Our Good Beta portfolio sourced from Goldman Sachs Asset Administration helps meet the desire of our clients who’re prepared to tackle further dangers to doubtlessly outperform a market capitalization technique.

The Goldman Sachs Good Beta portfolio technique displays the identical underlying rules which have all the time guided the core Betterment portfolio technique—investing in a globally diversified portfolio of shares and bonds. The distinction is that the Goldman Sachs Good Beta portfolio technique seeks increased returns by shifting away from market capitalization weightings in and throughout fairness asset courses.

What is a brilliant beta portfolio technique?

Portfolio methods are sometimes described as both passive or energetic. Most index funds and exchange-traded funds (ETFs) are categorized as “passive” as a result of they observe the returns of the underlying market primarily based on asset class. In contrast, many mutual funds or hedge fund methods are thought of “energetic” as a result of an advisor or fund supervisor is actively shopping for and promoting particular securities to aim to beat their benchmark index. The result’s a dichotomy by which a portfolio will get labeled as passive or energetic, and buyers infer doable efficiency and threat primarily based on that label.

In actuality, portfolio methods reside inside a airplane the place passive and energetic are simply two cardinal instructions. Good beta funds, like those that have been chosen for this portfolio, search to attain their efficiency by falling someplace in between excessive passive and energetic, utilizing a set of traits, referred to as “components,” with an goal of outperformance whereas managing threat. The portfolio technique additionally incorporates different passive funds to attain acceptable diversification.

This different strategy can also be the rationale for the identify “sensible beta.” An analyst evaluating standard portfolio methods normally operates by assessing beta, which measures the sensitivity of the safety to the general market. In creating a sensible beta strategy, the efficiency of the general market is seen as simply one in every of many components that impacts returns. By figuring out a variety of things which will drive return potential, we search the potential to outperform the market in the long run whereas managing affordable threat.

After we develop and choose new portfolio methods at Betterment, we function utilizing 5 core rules of investing:

- Personalised planning

- A stability of price and worth

- Diversification

- Tax optimization

- Behavioral self-discipline

The Goldman Sachs Good Beta portfolio technique aligns with all 5 of those rules, however the technique configures price, worth, and diversification differently than Betterment’s Core portfolio. With a purpose to pursue increased total return potential, the sensible beta technique provides further systematic threat components which might be summarized within the subsequent part.

Moreover, the technique seeks to attain world diversification throughout shares and bonds whereas overweighting particular exposures to securities which might not be included in Betterment’s Core portfolio. In the meantime, with the sensible beta portfolio, we’re capable of proceed delivering all of Betterment’s tax-efficiency options, equivalent to tax loss harvesting and Tax Coordination.

Investing in sensible beta methods has historically been costlier than a pure market cap-weighted portfolio. Whereas the Goldman Sachs Good Beta portfolio technique has a far decrease price than the business common, it’s barely costlier than the core Betterment portfolio technique.

As a result of a sensible beta portfolio incorporates using further systematic threat components, we sometimes solely advocate this portfolio for buyers who’ve a excessive threat tolerance and plan to avoid wasting for the long run.

Which “components” drive the Goldman Sachs Good Beta portfolio technique?

Elements are the variables that drive efficiency and threat in a sensible beta portfolio technique. Should you consider threat because the foreign money you spend to attain potential returns, components are what decide the underlying worth of that foreign money.

We are able to dissect a portfolio’s return right into a linear mixture of things. In educational literature and practitioner analysis (Analysis Associates, AQR), components have been proven to drive historic returns. These analyses kind the spine of our recommendation for utilizing the sensible beta portfolio technique.

Elements replicate economically intuitive causes and behavioral biases of buyers in mixture, all of which have been nicely studied in educational literature. A lot of the fairness ETFs used on this portfolio are Goldman Sachs ActiveBetaTM, that are Goldman Sach’s factor-based sensible beta fairness funds. Shares are scored in line with 4 components the place the very best scoring firms have higher weighting. The weights are then constrained to be in-line with the market. These components embody:

Good Worth

When an organization has strong earnings (after-tax web revenue), however has a comparatively low value (i.e., there’s a comparatively low demand by the universe of buyers), its inventory is taken into account to have good worth. Allocating to shares primarily based on this issue provides buyers publicity to firms which have excessive development potential however have been ignored by different buyers.

Excessive High quality

Excessive-quality firms show sustainable profitability over time. By investing primarily based on this issue, the portfolio contains publicity to firms with robust fundamentals (e.g., robust and secure income and earnings) and potential for constant returns.

Low Volatility

Shares with low volatility are likely to keep away from excessive swings up or down in value. What could appear counterintuitive is that these shares additionally are likely to have increased returns than excessive volatility shares. That is acknowledged as a persistent anomaly amongst educational researchers as a result of the upper the volatility of the asset, the upper its return needs to be (in line with commonplace monetary principle). Low-volatility shares are sometimes ignored by buyers, as they normally don’t improve in worth considerably when the general market is trending increased. In distinction, buyers appear to have a scientific desire for high-volatility shares primarily based on the information and, consequently, the demand will increase these shares’ costs and subsequently reduces their future returns.

