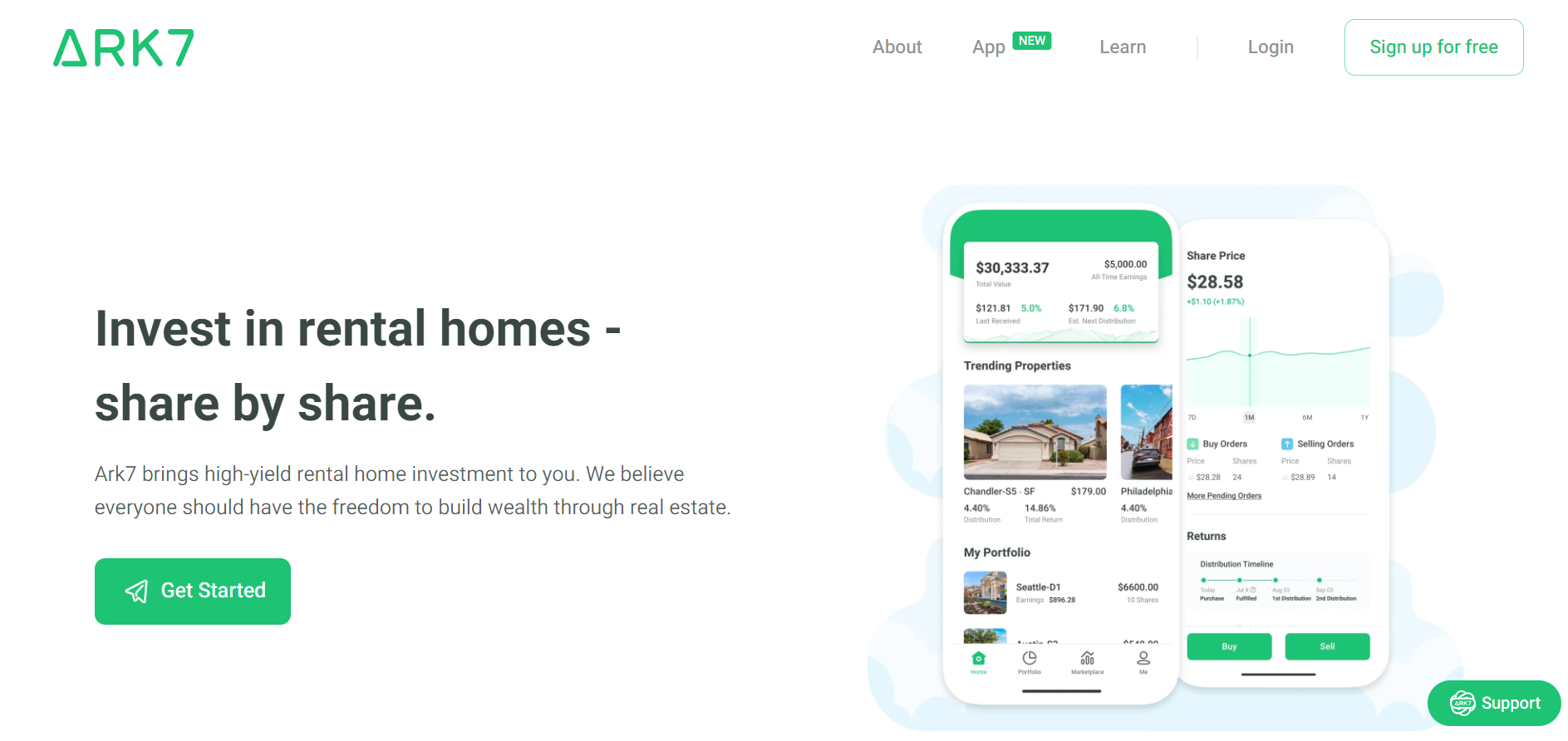

Ark7 is an actual property funding platform that has gained reputation lately. It presents buyers the chance to personal shares in income-producing properties with out the effort of being a landlord or coping with the complexities of conventional actual property investing. On this complete Ark7 assessment, I’ll take a better take a look at Ark7 and look at if it’s price your time.

