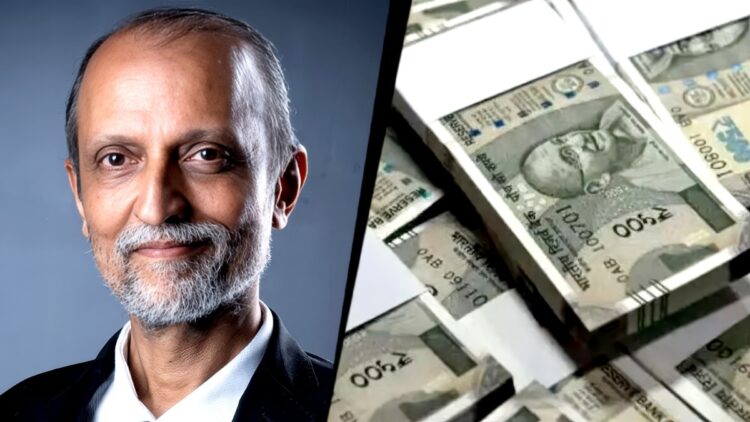

Economist Ajit Ranade has renewed the case for a wealth tax, arguing that rising focus of wealth throughout generations is creating limitations to financial mobility and, past some extent, posing dangers to development and stability.

“Wealth is getting accrued throughout a number of generations and it’s getting entrenched in a slim part of society,” he mentioned in an interview with Outlook Enterprise. In response to him, this sample isn’t producing adequate mobility. “The wealth accumulation isn’t resulting in any social churning. The rags-to-riches tales are exceptions; such instances are only a few.”

Ranade mentioned the broader impact is a focus of financial energy. “By and huge, wealth retains getting accrued throughout generations, resulting in a focus of cash energy with limitations to entry into the wealth circle.”

He warned that worsening inequality, if left unchecked, can start to harm the economic system itself. “This growing focus of wealth, mirrored in worsening wealth inequality, past a sure level is dangerous for the economic system,” he mentioned. “When inequality, whether or not of wealth or earnings, turns into too excessive, it results in social instability, investor nervousness, capital flight, and ultimately development stagnation.”

On the similar time, the economist mentioned inequality isn’t inherently detrimental. “For positive, some inequality is inevitable and will even be welcome,” he mentioned, pointing to sectors akin to IT and startups the place incomes typically rise sooner than the typical. “That widening hole is what we name inequality.”

The priority, he mentioned, is the place society chooses to attract the road. “However there comes some extent the place this inequality turns into extreme. How a lot is an excessive amount of has no exact reply in financial textbooks; it’s a societal alternative,” Ranade mentioned, citing arguments by Thomas Piketty and others that inequality is turning into unhealthy throughout nations.

On coverage responses, the famous economist mentioned step one ought to be rationalising earnings taxation. “One response is to purpose for a good and environment friendly taxation of earnings, ideally bringing all incomes, whether or not from agriculture or dividends, underneath one framework.”

Wealth taxation, he mentioned, ought to be thought-about as a further measure, whereas acknowledging its challenges. “One other extra choice is wealth taxation. That is onerous as a result of individuals could discover intelligent technique of hiding their wealth in land, gold, benami properties or stash overseas.”

To make the thought workable, Ranade proposed narrowing its scope. “A technique is to focus solely on monetary wealth, which is already reported and well-documented,” he mentioned, itemizing shares, mutual funds, bonds, financial institution deposits, personal fairness and sovereign gold bonds. “Utilizing market values or a mean over six or twelve months, a modest tax could possibly be designed.”

He addressed criticism that such a tax could be simply prevented. “There’s robust opposition to this concept, with claims that it’s unworkable,” Ranade mentioned, noting issues that wealth could possibly be routed by tax-exempt trusts. “However my suggestion was exactly to make it workable by excluding actual property and different types of wealth, and focusing solely on monetary property to start with, and to look at the taxability of trusts which maintain immense wealth.”