U.S. median family incomes have surged—rising from $68,700 to $83,730 nationally, a 21.9% enhance since 2019.

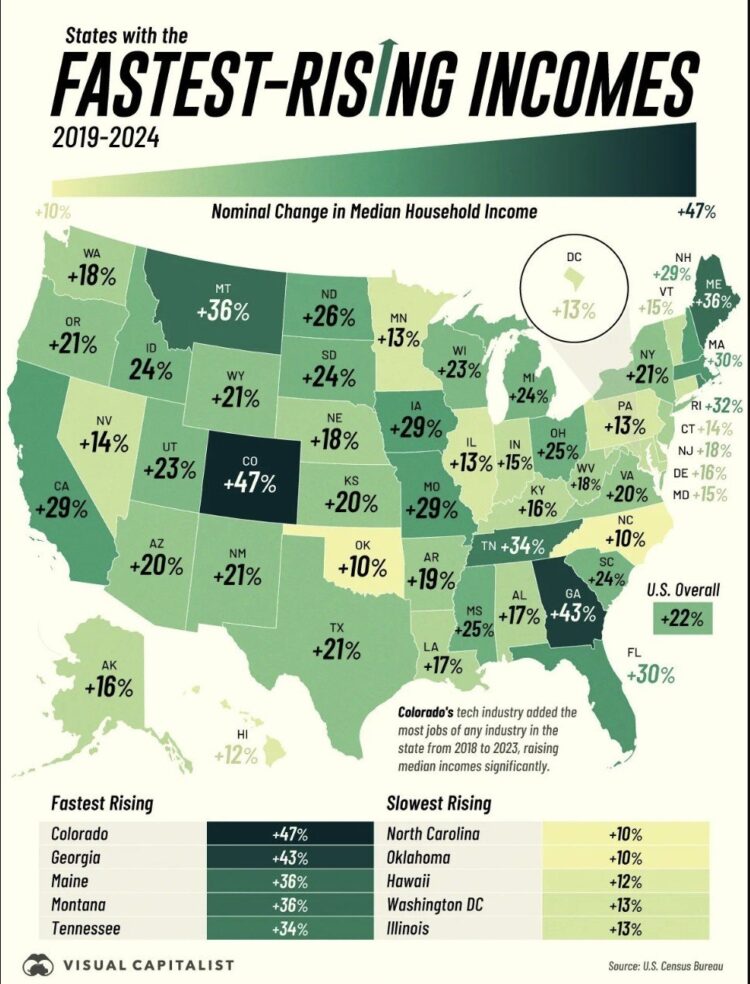

However in some states, salaries spiked even increased. A brand new research from Visible Capitalist has revealed which states had the quickest rising incomes from 2019 to 2024.

“The place you reside issues loads,” the research famous. “Whereas some states tracked near the nationwide common, others noticed incomes climb at practically double the tempo, pushed by booming native industries and main funding.”

Colorado tops the listing—with incomes rising practically 50%.

That dynamic is particularly vital for homebuyers and sellers, since incomes energy instantly shapes housing demand and pricing.

“Rising incomes enhance buying energy, permitting patrons to qualify for bigger mortgages, compete extra aggressively, and take up increased month-to-month funds,” says Hannah Jones, senior financial analysis analyst at Realtor.com®. “For sellers, stronger incomes can translate into firmer demand, fewer worth cuts, and improved leverage in markets the place stock stays tight.”

Colorado tops the listing

In line with knowledge from the U.S. Census Bureau, the state that noticed the most important soar was Colorado, the place incomes elevated by a whopping 46.9%.

“Colorado stands out as a result of earnings progress has been among the many strongest nationally, supported by a high-paying job base and sustained in-migration,” says Jones.

“Dwelling costs surged dramatically in the course of the [COVID-19] pandemic, rising roughly 40% from pre-2020 ranges on the peak in 2023. Nonetheless, worth progress has cooled considerably, and residential costs sit nearly 14% above pre-pandemic ranges as of January. Because of this households in Colorado are in an excellent place with sturdy earnings progress and residential costs well-below their peak stage.”