.wp-review-35098.review-wrapper { font-family: ‘Open Sans’, sans-serif; }

Ark7 Abstract

The Dinks Ark7 Abstract

Ark7 is a fintech start-up with cellular and browser functions. The corporate buys rental property with an LLC and points shares to buyers. Ark7 then takes a administration price and manages every property on behalf of its buyers. The corporate is new however well-suited for risk-tolerant buyers who desire a geographically centered investing technique.

Execs

- Extremely particular geographic alternatives

- Robust operational self-discipline

- Person pleasant interface

- Low investing minimums

- Good high quality alternatives

- Aggressive returns

Cons

- New platform

- Lack of managerial management

- Loss danger

- Lack of leverage

- Much less tax flexibility

.wp-review-35098.review-wrapper {

width: 100%;

float: left;

}

.wp-review-35098.review-wrapper,

.wp-review-35098 .review-title,

.wp-review-35098 .review-desc p,

.wp-review-35098 .reviewed-item p {

shade: #555555;

}

.wp-review-35098 .review-title {

padding-top: 15px;

font-weight: daring;

}

.wp-review-35098 .review-links a {

shade: #26af1a;

}

.wp-review-35098 .review-links a:hover {

background: #26af1a;

shade: #fff;

}

.wp-review-35098 .review-list li,

.wp-review-35098.review-wrapper {

background: #ffffff;

}

.wp-review-35098 .review-title,

.wp-review-35098 .review-list li:nth-child(2n),

.wp-review-35098 .wpr-user-features-rating .user-review-title {

background: #26af1a;

}

.wp-review-35098.review-wrapper,

.wp-review-35098 .review-title,

.wp-review-35098 .review-list li,

.wp-review-35098 .review-list li:last-child,

.wp-review-35098 .user-review-area,

.wp-review-35098 .reviewed-item,

.wp-review-35098 .review-links,

.wp-review-35098 .wpr-user-features-rating {

border-color: #26af1a;

}

.wp-review-35098 .wpr-rating-accept-btn {

background: #26af1a;

}

.wp-review-35098.review-wrapper .user-review-title {

shade: inherit;

}

.wp-review-35098.review-wrapper .user-review-area .review-circle { peak: 32px; }

{

“@context”: “http://schema.org”,

“@kind”: “Assessment”,

“itemReviewed”: {

“@kind”: “SoftwareApplication”,

“title”: “Ark7”,

“picture”: “https://www.dinksfinance.com/photographs/2023/05/ark7-logo.jpg”,

“url”: “https://ark7.sjv.io/k0o0Gz”

},

“reviewRating”: {

“@kind”: “Ranking”,

“ratingValue”: 0,

“bestRating”: 100,

“worstRating”: 0

},

“creator”: {

“@kind”: “Individual”,

“title”: “James Hendrickson”

},

“reviewBody”: “Ark7 is a fintech start-up with cellular and browser functions. The corporate buys rental property with an LLC and points shares to buyers. Ark7 then takes a administration price and manages every property on behalf of its buyers. The corporate is new however well-suited for risk-tolerant buyers who desire a geographically centered investing technique.”

}

Understanding Ark7: A Transient Overview

Actual property investing has lengthy been thought-about probably the greatest methods to construct wealth and generate passive earnings. Nevertheless, for many individuals, investing in actual property is out of attain as a consequence of excessive transaction prices and important paperwork necessities. Ark7, at its core, is an answer to this downside. It permits buyers to entry actual property markets with out requiring massive quantities of capital.

Ark7 is an actual property crowdfunding platform that was based in 2017 to democratize actual property investing. The platform permits on a regular basis buyers to entry high-quality actual property offers that have been beforehand solely accessible to excessive socioeconomic standing or institutional buyers. Whereas the platform has charges and is much less versatile from a taxation standpoint, it’s appropriate for buyers who need to put money into a focused geographic method.

