Supply: The Faculty Investor

Going to an out-of-state “state” faculty may be considerably dearer that in-state faculty and even personal universities. And the price is probably not value it.

Embarking on the journey to increased schooling is a life-changing choice. One of many first and largest challenges many potential college students encounter is whether or not to pursue a school schooling in-state or out-of-state.

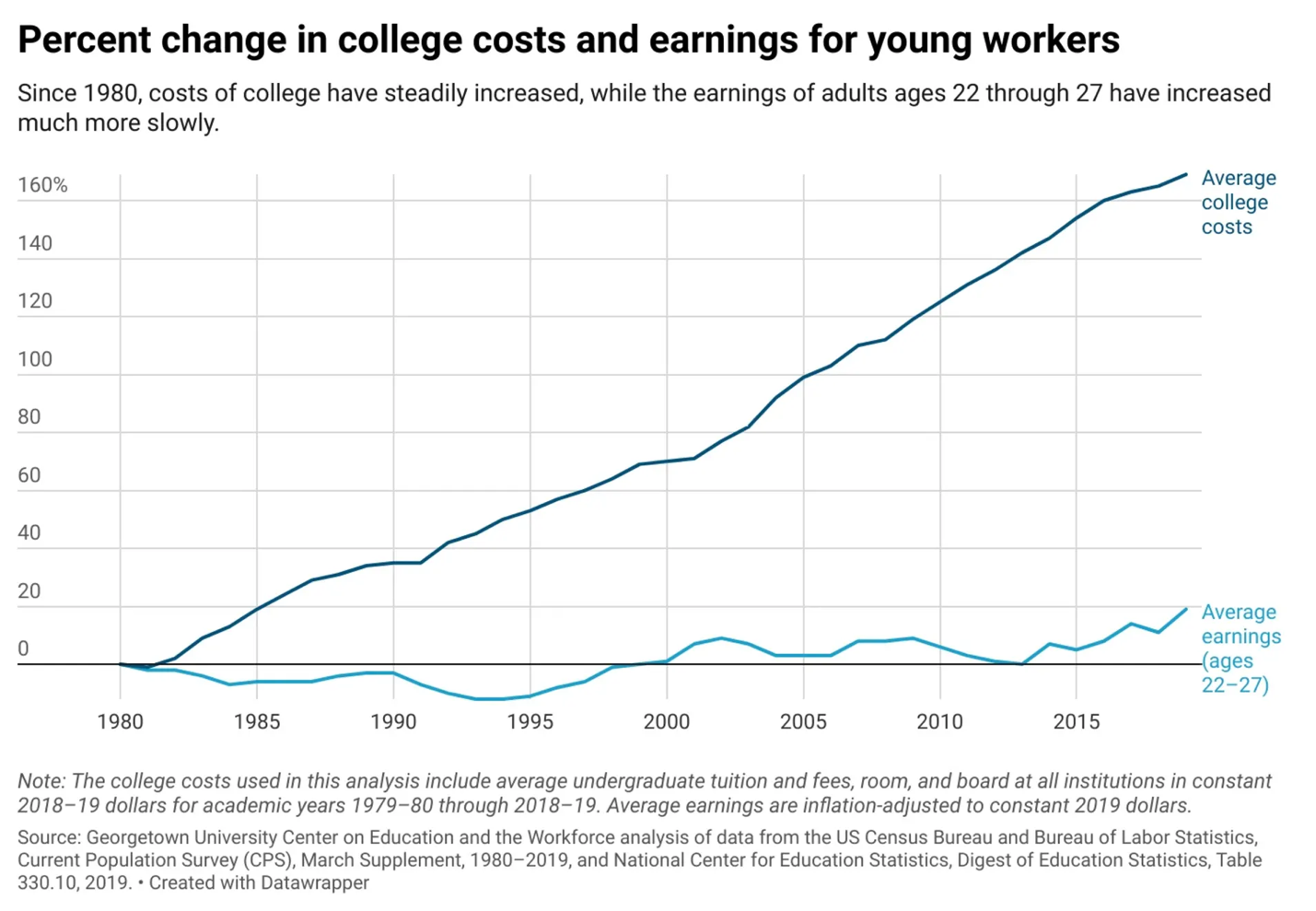

As , the common price of tuition has been on an upward trajectory since someday across the Nineteen Eighties. Faculty tuition at a public four-year college elevated 9.24% between 2010 and 2022, averaging a 12% enhance every year in that interval.

Not solely does increased tuition imply larger prices for schooling, however it additionally means larger chance of discovering your self graduating with bigger scholar loans. That is notably regarding when the common scholar mortgage debt of current graduates is $33,500.

