President Donald Trump has introduced that he is nominating Kevin Warsh to be the following Chair of the Board of Governors of the Federal Reserve.

Trump made the announcement in a Fact Social submit Friday morning, saying Warsh “has performed intensive analysis within the discipline of Economics and Finance. Kevin issued an Unbiased Report back to the Financial institution of England proposing reforms within the conduct of Financial Coverage in the UK. Parliament adopted the Report’s suggestions.”

The announcement comes off the again of the Federal Reserve’s determination to maintain rates of interest regular and Trump’s heated criticism of Fed Chair Jerome Powell.

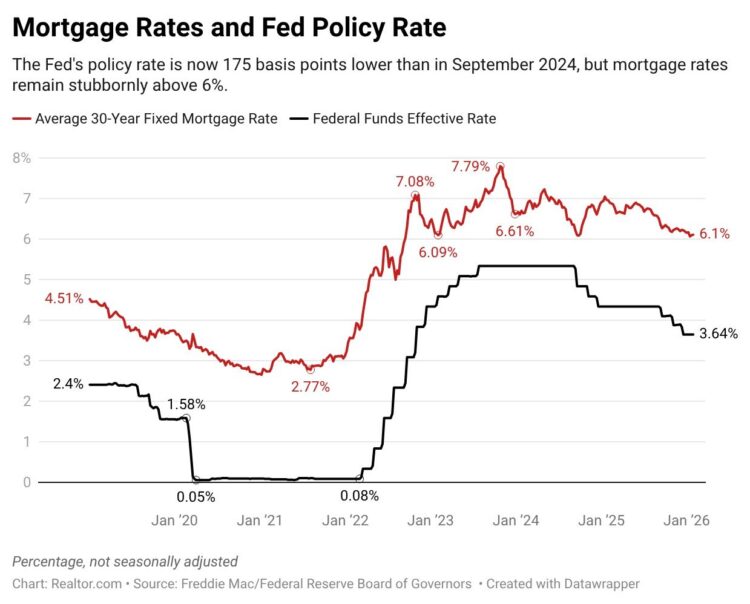

Powell doesn’t set rates of interest alone, however joined the 10-2 majority on the Federal Open Market Committee on Wednesday to vote in favor of leaving the Fed’s benchmark charge unchanged in its present vary of three.5% to three.75%. That is 75 foundation factors decrease than in early September, earlier than three consecutive quarter-point cuts.

Over the identical interval, mortgage charges have eased, falling from 6.5% in early September to six.09% final week, near a three-year low, in accordance with Freddie Mac.

“Jerome ‘Too Late’ Powell once more refused to chop rates of interest, despite the fact that he has completely no motive to maintain them so excessive,” Trump wrote on his Fact Social social media platform after the choice. “We should always have a considerably decrease charge now that even this moron admits inflation is now not an issue or menace.”

Warsh’s choice as the following Federal Reserve Chair will naturally be learn as a sign that charge cuts are on the horizon and quick approaching. Nonetheless, Realtor.com senior economist Jake Krimmel says that conclusion is “too easy and possibly too short-termist”.

“As one in all 12 voting members, a brand new chair doesn’t assure a Fed coverage pivot, no matter who’s confirmed,” he says.

“We do know Warsh is more likely to push for cuts. That was very clearly a prerequisite for the nomination. We should always not, nevertheless, assume the brand new Chair’s energy and sway over the Federal Open Market Committee (FOMC) will look the identical because it has in recent times.”

Krimmel provides that “projecting Jerome Powell’s inner Fed affect mechanically onto Warsh might be a mistake”.

Trump has been publicly vital of Powell for not reducing rates of interest. He has additionally known as for the central financial institution to slash its rate of interest to 1%, claiming it will scale back authorities borrowing prices and increase the housing market.

Kevin Warsh has advocated for change on the Federal Reserve

In Warsh, Trump has a nominee who served as a Fed governor from 2006 to 2011 throughout the depths of the World Monetary Disaster, and who advocates for what he calls “regime change” on the Fed.

In public feedback, Warsh has promoted extra aggressive charge cuts and substantial reform of the Fed’s coverage framework, saying present insurance policies are holding down financial development and inflicting a housing recession, with first-time homebuyers struggling to afford a house.

Warsh was born in Albany, NY. He studied public coverage, with an emphasis on economics and statistics at Stanford College, the place he acquired a bachelor’s diploma with honors in 1992. He then went on to Harvard Regulation Faculty the place he centered his research on the intersection between legislation, economics, and regulatory coverage and acquired a legislation diploma in 1995.

He additionally accomplished coursework in market economics and debt capital markets at Harvard Enterprise Faculty and the Massachusetts Institute of Expertise’s Sloan Faculty of Administration.