What’s Ark7?

At its core, Ark7 is a platform that enables buyers to buy fractional shares in properties. What Ark7 does is purchase a property, put it below a company umbrella and difficulty shares within the company. Which means that buyers can personal shares in an organization that owns a property, reasonably than having to buy the complete property themselves. By pooling their assets with different buyers, people can put money into high-quality actual property offers that they might not have been in a position to entry on their very own.

At its core, Ark7 is a platform that enables buyers to buy fractional shares in properties. What Ark7 does is purchase a property, put it below a company umbrella and difficulty shares within the company. Which means that buyers can personal shares in an organization that owns a property, reasonably than having to buy the complete property themselves. By pooling their assets with different buyers, people can put money into high-quality actual property offers that they might not have been in a position to entry on their very own.

Ark7 was based by Andy Zhao (an ex-Google engineer), James Weng, and Lynn Yang who acknowledged the potential of actual property investing for constructing wealth and producing passive earnings. They wished to create a platform that may enable on a regular basis buyers to entry actual property markets with extra ease and decrease value than current markets allowed for.

How Does Ark7 Work?

Ark7 is a fintech start-up with cellular and browser functions. Ark7 buys rental property below an LLC and points shares in that LLC that promote at various costs primarily based on the underlying financial worth of the property.

Share costs are decided by the property’s worth and might differ an awesome deal throughout markets. Ark7 permits the securities to be traded and has choices for holding your funding in an IRA.

Once you purchase shares within the LLC, you obtain part of the month-to-month property earnings proportionate to the proportion you personal. For instance, in the event you owned 10,000 shares in a property and there have been 20,000 shares excellent, you’d be entitled to 50% of the earnings, much less charges.

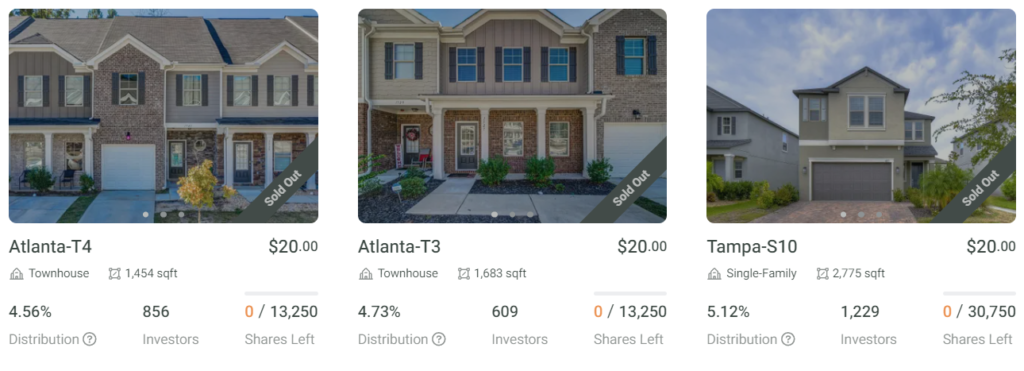

Rental properties listed on Ark7 are situated in varied actual property markets and cities across the nation. Ark7 is energetic in ten states with a great quantity of market information for app customers to assessment. The corporate requires a three-month minimal maintain on its properties. Customers are offered a really consumer-friendly consumer change to peruse, analyze, and purchase into properties, in addition to monitor the investments they make and monitor dividend funds. The corporate signifies it has near 90,000 energetic customers, pays out $1.4 million in dividends month-to-month and its portfolio is price round $19 million. Its securities are registered with the SEC.

Ark7 is a full-service group. The corporate manages all the actual property, together with accumulating lease and coping with any needed property administration and upkeep. For these companies Ark7 prices between 8% and 15% of the rental earnings. Ark7 presents retirement accounts and alternatives for accredited buyers.

Key Options of Ark7

As an rising fintech, Ark7 has some options that different fractional possession of actual property corporations don’t. These are: providing extremely particular funding opportunities and a excessive diploma of operational self-discipline.

