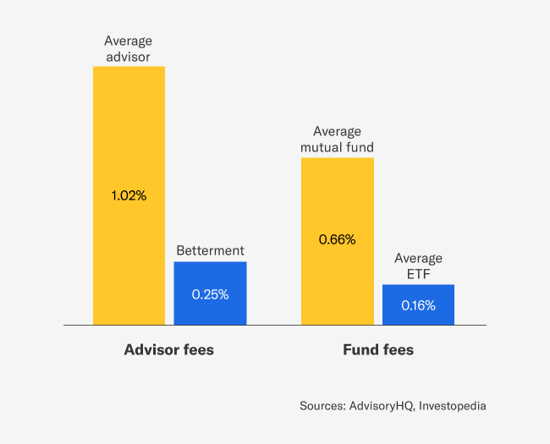

Some advisors are lower than forthcoming in regards to the charges tied to their providers or the investments they select. So ask questions, and take into account it a pink flag in the event that they don’t make it simple to know your all-in prices.

Returns

Right here’s the place issues get tough, as a result of evaluating apples-to-apples returns between totally different suppliers and their varied portfolios will be troublesome. Some could also be promoting apples, whereas others could also be promoting a low-cost, globally-diversified assortment of fruit.

However you possibly can level-set considerably by evaluating portfolios with 1) comparable allocations of shares and bonds and a pair of) comparable ranges of diversification. U.S. equities have outperformed worldwide markets because the Nice Recession, however these tables have been turned for prolonged stretches within the 80s, 90s, and 2000s, and they very effectively may flip once more.

Personalization

For a lot of buyers, it’s essential to know what they’re investing in—and to really feel enthusiastic about it. So in case your outdated 401(ok)’s “2050 Goal Date Fund” doesn’t precisely set your coronary heart aflutter, attempt scoping out options. It’s why we construct easy-to-understand portfolios interesting to a variety of pursuits from socially accountable investing to modern expertise. Each will be custom-made to your particular goal date and simply up to date when life occurs and circumstances change.

Aim alignment

Consolidating extra of your retirement accounts beneath the identical roof unlocks a number of advantages. Asset location, as beforehand lined, is one. Asset allocation, or the ratio of various asset sorts like shares and bonds, is one other. It’s greatest when accounts serving the identical objective add as much as your most popular asset allocation, and that may be arduous to perform once they’re unfold throughout a number of advisors. At Betterment, you possibly can nest a number of accounts beneath the identical objective and simply set one asset allocation for all of them.

II. Particular concerns for tax-advantaged accounts

In the event you’re contemplating shifting tax-advantaged accounts like 401(ok)s, 403(b)s, and IRAs, hold just a few extra issues in thoughts.

Account compatibility – Deciding what sort of account to maneuver to could make for a dizzying choice, however in a nutshell:

- Roth accounts should be moved to a fellow Roth account.

- Conventional IRAs usually transfer into conventional IRAs. Exceptions embrace some circumstances of backdoor Roth conversions.

- 401(ok)s can movement into both a 401(ok) or IRA.

Right here’s a simplified model of the IRS’s notorious rollover chart to assist:

| Roll to | |||||

| Roth IRA | Trad. IRA | Trad. 401(ok) | Roth 401(ok) | ||

| Roll from |

Roth IRA |

✓ | X | X | X |

|

Trad. IRA |

✓ | ✓ | ✓ | X | |

|

Trad. 401(ok) |

✓ | ✓ | ✓ | ✓ | |

|

Roth 401(ok) |

✓ | X | X | ✓ | |

Some essential qualifiers rely in your actual transfer, so we advise finding out the total chart rigorously. An enormous one to name out is that any conventional (i.e. pre-tax) funds moved to a Roth (i.e. after-tax) account should be included in your taxable revenue for that yr and taxed accordingly. It’s one cause why we extremely suggest working with a tax advisor, particularly in case your particular case isn’t so lower and dry.

Entry – After you permit a job, your 401(ok) from that job continues to be yours, and you may nonetheless change its investments, however you possibly can not contribute to that particular 401(ok) account.

Avoiding taxes – Normally, you possibly can transfer tax-advantaged accounts to a brand new supplier and pay zero {dollars} in taxes, however when you merely money them out and pocket the cash earlier than the age of 59 ½, these funds are topic to a 10% early withdrawal tax on prime of abnormal revenue tax, with few exceptions.

III. Particular concerns for taxable accounts

Transferring taxable accounts doubtlessly comes with (shock, shock) tax implications. The very first thing to do is suss out which of your outdated property will be moved “in-kind” to a brand new supplier. This implies the brand new supplier is ready to settle for the brand new property, both slotting them into your new portfolio as-is or promoting them in your behalf and reinvesting the proceeds.

Some property first must be offered earlier than you possibly can switch the funds. In these circumstances, you possibly can first work with a brand new supplier (like us!) and a tax advisor to estimate the potential tax hit. Then, when you determine to maneuver forward, you’d work together with your outdated supplier to liquidate these property earlier than transferring the funds.

IV. A sneak peek of how we make shifting simpler

The method of really packing up and making a transfer will be sophisticated. It doesn’t assist that it takes two advisors to tango, and your outdated supplier might not make issues simple. However we do every little thing potential on our finish to assist streamline the method.

That features letting you shortly provoke a switch or rollover within the Betterment app. Some transfers will be serviced totally on-line, whereas different transfers and most rollovers require some paperwork.

In the event you’re contemplating shifting $20k or extra, our Licensed Concierge staff is accessible for free of charge to stroll you thru all of the concerns above, measurement up whether or not a transfer is in your greatest curiosity, and do you have to determine to change, assist transfer your outdated property to Betterment.

As a result of whether or not shifting to a brand new home or a brand new advisor, it by no means hurts to have just a little assist.