Beijing has retaliated in opposition to Donald Trump’s tariffs on imports from China with duties of its personal however restricted their scope in a attainable try and keep away from a full-blown commerce battle.

The measures in opposition to US merchandise starting from liquefied pure fuel to automobiles will take impact on February 10. They had been introduced on Tuesday, hours after the US president’s new extra tariff of 10 per cent on Chinese language items got here into power.

Beijing additionally stated it might launch an antitrust probe into Google, whose search engine is blocked in China.

Beijing’s new tariffs goal about $14bn of products, Citigroup analysts stated — lower than 10 per cent of whole imports from the US in 2023, the final yr for which there was full information.

The transfer was “not an escalatory response”, stated Chris Beddor, deputy China analysis director at Gavekal. “They’re clearly aiming for negotiations and a deal.”

Trump unnerved allies and traders on Friday by asserting levies on Canada, Mexico and China, which he accused of failing to curb immigration and the move of the lethal opioid fentanyl into the US.

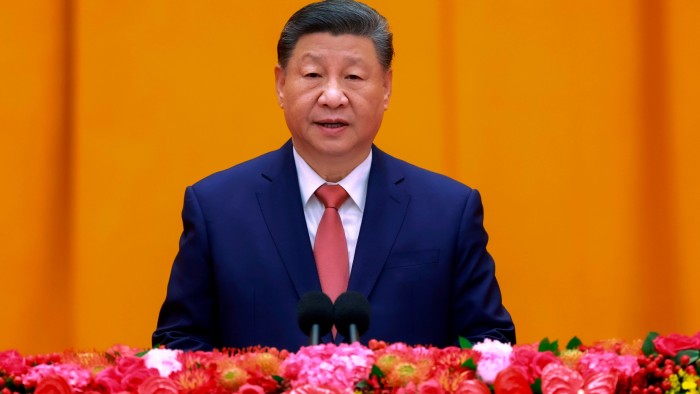

Beijing has taken some measures to stem the move of elements for fentanyl — often called precursor chemical substances — since former president Joe Biden and China’s chief Xi Jinping held a summit in San Francisco in late 2023. However the Trump administration says the Asian nation is subsidising Chinese language corporations that make the precursors.

Trump has held off on his marketing campaign pledge of imposing 60 per cent tariffs on Chinese language exports to the US. Individuals accustomed to the scenario stated he desires to do a take care of Beijing, so opted to initially hit China with a decrease tariff fee.

The buying and selling relationship between the US and China has formed each international locations’ economies in latest many years. However Beijing’s share of the US’s whole imports has fallen markedly since Trump launched tariffs in his first time period in workplace.

China’s newest measures in opposition to the US will impose tariffs of between 10 per cent and 15 per cent on US LNG, coal, crude oil and farm gear. Beijing can even impose tariffs on some automotive imports from the US and extra export controls on 5 uncommon metals.

Trump is predicted to talk to Xi within the coming days, prompting hopes the 2 leaders will have the ability to work out a deal to avert a full-blown commerce battle between the world’s two largest economies.

In response to the Chinese language retaliation, White Home Nationwide Safety Council spokesperson Brian Hughes stated: “President Trump is dedicated to saving American lives through the use of his authority to finish the move of fentanyl over our southern and northern borders that’s originating from China. That is about prioritising the protection and nationwide safety of Individuals.”

Hong Kong’s Hold Seng index, which had risen as a lot as 3.3 per cent in early buying and selling, shed a few of its positive aspects to shut up 2.7 per cent, whereas the offshore renminbi strengthened barely to Rmb7.32 and oil costs edged down about 1 per cent.

Beijing’s preliminary retaliation was a “extra symbolic transfer”, analysts at Oxford Economics stated, including the choice amounted to a rise within the general weighted efficient tariff fee of two share factors on US imports.

Beijing’s antitrust regulator introduced the investigation into Google for suspected violations of anti-monopoly legal guidelines on Tuesday. Whereas the search engine is blocked in China — together with most of father or mother firm Alphabet’s companies — the US group income from Chinese language companies promoting overseas.

Chinese language phonemakers additionally extensively use its Android working system, a long-standing level of frustration for the nation’s officers, who chafe at American management of the software program underpinning most smartphones.

Through the first Trump administration, Washington blocked Huawei from Google’s software program ecosystem, damaging gross sales of the Chinese language nationwide champion’s smartphone outdoors its residence market.

Referring to Washington and Beijing’s strikes this week, Louise Bathroom, China lead economist at Oxford Economics, wrote in a observe that “the commerce battle clearly [is] within the early phases”.

Trump put his tariffs in opposition to Canada and Mexico on maintain for a month following last-minute talks on Monday with Canadian Prime Minister Justin Trudeau and Mexican President Claudia Sheinbaum.

China’s finance ministry stated the US tariffs violated World Commerce Group guidelines. “It isn’t solely unhelpful in fixing its personal issues, but additionally undermines the conventional financial and commerce co-operation between China and the US,” it stated because it introduced the brand new tariffs.

The ministry stated US coal and LNG exports would face a further 15 per cent tariff, whereas crude oil, agricultural equipment, automobiles and pick-ups would obtain a ten per cent tariff.

China was the second-largest purchaser of US coal within the first three-quarters of 2024, accounting for 10.9 per cent of whole coal exports and trailing solely India, in accordance with information from the US Vitality Data Administration.

The nation accounted for two.9 per cent of US pure fuel exports from January to November 2024, in accordance with EIA figures.

China’s commerce ministry on Tuesday additionally introduced export controls on tungsten and greater than two dozen different uncommon metals merchandise and applied sciences, efficient instantly.

Goldman Sachs analysts described China as a “dominant producer” of the metals topic to the controls, including “vital minerals [were] an more and more essential supply of leverage”.

The financial institution famous Beijing blocked exports of a number of different key minerals in December — a transfer that hit the US semiconductor trade.

China on Tuesday additionally expanded its “unreliable entity record”, a nationwide safety blacklist, by including US biotech group Illumina and PVH Group, an American clothes maker whose manufacturers embody Calvin Klein and Tommy Hilfiger.

The ministry had beforehand investigated PVH for alleged discrimination in opposition to cotton from Xinjiang, the western area the place Chinese language authorities are accused of human rights abuses together with pressured labour.

Further reporting by Zijing Wu in Hong Kong