Extremely Particular Funding Alternatives

One of many key options of Ark7 is the extremely particular funding alternatives that it gives to buyers. The platform presents entry to a spread of several types of properties, from single-family properties to multi-unit condo buildings. This range of funding choices permits buyers to tailor their portfolios to satisfy their funding targets and danger tolerance.

One of many key options of Ark7 is the extremely particular funding alternatives that it gives to buyers. The platform presents entry to a spread of several types of properties, from single-family properties to multi-unit condo buildings. This range of funding choices permits buyers to tailor their portfolios to satisfy their funding targets and danger tolerance.

Tailoring funding targets and danger tolerance normally means diversification, however not at all times. Not like different REITs or fractional possession apps, Ark7 permits budget-conscious buyers to make extremely focused investments.

For instance, if an investor felt that single-family properties in Texas have been prone to outperform different asset courses, they’d have the ability to execute a method round this utilizing Ark7. In distinction, corporations corresponding to Fundrise, which difficulty shares in a pool of belongings, are usually not in a position to present this degree of exactness.

Very Good Operational Self-discipline

Ark7 workout routines a excessive diploma of self-discipline in its inside operations. For instance, for every property within the Ark7 market, the corporate will take a look at over 1,000 attainable alternatives. Ark7 normally makes use of three components to guage alternatives: the presence of large socioeconomic improvement, inhabitants progress, and pro-growth home insurance policies.

Ark7 additionally totally vets native actual property market circumstances and communities across the candidate property. Its crew appears for nicer properties in communities with good accessibility, good public colleges, and a lovely look. It additionally appears at neighborhood comparables, corresponding to native rental charges, and native insurance policies on renting, zoning, and different pure components (Coinmonks.com).

Along with extremely centered investments and good operational self-discipline, Ark7 has a number of different benefits.

Person-Pleasant Platform

In distinction with competing apps corresponding to HappyNest, the Ark7 platform is simple to make use of and navigate, making it accessible to a spread of buyers. The platform can be well-designed, with clear and concise details about every property and the funding alternative it presents. The consumer interface is intuitive, and buyers can simply monitor their investments and the earnings generated.

Investing in actual property could be sophisticated, however Ark7 makes it easy. The platform gives buyers with all the knowledge they should make knowledgeable funding choices, and the consumer interface is designed to be user-friendly and accessible to everybody.

Utilizing Ark7

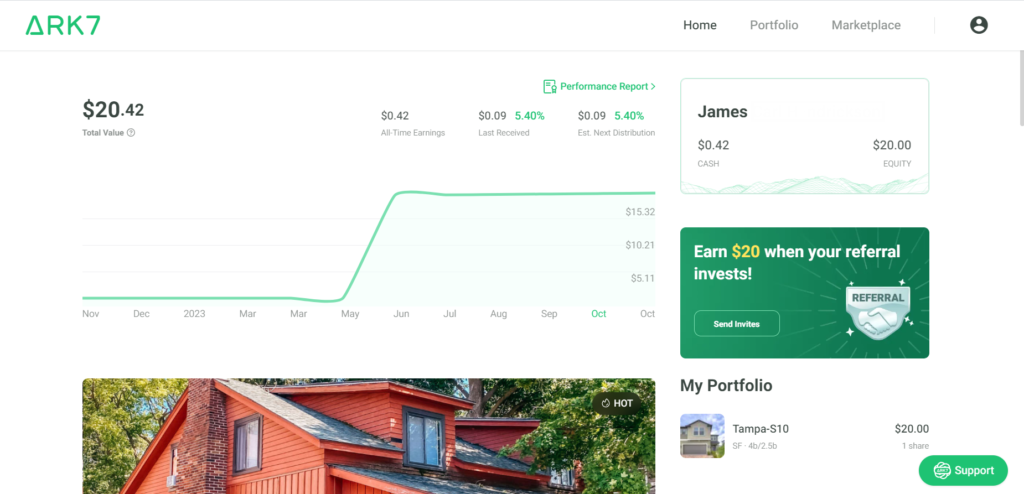

After you open an account you’ll get a dashboard that appears like this.