On this article, I’ll dive into the the reason why choosing an in-state faculty may show to be a greater long-term choice for you. From location and affordability to in-state advantages and high quality of schooling, I goal to make clear some great benefits of conserving your academic funding in-state.

First, a fast overview of the professionals and cons of staying in-state:

Professionals of Making use of to In-State Faculties

- Decrease tuition and costs

- Comparable schooling

- Elevated alternatives for monetary help

- Geographical familiarity and luxury

- Identified private & skilled community

- Retains journey prices low

Cons of Apply to In-State Faculties

- Restricted range or publicity

- Staying in a well-known surroundings

- Restricted program specialization

- Lack of private independence

First Issues First: What Ought to I Know?

Whether or not or not you’re the primary individual in your loved ones to pursue a better schooling, there are a couple of essential issues to bear in mind, starting with frequent phrases used when discussing the general price of attending postsecondary college.

Tuition: The price of attending faculty lessons. Some schools cost one set tuition fee, whereas others cost per credit score hour. Tuition is commonly completely different for resident vs. non-resident college students.

Charges: There are virtually at all times further costs to cowl the price of your lessons, similar to further course supplies or a lab payment.

Direct Prices: These are prices paid on to the college, similar to tuition and costs, housing, and a meal plan.

Oblique Prices: These are academic prices not paid on to the college, similar to textbooks, transportation, and different private bills related along with your schooling.

Value of Attendance: That is the utmost amount of cash an educational establishment prices to attend for one yr, earlier than any monetary help is utilized. This consists of each direct and oblique bills.

Internet Worth: That is the quantity you pay to attend an educational establishment for one yr, after any monetary help has been utilized. Internet value calculators are a helpful function the place you may enter details about your self to search out out what related college students paid to attend the identical college the earlier yr, after taking grants and scholarships under consideration.

Understanding the total price of attendance at a college will assist carry your monetary image into perspective, figuring out how a lot monetary help is required and the extent of any out-of-pocket bills you face. Now that we’ve gotten primary phrases out of the best way, right here’s a have a look at why figuring out your prices is so essential within the long-term.

Supply: Georgetown College Middle on Training and the Workforce

To be clear, median earnings of early-career professionals with a bachelor’s diploma or increased have been rising. Nonetheless, we’re seeing the common price of tuition enhance virtually 10 occasions sooner than common earnings, and also you don’t want a school diploma to acknowledge the gross imbalance that creates. Rising tuition charges is likely one of the biggest contributing elements to the excessive scholar mortgage debt skilled in current a long time. It begs the query: How a lot debt are you keen to tackle to your four-year diploma?

Common Tuition Charges

The price of schooling stays a big monetary problem for many households, and the very last thing you wish to do is underestimate your dues. One strategy to absolutely perceive the present weight of tuition is to take a look at the price of attending the flagship college in every state. I assure in the event you examine in-state and out-of-state tuition at a handful of flagship colleges throughout the nation, you’ll begin to discover a sample. (This knowledge was discovered at TuitionFit and IPEDS.)

Additionally, when researching tuition charges, I additionally observed that some colleges set completely different charges for lower-classmen vs. upper-classmen. Ensure to do your personal analysis and ask round to uncover any hidden prices you’ll be hit with later.

Keep in mind, your first yr of school can also be sometimes the least costly yr. Tuition and costs normally rise yearly. You might be paying considerably extra your final yr of school than your first.

Let’s begin by evaluating common tuition throughout all four-year public universities within the U.S. with common tuition of solely the flagship college in every state.

|

Header |

Common Out-of-State Tuition |

|

|---|---|---|

|

U.S. General State Common, 2022-2023 |

||

|

U.S. Flagship-Solely Common, 2022-2023 |

What does this inform us? Instantly, you see that common out-of-state tuition is increased than in-state tuition, although what’s extra telling is simply how excessive out-of-state tuition is at a flagship college.

Common out-of-state tuition at a flagship college is greater than $6,000 increased than common out-of-state tuition at a non-flagship college. This immediately tells me states are slapping on a “premium” for attending their flagship college.

Not satisfied? Check out common annual tuition charges for 2022 -2023 throughout among the hottest flagship colleges within the U.S. and control that premium I discussed.

|

Out-of-State Premium (as a proportion) |

||||

|---|---|---|---|---|

|

U. of Colorado at Boulder |

||||

|

U. of Michigan – Ann Arbor |

||||

The out-of-state tuition fee at flagship colleges is no less than twice the in-state tuition fee and, in some circumstances, three or 4 occasions the in-state tuition fee.

