Enterprise exercise within the euro space unexpectedly shrank this month, fueling issues concerning the prospects for Europe’s financial system and suggesting the European Central Financial institution will must be extra aggressive with interest-rate cuts.

Article content material

(Bloomberg) — Enterprise exercise within the euro space unexpectedly shrank this month, fueling issues concerning the prospects for Europe’s financial system and suggesting the European Central Financial institution will must be extra aggressive with interest-rate cuts.

The euro fell to its lowest stage since 2022 towards the greenback after the buying managers gauge of service suppliers and producers weakened. Political crises in Germany and France, in addition to the specter of tariffs from a Donald Trump presidency within the US, additionally weighed on the forex.

Commercial 2

Article content material

Listed below are a number of the charts that appeared on Bloomberg this week on the newest developments within the world financial system, markets and geopolitics:

Europe

Euro-area enterprise exercise unexpectedly shrank in November, an indication of the injury being wrought by political chaos and heightened discord over commerce. The euro fell to its weakest ranges since 2022 towards the greenback as merchants priced in additional interest-rate cuts from the European Central Financial institution. The possibility of a 50 basis-point discount in December rose to 50%, from about 15% at Thursday’s shut.

UK inflation accelerated greater than forecast in October to effectively above the Financial institution of England’s 2% goal. Client-price inflation rose 2.3% from a yr earlier after a leap in vitality payments. Companies inflation — which is being monitored intently by rate-setters for indicators of home pressures — remained elevated at 5%.

A key gauge of euro-zone wages jumped by probably the most for the reason that frequent forex was launched in 1999 — complicating the ECB’s plans for interest-rate cuts as inflation eases. Third-quarter negotiated pay rose 5.4% from a yr in the past. That’s up from 3.5% within the earlier three months and was largely pushed by Germany.

Article content material

Commercial 3

Article content material

A dormant inventory market, brittle forex, crisis-ridden political system, stagnant financial system — so was the panorama in Europe even earlier than Donald Trump gained election within the US. Now, the continent faces new commerce tariffs towards its greatest firms and funding outflows as Trump’s plans to chop taxes and intestine regulation make US shares extra enticing. Add to that the rising angst round Germany’s upcoming snap election and escalating Russia tensions and even probably the most optimistic buyers are struggling to remain upbeat.

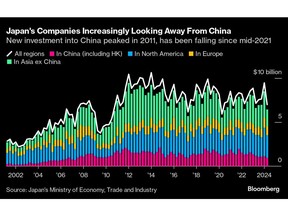

Asia

Japanese companies in China have gotten extra pessimistic concerning the world’s second-biggest financial system, with about two-thirds saying it’s getting worse and virtually half scaling again or halting their investments. About 64% of Japanese firms mentioned the Chinese language financial system is faring worse than final yr, based on the newest survey from the Japanese Chamber of Commerce and Business in China.

South Korea’s family debt grew probably the most in three years final quarter, highlighting a growth that saved the central financial institution from pivoting on coverage till final month. Mortgage loans, a serious part of the credit score, additionally rose by probably the most for the reason that third quarter of 2021.

Commercial 4

Article content material

US & Canada

Housing begins declined in October to the slowest tempo in three months as hurricanes exacerbated an easing in building exercise extra usually. Residential building has struggled to achieve traction this yr towards a backdrop of a rising variety of new houses on the market and mortgage charges close to 7%.

Trump’s vows to “frack, frack, frack” are about to collide with a worldwide crude glut that’s set to, lastly, mood document shale manufacturing.

Inflation in Canada rose by greater than forecast and underlying worth pressures reaccelerated, hiccups which will dissuade policymakers from a second straight 50 basis-point minimize to rates of interest subsequent month. The primary acceleration of headline inflation in 5 months could bolster a case for the Financial institution of Canada to scale back borrowing prices steadily, after officers stepped up the tempo of easing in October.

Rising Markets

Years of runaway inflation are testing the bodily limits of Turkey’s cash-centric financial system as its greatest banknotes develop into more and more insufficient to cowl even day by day spending. The very best-denominated invoice, for 200 liras ($5.80), now represents greater than 80% of all money in circulation, up from 16% in 2010, based on central financial institution information. After dropping virtually all its buying energy, every word is price sufficient to purchase two filter coffees at Starbucks.

Commercial 5

Article content material

Mexico’s inflation decelerated in early November whereas the financial system continues to lose momentum, giving the central financial institution room to chop rates of interest for a fourth straight assembly subsequent month.

World

Ukrainian forces earlier this week carried out their first strike on a border area in Russia utilizing Western-supplied missiles as President Vladimir Putin accepted an up to date nuclear doctrine increasing the situations for utilizing atomic weapons. The information despatched buyers scrambling into a number of the world’s most secure property.

Iceland’s central financial institution accelerated its easing marketing campaign, whereas South Africa additionally minimize charges. Financial institution Indonesia warned there’s much less scope to decrease them. Hungary, Angola, Paraguay and Egypt saved borrowing prices regular. Turkey additionally held whereas implying a minimize might quickly be justified on account of slowing inflation.

—With help from Irina Anghel, Alice Atkins, Maya Averbuch, Taylan Bilgic, Kevin Crowley, Robert Jameson, Lucia Kassai, Sam Kim, Aliaksandr Kudrytski, James Mayger, Henry Meyer, Michael Msika, Tom Rees, Michael Sasso, Zoe Schneeweiss, Mark Schroers, Patrick Sykes, Randy Thanthong-Knight, Alex Vasquez and David Wethe.

Article content material