The dashboard reveals you a bunch of properties, in addition to the price of a share, your complete portfolio overview, and a few tabs to entry {the marketplace} and your portfolio. Once you click on on a property it provides you with details about its location, circumstances, share pricing, and money distribution information.

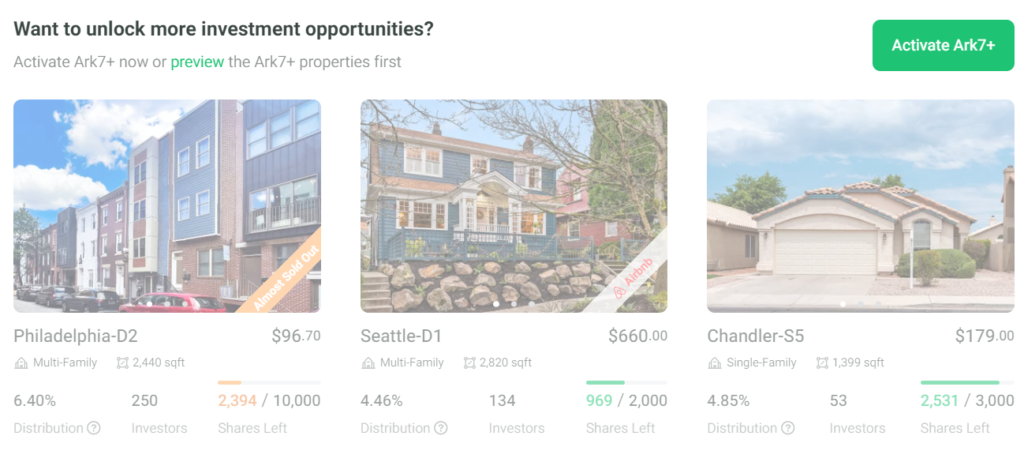

Most of what’s accessible to retail buyers on the platform are single-family properties. To get entry to business and multifamily properties, you’ll must be an accredited investor. Ark7’s channel for accredited buyers known as Ark7+. The Ark7+ accredited investor alternatives are greyed out till you apply, see right here:

Typically, their interface is easy and well-designed. Cash deposited is credited promptly.

Good High quality Investments

One of many largest benefits of utilizing Ark7 is the entry it gives to good-quality actual property investments. The properties within the Ark7 app are all sometimes newer, well-maintained properties in good neighborhoods. You’re not shopping for trailer parks or $500 homes in Detroit.

Diversification

Most fractional possession actual property apps provide diversified actual property investments. Ark7 isn’t any exception. It presents a diversified portfolio of actual property investments, decreasing the danger of anyone property underperforming. This diversification gives buyers with extra stability and safety of their investments. Furthermore, buyers can select from a spread of funding choices, together with long-term holds, short-term flips, and extra.

Returns: How A lot Does Ark7 Pay?

Ark7 generates earnings for buyers in two methods:

- month-to-month lease funds

- capital positive aspects.

As of the time of this writing, listed properties on the Ark7 market have been paying annualized lease funds of between 4.5% and seven.3%, and capital positive aspects appreciation charges between 4.1 and 20.7%.

In Ark7 each sources are basically passive for buyers. Whereas some effort is required to pick out and monitor investments, in addition to talk with the Ark7 crew, small buyers don’t must spend a lot time past some preliminary due diligence and ongoing investing monitoring.

Ark7 additionally presents IRA choices. Their IRA choices enable your returns to develop in tax-advantaged accounts. This will increase the actual returns of the funding as a result of the impression of taxation on income is lessened or eradicated. With Ark7 the accounts are held in custody for you. You maintain the belongings within the account since you aren’t concerned within the day-to-day administration of the businesses working your properties – making them appropriate for being held in an IRA.

