The board of administrators of ZIM Built-in Delivery Providers (NYSE: ZIM) has obtained presents from a number of main delivery corporations because it examines strategic potentialities for the corporate. After “Globes” revealed {that a} takeover bid had been obtained from Hapag-Lloyd, one other supply was obtained, so far as is thought from a bigger firm, MSC. Maersk has additionally been talked about as interested by ZIM.

ZIM’s board acknowledged in response: “The method of the strategic overview of alternate options for yielding worth to the shareholders is progressing, and a number of other proposals from main corporations are being examined. We is not going to touch upon the id of the events or the content material of the proposals till an settlement has been reached.”

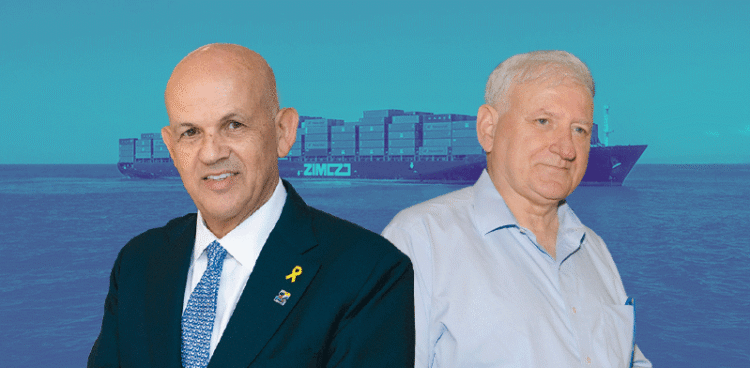

ZIM, headed by Eli Glickman, has a market cap of $2.26 billion. Final month, Glickman along with delivery magnate Rami Ungar submitted a suggestion for the corporate that was turned down, however the board subsequently launched into a technique of inspecting strategic alternate options.

In the meantime, the ZIM board has obtained assist in its battle with a bunch of shareholders looking for to nominate administrators on its behalf. Consultancy and proxy advisor Glass, Lewis & Co. has really useful to its clients to assist the board’s proposal on the firm’s forthcoming shareholders assembly and to oppose the transfer by the shareholder group. It thereby joins proxy advisor ISS, which additionally really useful supporting the board’s proposal.

A bunch of Israeli shareholders holding a complete of 8% of ZIM lately put ahead three candidates of their very own for the board: Dr. Keren Bar-Hava CPA, Ron Hadassi, and Ran Gritzerstein. After a couple of days, two administrators resigned, and former supervisor of banks on the Financial institution of Israel Yair Avidan, and Dr. Yoram Turbowicz, a former competitors commissioner and head of the prime minister’s bureau, had been appointed of their place.

ZIM shareholders shall be requested which administrators they want to see on the board, Avidan and Turbowicz or the three candidates put ahead by the shareholder group. Altogether, the shareholders will elect eight administrators from eleven candidates.

Glass, Lewis & Co. states that the fears raised by the shareholder group about the potential for a administration buyout led by Glickman ignore the truth that the possession of the corporate could be very decentralized, with the ten largest shareholders holding only one.2-2.4% every. With such an possession construction, any acquisition supply (whether or not from the administration or from an exterior purchaser) would require broad assist among the many shareholders to succeed.

RELATED ARTICLES

Glass, Lewis provides that the board’s actions mirror an effort to make sure an neutral course of, and that the marketing campaign by the opposing shareholders will not be based mostly on proof and that they haven’t introduced a convincing argument for electing their candidates.

ZIM chairperson Yair Seroussi welcomed the advice to assist the board’s candidates, saying, “The shareholders have clear exterior affirmation that the board of administrators supervising the strategic overview is impartial, empowered, and performing for the good thing about all of the shareholders. I hope that the Israeli establishments will be part of the traders normally in reaching the suitable consequence. We’re dedicated to the continuation of a clear and punctilious course of, even because the overview approaches its conclusion.”

Printed by Globes, Israel enterprise information – en.globes.co.il – on December 14, 2025.

© Copyright of Globes Writer Itonut (1983) Ltd., 2025.