Sturdy Momentum

Shares with robust momentum have lately been trending strongly upward in value. It’s nicely documented that shares are likely to pattern for a while, and investing in these kinds of shares permits you to benefit from these tendencies. It’s vital to outline the momentum issue with precision since securities may exhibit reversion to the imply—which means that “what goes up should come down.”

How can these components result in future outperformance?

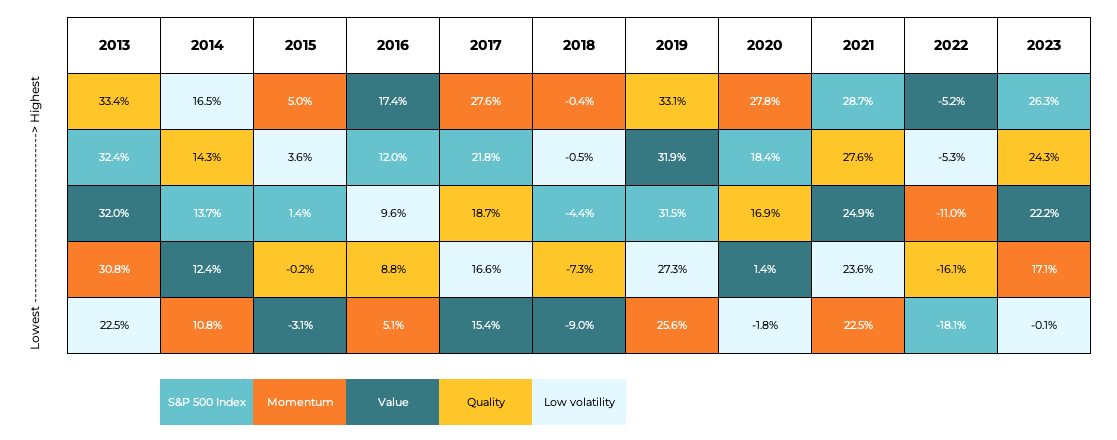

In particular phrases, the components that drive the sensible beta portfolio technique—whereas having various efficiency year-to-year relative to their market cap benchmark—have potential to outperform their respective benchmarks when mixed. You possibly can see an instance of this within the chart of yearly issue returns for US massive cap shares under. You’ll see that the rating of the 4 issue indexes varies over time, rotating outperformance over the S&P 500 Index in practically the entire years.

Efficiency Rating of Good Beta Indices vs. S&P 500

Benchmark efficiency info relies on annual returns information from Bloomberg as of January 2013 to December 2023.

Efficiency is offered for illustrative functions solely, and the issue returns it references usually are not essentially the identical issue returns within the Goldman Sachs Good Beta portfolio technique. For every year, we’ve ranked the annual efficiency of every issue alongside the S&P 500 as a comparability. The returns for Momentum, High quality, Worth and Low volatility are calculated from the S&P 500 Momentum Whole Return Index, S&P 500 High quality Whole Return Index, S&P 500 Worth Whole Return Index, and S&P Low-volatility Whole Return Index, respectively. This calculation was not offered by Goldman Sachs Asset Administration and doesn’t replicate or predict future efficiency. Furthermore, this evaluation doesn’t embody charges, liquidity, and different prices related to truly holding a portfolio primarily based on these actual indexes that might decrease returns of the portfolio. Previous efficiency shouldn’t be indicative of future outcomes. You can’t make investments straight within the index. Content material is supposed for academic functions and never supposed to be taken as recommendation or a suggestion for any particular funding product or technique.

Why spend money on a sensible beta portfolio?

As we’ve defined above, we usually solely advise utilizing Betterment’s selection sensible beta technique for those who’re searching for a extra tactical technique that seeks to outperform a market-cap portfolio technique in the long run regardless of potential intervals of underperformance.

For buyers who fall into such a situation, our evaluation, supported by educational and practitioner literature, reveals that the 4 components above might present increased return potential than a portfolio that makes use of market weighting as its solely issue. Whereas every issue weighted within the sensible beta portfolio technique has particular related dangers, a few of these dangers have low or unfavorable correlation, which permit for the portfolio design to offset constituent dangers and management the general portfolio threat.

In fact, these dangers and correlations are primarily based on historic evaluation, and no advisor might assure their outlook for the long run. An investor who elects the Goldman Sachs Good Beta portfolio technique ought to perceive that the potential losses of this technique might be higher than these of market benchmarks. Within the yr of the dot-com collapse of 2000, for instance, when the S&P 500 dropped by 10%, the S&P 500 Momentum Index misplaced 21%.

Given the systematic dangers concerned, we imagine the proof that reveals that sensible beta components might result in increased anticipated return potential relative to market cap benchmarks, and thus, we’re proud to supply the portfolio for patrons with lengthy investing horizons.