Referral Program

Since Ark7 is in a progress part, they’ve a beneficiant referral program. When you join, you possibly can decide up some extra cash by getting a buddy to affix — you’ll each get $30. Thirty {dollars} isn’t so much, however if you think about a few years of extra passive earnings the $30 offers you, it begins to look price it. You’ll be able to join right here.

Since Ark7 is in a progress part, they’ve a beneficiant referral program. When you join, you possibly can decide up some extra cash by getting a buddy to affix — you’ll each get $30. Thirty {dollars} isn’t so much, however if you think about a few years of extra passive earnings the $30 offers you, it begins to look price it. You’ll be able to join right here.

Potential Drawbacks of Ark7

Ark7 has a number of potential drawbacks.

The Platform is New

Ark7 was based in 2019. Working a high-growth fintech startup is notoriously troublesome. About 80% of fintech startups fail throughout the first 15 years of enterprise operation. And, whereas Ark7 is a comparatively new investing platform with an fascinating enterprise mannequin, it has not but stood the take a look at of time.

Lack of Managerial Management

One potential downside of utilizing Ark7 is the shortage of management that buyers have over their investments. As fractional homeowners, buyers have restricted management over the underlying property and its administration. This lack of management could also be a priority for some buyers preferring to have extra management over their investments.

Threat of Capital Loss

As well as, whereas Ark7 presents a diversified portfolio, there’s nonetheless a danger of loss related to actual property investments. Actual property values can fluctuate, and surprising occasions corresponding to pure disasters or financial downturns can negatively impression the efficiency of actual property investments. Traders ought to be conscious that Ark7 investments may lose as much as 100% of their worth.

Lack of Leverage

Conventional actual property investing permits homeowners a excessive diploma of leverage. Take for instance the case of a house owner who buys a home for $100,000 and places down $20,000. If the worth of the home grows to $150,000, the house owner has acquired an funding return of 250%. The quantity of leverage an Ark7 share gives is unclear because the platform continues to be new, nonetheless, it’s seemingly lower than straight proudly owning actual property.

Unclear If You Can Borrow Towards Your Ark7 Shares

One benefit of conventional actual property is the power to borrow and use your actual property as collateral. Borrowing is the precept underlying mortgages, dwelling fairness traces of credit score, and the like. The power to borrow is non-trivial. Many high-net-worth buyers can develop their actual property portfolios aggressively and shortly utilizing leverage. Nevertheless, it’s not clear if that is an possibility with Ark7.

Much less Taxation Flexibility

Funds from Ark7 are taxed as LLC partnership earnings, per Ark7. That is barely much less versatile than the taxation of REIT distributions, which could be thought-about odd earnings, capital positive aspects, or return of capital (Reit.com). As well as, Ark7 shares don’t have as many tax benefits as straight proudly owning actual property such because the deductibility of curiosity and property tax funds.

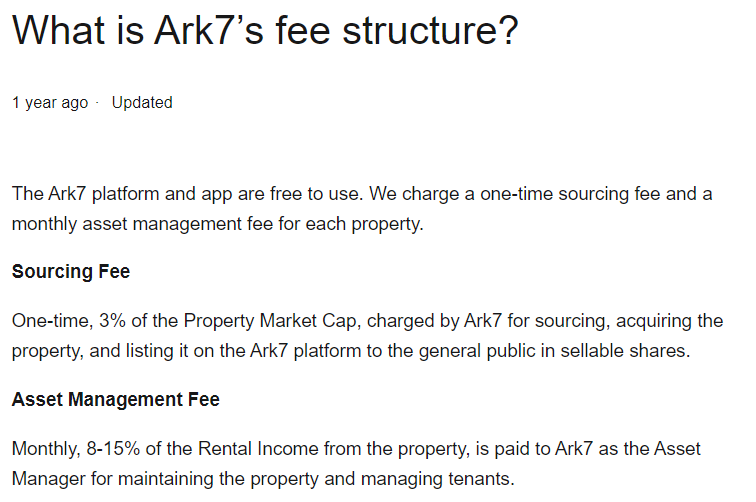

Charges and Pricing Construction

The platform prices buyers a one-time sourcing price of three%, which is deducted from the rental earnings generated by the properties during which they’ve invested. This price covers the price of managing the properties, together with property upkeep, tenant administration, and different administrative duties. Ark7 additionally prices between 8% and 15% month-to-month for administration charges. Additionally they cost an annual price for IRS accounts.

