funding after the primary yr by $150 ($3,000 occasions 5 per cent) to a worth of $3,150. If you happen to had been then to money in your RRSP by withdrawing the funds, you’d pay tax of $1,050 (33.33 per cent on the complete $3,150 withdrawn from the RRSP), leaving you with $2,100 after-tax.

Now, let’s examine that to the non-registered account, which some taxpayers imagine is a more sensible choice since capital positive factors are solely 50 per cent taxable. If as a substitute you selected to take a position your $3,000 of employment earnings in a non-registered account, you’d pay upfront tax of $1,000 ($3,000 occasions 33.33 per cent) in your $3,000 of earnings, leaving solely $2,000 to take a position.

On the identical 5 per cent price of return, your non-registered funding would have grown by $100 ($2,000 occasions 5 per cent), making your account price $2,100 on the finish of the yr. If you happen to had been to then money in your non-registered funding, assuming that the 5 per cent development was within the type of a 50 per cent taxable capital acquire, you’ll pay tax of about $17 (50 per cent occasions $100 occasions 33.33 per cent), yielding $2,083.

As we will see, the worth of non-registered funding ($2,083) after-tax, is price lower than the worth of the RRSP ($2,100), that means your RRSP has successfully given you a tax-free return of $100 (5 per cent) in your “web funding” of $2,000 (being the $3,000 you contributed much less the 33.33 per cent tax you paid).

One other means to think about it’s to contemplate your RRSP a partnership between you and the federal government. Retired Ottawa accountant Paul Rastas has greater than 50 years’ expertise in Canadian tax planning and compliance, and for years has been making an attempt to assist Canadians higher perceive the mechanics of the RRSP. As Mr. Rastas places it, “Opposite to in style perception, your RRSP assertion doesn’t report your funding ‘worth’ in actual Canadian {dollars}. It’s in ‘RR$P {dollars}.’ RR$P {dollars} are analogous to a overseas forex and have to be transformed to actual Canadian {dollars} earlier than being spendable. The change price is your particular person, private, marginal tax price.”

Mr. Rastas provides an instance of somebody who contributes $10,000 to an RRSP. Whereas their RRSP assertion might present $10,000, this truly represents (at a 30 per cent marginal price) a $7,000 funding, plus $3,000 of what he refers to as “pre-paid tax,” as a result of CRA upon withdrawal. (The instance assumes your tax price within the yr of contribution of 30 per cent is similar as your price within the yr of withdrawal).

If that $10,000 was invested at 7 per cent, a decade later the RRSP can be price almost double, or nearly $20,000. This $20,000 steadiness represents the preliminary $7,000 funding, plus $7,000 of development, plus the unique $3,000 of “pre-paid tax,” plus $3,000 of development on that. The web $7,000 funding doubled, tax-free, and is now price $14,000 after-tax. As proof, if the RRSP price $20,000 is cashed in, tax of 30 per cent, or $6,000, can be paid, leaving $14,000 after-tax.

As a reminder, the 2026 RRSP contribution deadline is Monday, March 2, 2026, if you wish to declare a deduction towards your 2025 earnings.

Jamie Golombek,

FCPA, FCA, CFP, CLU, TEP, is the managing director, Tax & Property Planning with CIBC Personal Wealth in Toronto.

Jamie.Golombek@cibc.com

.

If you happen to favored this story,

join extra

within the FP Investor e-newsletter.