Different states that noticed rising incomes

The opposite states that spherical out the highest 10 are Georgia, Maine, Montana, Tennessee, Rhode Island, Massachusetts, Florida, Iowa, and Missouri.

“A number of of those states—similar to Colorado, Georgia, Tennessee, and Florida—have skilled sturdy job progress and in-migration, which are inclined to carry each family incomes and housing demand concurrently,” says Jones.

“In additional supply-constrained markets like Massachusetts and Rhode Island, earnings progress usually reinforces already excessive costs as a result of restricted new building prevents stock from increasing shortly.”

“In Florida, rising incomes undoubtedly assist the true property market. When individuals earn extra, they really feel extra assured shopping for a house or upgrading to one thing larger,” actual property agent and investor Ron Myers, of Ron Buys Florida Houses, inform Realtor.com.

“I’ve seen patrons are available with barely increased budgets than a number of years in the past, particularly individuals relocating from different states the place salaries are even increased. For sellers, rising incomes can imply extra move-up patrons. Some householders who constructed fairness over the previous couple of years are promoting and transferring into bigger houses or higher neighborhoods.”

Robert Dodson, gross sales supervisor and dealer at Charles Burt Realtors in Joplin, MO, says as incomes elevated in Missouri, he noticed extra individuals look into investing in rental properties or flip alternatives.

However whilst paychecks develop, some individuals battle to maintain tempo with climbing dwelling costs.

“Dwelling worth progress has usually outpaced wage progress over the past five-plus years, which means shopping for a house calls for extra earnings share than earlier than,” says Jones. “If dwelling costs and mortgage charges rise quicker than wages, month-to-month housing funds can enhance even when incomes are rising. In lots of markets, earnings positive aspects have helped maintain demand, however they haven’t absolutely offset the mixed affect of elevated dwelling costs and better borrowing prices.”

Myers agrees: “In Florida, increased earnings doesn’t all the time imply houses really feel inexpensive,” he says. “Insurance coverage, taxes, and HOA charges have additionally gone up. So even when somebody is making more cash, their month-to-month prices are nonetheless tight.”

Homebuyers and sellers in states with the slowest earnings progress—North Carolina (up 9.9%), Oklahoma (up 9.9%), Hawaii (up 11.6%), Washington, DC (up 12.6%), and Illinois (up 13.2%)—notably really feel the squeeze.

High 10 states the place incomes are rising the quickest

1. Colorado

Median itemizing worth: $548,900

Median family earnings 2024: $106,500

Median family earnings 2019: $72,500

Change in earnings: 46.9%

2. Georgia

Median itemizing worth: $380,000

Median family earnings 2024: $81,210

Median family earnings 2019: $56,630

Change in earnings: 43.4%

3. Maine

Median itemizing worth: $420,000

Median family earnings 2024: $90,730

Median family earnings 2019: $66,550

Change in earnings: 36.3%

4. Montana

Median itemizing worth: $599,000

Median family earnings 2024: $81,920

Median family earnings 2019: $60,190

Change in earnings: 36.1%

5. Tennessee

Median itemizing worth: $419,023

Median family earnings 2024: $75,860

Median family earnings 2019: $56,630

Change in earnings: 34%

6. Rhode Island

Median itemizing worth: $540,000

Median family earnings 2024: $92,290

Median family earnings 2019: $70,150

Change in earnings: 31.6%

7. Massachusetts

Median itemizing worth: $699,000

Median family earnings 2024: $113,900

Median family earnings 2019: $87,710

Change in earnings: 29.9%

8. Florida

Median itemizing worth: $425,000

Median family earnings 2024: $75,630

Median family earnings 2019: $58,370

Change in earnings: 29.6%

9. Iowa

Median itemizing worth: $269,900

Median family earnings 2024: $85,480

Median family earnings 2019: $66,050

Change in earnings: 29.4%

10. Missouri

Median itemizing worth: $295,000

Median family earnings 2024: $78,390

Median family earnings 2019: $60,600

Change in earnings: 29.4%