(Bloomberg) — Shares of Tesla Inc. slumped Tuesday alongside different electric-vehicle makers, whereas area firm shares noticed massive good points, after President Donald Trump introduced a collection of insurance policies that might have wide-ranging impacts on markets.

Most Learn from Bloomberg

Particularly, Trump ordered his administration to contemplate eradicating subsidies for EVs and insurance policies favoring the automobiles, which weighed on Elon Musk’s firm. He additionally introduced plans to impose 25% tariffs on Mexico and Canada by Feb. 1, and pledged in his inaugural tackle on Monday to land American astronauts on Mars.

“As we enter Trump 2.0, the market seems very delicate and reactionary to headlines from the brand new administration,” stated Walter Todd, president and chief funding officer at Greenwood Capital Associates. “This might enhance volatility for a wide range of monetary markets.”

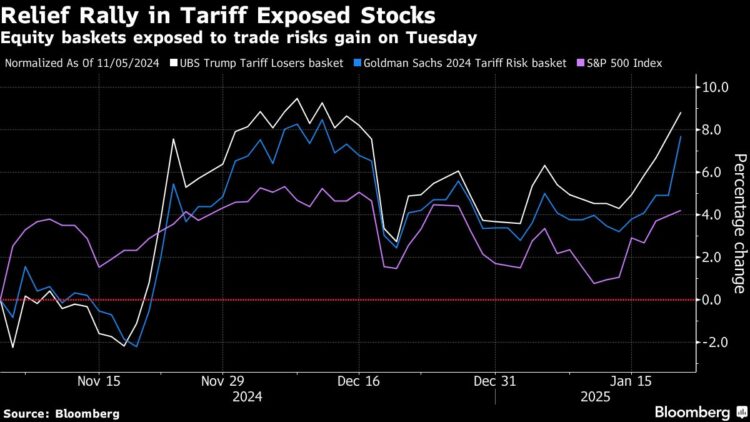

Traders are intently watching additional strikes from Trump to evaluate their have an effect on on markets. JPMorgan Chase & Co. is establishing a “warfare room” for simply this objective. Precisely how the coverage proposals will play out isn’t clear but. For instance, shares of corporations with tariff dangers are largely shrugging off the threats for now.

One space new administration hasn’t touched but is cryptocurrencies, leaving that business eagerly ready.

“We’re seeing some promote the information in sizzling elements of the market like Tesla and crypto that have been priced for extra going into the inauguration,” stated Chris Murphy, co-head of derivatives technique at Susquehanna Worldwide Group. “Even China shares, which benefited from an absence of ire from Trump, have largely reversed and are actually flat on the day after near-term revenue taking.”

EV Slide

Tesla fell as a lot as 4.7% and was the second largest weight on the S&P 500 Index Tuesday, whereas the Bloomberg Electrical Autos Index slid as a lot as 1.7%, after Trump directed his administration to contemplate eradicating EV subsidies and different insurance policies that favor the automobiles. EV startups Rivian Automotive Inc. and Lucid Group Inc. additionally slumped.

Whereas Trump didn’t explicitly order the Environmental Safety Company to rewrite the principles, his directive units the stage for actions that might sluggish the adoption of EVs within the US.

Area Shares Bounce

Shares of area corporations leaped on Trump’s promise to “pursue our manifest future into the celebrities” by touchdown American astronauts on Mars.