Right here is the price construction from its webpage.

It is very important notice that buyers could also be topic to different charges, corresponding to a documentation price or transaction price. These charges are sometimes charged when buyers make a transaction on the platform, corresponding to once they put money into a brand new property or once they withdraw funds from their accounts.

Ark7 additionally prices annual charges for his or her IRAs. This can be a $100 custodial price, per property, per yr. Ark7 will waive the charges in case your IRA steadiness is greater than $100,000 and caps the price at $400 per yr.

Ark7’s charges typically decrease the platform’s return on fairness. Nevertheless, these charges are akin to price buildings charged by realtors and administration corporations. On this regard, they seemingly replicate the underly unavoidable financial prices of proudly owning and working actual property. Tenants must be screened, properties must have home equipment up to date, roofs repaired, and so forth.

What are Ark7’s Lengthy-Time period Prospects?

Whereas the fintech actual property area is extraordinarily aggressive, Ark7 is effectively funded.

Any potential investor Ark7 might marvel if the platform can be round within the subsequent 5 to 10 years to ship on the returns buyers are anticipating. On this regard, Ark7 is well-funded. It acquired two tranches of funding considered one of $2,000,000 in 2019 (Crunchbase) and considered one of $9,000,000 in 2022 (Pitchbook). Whereas precise figures are usually not accessible, Ark7 has seemingly offered at the least over a further $1,000,000 price of securities. As well as, Ark7 prices administration charges on the $19 Million price of property it manages.

Briefly, the corporate seems well-funded and has a cash-generating enterprise mannequin. This means it is going to be round for the medium to quick time period.

Is Ark7 Proper For You?

On the entire, Ark7 is an efficient match for risk-tolerant buyers who’re concerned about passive geographically focused actual property investments.

Relative to its rivals, Ark7 presents high quality investments in geographic actual property. It’s nonetheless a more moderen platform. Along with market danger, rate of interest danger, and asset dangers, buyers tackle the added danger of investing by means of a brand new platform with unproven longevity.

Nevertheless, actual property as an asset class is usually fascinating. When you’re searching for a approach to generate a gentle passive earnings stream from actual property investments, then Ark7 could also be a great match for you. Nevertheless, in the event you desire extra management over your investments or are searching for increased returns, you might need to contemplate different choices.

In the end, whether or not or not Ark7 is best for you will rely in your particular person funding targets and danger tolerance. When you’re searching for much less dangerous returns, you might need to contemplate a REIT index fund. Nevertheless, in case you are risk-tolerant and desire a low-maintenance approach to make concentrated investments in actual property and generate passive earnings, Ark7 is a good possibility.

Join For Ark7

Signing up with Ark7 is simple. Just about all that’s required is a US checking account and a social safety quantity. The method is rather like opening a checking account — you must fill out a few kinds and supply your deal with and different figuring out data. A easy account will get you entry to Ark7’s single-family dwelling investments. You must be an accredited investor to get entry to their multifamily and business listings.

You’ll be able to join Ark7 right here, or click on on the button under.

Ark7 Assessment: Backside line

Ark7 is a respectable platform that lets risk-tolerant buyers passively put money into actual property for as little as $20.

The charges you pay if you use Ark7 could be excessive, which might cut back your potential returns. You additionally must hold your cash invested for a minimal holding interval, between three months and a yr.

Nevertheless, the platform is modern, fascinating, and well-suited for buyers who desire a focused actual property technique.