In line with Mark Salisbury of TuitionFit, “Flagship universities see out-of-state college students as money cows and do not feel any obligation in any respect to make themselves financially possible for out-of-state college students.”

Common out-of-state tuition is already 172% greater than in-state tuition amongst public establishments. Is it value it? I’ll dive into that subsequent.

Is This Information Useful? Need To See How Your Monetary Assist Award Compares With Others?

Submit your monetary help award to TuitionFit and see if you’re getting a good supply! And assist others know the “actual” numbers as properly. Take a look at TuitionFit right here >>

Why You Ought to Keep In-State

Value and Affordability

Realizing how a lot increased out-of-state tuition and costs are in comparison with in-state charges, selecting to attend an out-of-state college immediately will increase your monetary burden, and you might discover fewer alternatives for monetary help, grants, or scholarships.

TuitionFit knowledge from college students accepted by out-of-state public establishments reveals that out-of-state college students get proportionally smaller advantage help awards. Plus, you’ll must consider the price of dwelling in a brand new state, in addition to the price to journey forwards and backwards to see household.

High quality of Training

Don’t quietly rule out in-state colleges due to a fantasy that out-of-state colleges supply a greater schooling. In-state colleges have comparable high quality of schooling and educational choices, and lots of are respected sufficient to warrant your curiosity and analysis.

Location and Familiarity

Shifting to a brand new place may be emotionally distressing – take it from somebody who’s been there. Going out-of-state means eradicating your self out of your rapid assist community, which may really feel isolating at such an essential time in your life. Staying in-state could make it simpler to journey again residence or to commute out of your present residence.

Networking and Alternatives

Attending faculty in your house state can usually present quick access to networking alternatives, rising present relationships and forging new ones because of this. Having robust connections could make a distinction within the kinds of alternatives you obtain, particularly once you’re prepared to start out your profession.

Cultural and Social Match

Like being in a brand new location, adapting to a brand new tradition or local weather may be robust. There are lots of new issues to see and do, however exploring a brand new surroundings may be scary. Be trustworthy with what you worth in your present neighborhood and whether or not you’ll have the ability to discover those self same features elsewhere.

When An Out-Of-State College Makes Sense

There are occasions when going out-of-state is sensible, however it’s usually for very particular circumstances. Which may embody:

- Enrolling in a extremely specialised educational program

- Desirous to work with particular professors, analysis services, or different expertise

- Shifting nearer to different relations

- Shifting to a location that’s in higher alignment along with your private or skilled values

- Receiving a beautiful monetary help package deal that makes attending an out-of-state college possible.

There are additionally states that supply tuition reciprocity for universities positioned in neighboring states. For instance, the Western Undergraduate Change can be utilized by college students in Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, North Dakota, Oregon, South Dakota, Utah, Washington, and Wyoming. Examine the laws in your state.

Causes To Hold Pupil Mortgage Debt Low

The significance of affordable and manageable tuition actually can’t be overstated as a result of it immediately influences your current and future wellbeing. Holding tuition low not solely prevents you from incurring extreme debt now, however it additionally minimizes your month-to-month minimal funds later – a time once you’ll produce other prices to concern your self with.

I’d be remiss if I didn’t no less than briefly talk about the impacts of scholar mortgage debt right here. Whereas some scholar mortgage debt can really be an excellent factor, listed below are a couple of factors to think about earlier than signing on the dotted line:

- Pupil mortgage debt can have a long-lasting affect in your monetary well-being and pressure you to delay different life occasions similar to buying a house or beginning a household.

- Failing to make mortgage funds on time or defaulting in your loans can negatively have an effect on your credit score rating, which additional hurts your means to purchase a home or automobile.

- Making mortgage funds can maintain you from constructing your financial savings or retirement portfolio.

- Mortgage-burdened graduates could really feel the necessity to pursue higher-paying jobs over profession satisfaction to fulfill the wants of their month-to-month funds.

- Pupil mortgage debt creates socioeconomic inequities for a lot of graduates, which can restrict your private {and professional} progress general.

Closing Ideas

As you may see, there are ample advantages to conserving your faculty schooling in-state. Initially, you save hundreds of {dollars}. However you additionally preserve your geographical consolation, retain a community of assist, and obtain a top quality schooling only a stone’s throw from residence.

And whereas tuition at in-state college is way decrease than what you’d owe at an out-of-state college, pursuing a four-year diploma at any college is a expensive endeavor, basically. So, my recommendation to you is to analysis the faculties close to residence and discover out what they provide.