Unlock the Editor’s Digest at no cost

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.

The top of the world’s largest diamond firm has expressed his confidence that the US will take away tariffs on the dear stones that he believes are of “no profit” to the nation.

Al Cook dinner, chief government of De Beers, informed the Monetary Instances there have been “no US diamond mining jobs to guard” and that the corporate had held discussions with a number of governments in regards to the matter.

Tariffs had been of “no profit” to the US and “would purely be a consumption tax on the American client,” he mentioned. “There could be no jobs created.”

The US is the world’s largest marketplace for diamond jewelry, accounting for about half of worldwide demand, however has no home mining or identified industrial deposits of the stones.

The tariffs introduced final month by President Donald Trump have thrown the diamond trade into turmoil and briefly introduced commerce within the gems to a “standstill”, in accordance with market contributors.

The World Diamond Council, a foyer group that represents the trade, warned at this time that $117bn in annual revenues in addition to 200,000 American jobs within the jewelry sector could be in danger if the US didn’t take away tariffs on the stones.

“Tariffs on diamonds would perform as a consumption tax, elevating costs on engagement rings, anniversary presents, and different jewelry,” the group mentioned in a press release on Monday that urged the White Home to exempt the gems from the brand new import duties.

Diamonds coming into the US are topic to the ten per cent tariff on all imported items, and face a variable country-based levy that has been suspended for 90 days.

Many uncooked supplies had been excluded from the tariffs, however diamonds weren’t — including to the ache for an trade grappling with a downturn in demand and competitors from artificial diamonds, which will be manufactured at a fraction of the associated fee.

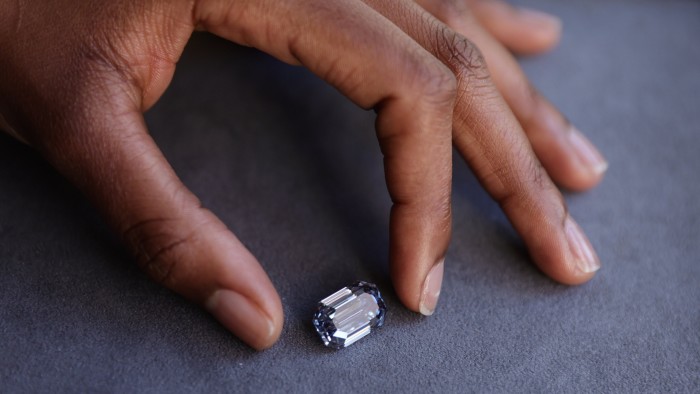

As a result of diamonds are so small and beneficial, they’re regularly flown around the globe in a fancy provide chain that stretches from mines in international locations corresponding to Botswana or Angola, to sharpening centres in India, to jewelry shops in China or the US — which makes them extremely inclined to commerce disruptions.

The dismal market circumstances and tariff disruptions come at a very delicate time for De Beers, because it prepares to be spun out from its dad or mum firm, London-listed Anglo American, both by way of a sale or by way of an preliminary public providing.

Anglo is about to launch a proper sale course of for De Beers “very quickly”, Cook dinner mentioned. The corporate is concurrently making ready for an IPO which may happen by early subsequent 12 months, he added.

De Beers reported first-quarter income of $520mn, which was 44 per cent under the identical interval a 12 months earlier due to decrease costs and gross sales volumes.

Anglo American has twice written down the worth of De Beers prior to now two years, taking an impairment cost of $2.9bn on the diamond unit in February and a $1.6bn impairment the earlier 12 months.

Cook dinner acknowledged tariffs had had “an influence” on the diamond trade, however mentioned it was “not as drastic because it may need been”.

“Persons are assured sufficient that in the long run, diamonds will likely be exempted from tariffs,” he mentioned.

“The US has been fairly clear that pure sources produced outdoors the US aren’t the targets for tariffs.”

Cook dinner’s feedback come after the White Home has given some floor on tariffs by granting exemptions for objects corresponding to smartphones and auto parts.

Optimistic noises from commerce talks between the US and India — the world’s largest diamond polisher — additionally counsel a reprieve could also be at hand.

A commerce deal between New Delhi and Washington may alleviate one of many key pinch factors alongside the diamond provide chain, as a result of India polishes greater than 90 per cent of the world’s diamonds and is a significant exporter to the US.