We’re dwelling in unusual monetary instances. Inflation has taken an enormous chunk out of our buying energy, but traders are sitting on report quantities of money, the identical money that is value 14% much less than it was simply three years in the past.

Excessive rates of interest clarify a variety of it. Who would not be tempted by a 5% yield for merely socking away their cash?

However rates of interest change, and we very nicely could possibly be popping out of a interval of excessive charges, leaving some savers with decrease yields and additional cash than they know what to do with.

So let’s begin there—how a lot money do you actually need? Then, what do you have to do with the surplus?

How a lot money do you actually need?

Money serves three principal functions:

Your spending ranges could differ, however for the standard American, that is $24,000 in money, plus any extra wanted for main purchases.

Should you’re extra threat averse—and for those who’re studying this, you simply is perhaps—then by all means add extra buffer. It is your cash! Strive a six-month emergency fund. Should you’re a freelancer and your earnings fluctuates month-to-month, think about 9 months.

Past that, nonetheless, you are paying a premium for money that’s not earmarked for any particular objective, and the fee is two-fold.

- Your money, as talked about earlier, could be very doubtless shedding worth every day due to inflation, even historically-normal ranges of inflation.

- Then there’s the chance value. You are lacking out on the potential features of the market.

And the historic distinction in yields between money and shares is stark, to say the least. The MSCI World Index, nearly as good a proxy for the worldwide inventory market as there’s, has generated a 8.5% annual yield since 1988. Excessive-yield financial savings accounts, alternatively, even at right now’s report highs, path that by a strong three share factors.

So as soon as you’ve got recognized your extra money, and also you’ve set your sights on placing it to raised use, the place do you go from there?

What do you have to do with the surplus?

Say hiya to lump sum deposits.

Investing by the use of a lump sum deposit can really feel like a leap of religion. Like diving into the deep finish quite than slowly wading into shallow waters. And it feels that approach for a motive! All investing comes with threat.

However when you’ve additional money mendacity round and accessible to speculate, diving in is extra prone to produce higher returns over the long run, even accounting for the potential for short-term market volatility.

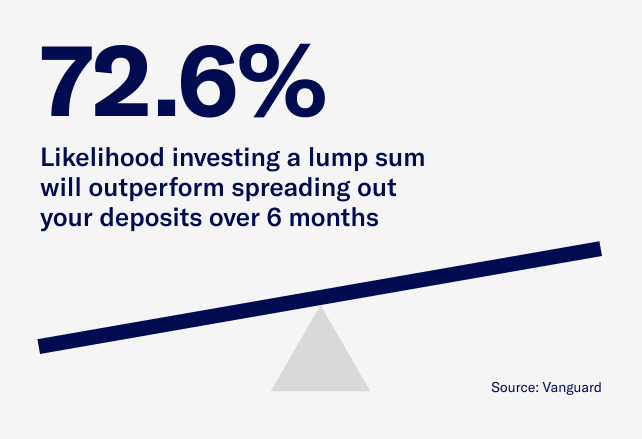

Vanguard crunched the numbers and located that almost three-fourths of the time, the scales tipped in favor of creating a lump sum deposit vs. spreading issues out over six months.

The follow of recurrently investing a hard and fast quantity is named greenback value averaging (DCA), and it’s designed for a distinct state of affairs altogether: investing your common money movement. DCA can allow you to begin and maintain a financial savings behavior, purchase extra shares of an funding when costs are low, and rebalance your portfolio extra affordably.

The follow of recurrently investing a hard and fast quantity is named greenback value averaging (DCA), and it’s designed for a distinct state of affairs altogether: investing your common money movement. DCA can allow you to begin and maintain a financial savings behavior, purchase extra shares of an funding when costs are low, and rebalance your portfolio extra affordably.

However within the meantime, for those who’ve obtained extra money, diving in with a lump sum deposit makes probably the most sense, mathematically-speaking.

And bear in mind it’s not an either-or proposition! Savvy savers make use of each methods—they greenback value common their money movement, they usually make investments lump sums as they seem. As a result of ultimately, each serve the identical purpose of constructing long-term wealth.