Melbourne auctions maintain agency after fee rise as CGT debate rattles buyers, with PropTrack displaying a 65 per cent preliminary clearance fee.

Melbourne consumers have barely blinked after the speed rise, however contemporary capital positive aspects tax debate is rattling buyers as auctions maintain agency.

Whereas exercise on the bottom has remained resilient heading into February, specialists warn the mixed strain of shrinking borrowing energy and renewed tax uncertainty is reshaping behaviour throughout the market.

Baseline Monetary director Ari Levinson mentioned the most recent fee rise had already decreased borrowing capability for typical Melbourne households, tightening competitors even when purchaser demand nonetheless seemed sturdy.

RELATED: Melb Qantas couple offloads first house for $683k

Melb’s 30-to-1 property battle: Provide hits zero

Bulldogs star eyes enormous property payday

Borrowing energy usually falls by about 2.3 per cent to 2.5 per cent for each 0.25 share level enhance in rates of interest, he mentioned.

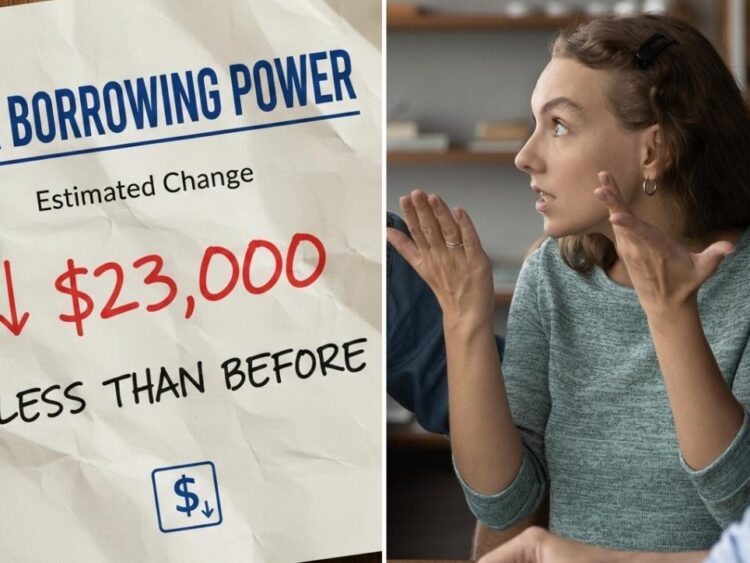

For a Melbourne couple incomes a mixed $180,000 a 12 months and beforehand in a position to borrow about $925,000, that equated to roughly $21,000 to $23,000 being shaved off capability, decreasing it to about $902,000 to $904,000.

“That will not really feel dramatic in isolation, however it may be the distinction between competing confidently and lacking out,” Mr Levinson mentioned.

Baseline Monetary director Ari Levinson says rising charges are tightening borrowing energy for Melbourne consumers heading into February.

What the speed rise has already value consumers: Baseline Monetary knowledge exhibits a typical Melbourne couple’s borrowing energy falling from $925,000 to about $902,000-$904,000.

He warned additional rises may compound strain on family budgets, pushing extra consumers in the direction of mortgage stress, generally outlined as repayments exceeding 30 per cent to 35 per cent of gross family revenue.

Mr Levinson mentioned consumers planning to bid within the coming weeks ought to test their borrowing limits early, keep away from taking up new credit score, and communicate to brokers earlier than public sale, noting that even small adjustments to debt ranges or rates of interest may materially have an effect on approvals.

The double whammy of upper rates of interest and renewed CGT debate is sharpening strain for consumers, buyers and renters throughout Melbourne.

Distinguished purchaser’s advocate Cate Bakos mentioned consumers had largely priced within the fee transfer, with little proof of hesitation at inspections or auctions.

“Apparently, I haven’t seen anybody step again,” Ms Bakos mentioned.

“Purchaser enquiry has flowed virtually seamlessly from final 12 months, and even after the speed announcement there was no noticeable slowdown.”

Purchaser’s advocate and PIPA chair Cate Bakos says Melbourne consumers have largely priced within the fee rise, with public sale competitors remaining regular.

Ms Bakos mentioned CGT uncertainty mattered primarily to buyers and potential buyers, however the penalties may spill into the rental market if extra landlords exited.

“That’s the paradox,” she mentioned.

“Disincentivising buyers dangers eradicating rental inventory once we don’t have sufficient properties to deal with renters.”

Alba director Thomas Mifsud says buyers are weighing CGT uncertainty as a part of broader portfolio choices over the following 12 to 18 months.

Alba director Thomas Mifsud mentioned buyers usually responded to coverage uncertainty in levels reasonably than speeding to promote.

“The primary response is reactionary — folks decide up the telephone and ask, ‘How does this have an effect on me?’” Mr Mifsud mentioned.

“As soon as the emotion settles, it turns into a portfolio query.”

He mentioned most present buyers have been unlikely to promote instantly, however many would reassess technique over the following 12 to 18 months, relying on how markets and coverage settings developed.

“Current house owners usually hold holding so long as they’ll,” Mr Mifsud mentioned.

“It’s the folks sitting on the sidelines making an attempt to get in who really feel it most.”

33 Stephens St, Balwyn North bought for $3.135m as Melbourne auctions held agency regardless of the most recent fee rise.

6 Bayles Crt, Donvale bought for $2.003m, underscoring continued demand for high quality household properties at Melbourne auctions.

Melbourne’s public sale market confirmed little signal of buckling, with PropTrack figures displaying a preliminary clearance fee of 65 per cent from 353 reported outcomes, with 230 properties promoting.

A number of sturdy outcomes on the higher finish pointed to continued depth of demand for high quality properties, together with a $3.135m sale in Balwyn North and a $2.003m end in Donvale, whereas near-$1.8m outcomes in Field Hill North and Mentone additionally underlined purchaser urge for food.

35 Ashley St, Field Hill North bought for $1.79m as consumers stayed lively following the RBA fee rise.

113 Whitby St, Brunswick West bought for $1.69m as inner-city demand held agency at Melbourne auctions.

Internal-city demand held agency, with a Brunswick West house promoting for $1.69m.

Brokers mentioned some consumers remained cautious round value ceilings, however competitors for A-grade properties was resilient, suggesting most bidders had already factored larger borrowing prices into expectations earlier than stepping as much as bid.

Signal as much as the Herald Solar Weekly Actual Property Replace. Click on right here to get the most recent Victorian property market information delivered direct to your inbox.

MORE: ‘Homeless by textual content’: Renter’s 14 day nightmare uncoveredPortelli launches price range Aussie gasoline empire

90pc investor income as Aus rental scarcity worsens

david.bonaddio@information.com.au