With the vacations rapidly approaching and plenty of Canadians feeling the pinch, it’s no shock that

purchase now, pay later (BNPL)

plans look particularly interesting. These short-term gives can look like a simple option to stretch a good price range and maintain seasonal spending on monitor, however and not using a clear understanding of how they work, they’ll simply as simply create a tough cycle of debt. Earlier than deciding whether or not to reap the benefits of a BNPL plan, listed here are suggestions that can assist you assess the advantages and related dangers.

Several types of BNPL plans

BNPL contracts have been round for many years and are available in quite a lot of types. They’re recognized by names equivalent to retail financing agreements,

instalment plans or retail credit score providers. Nonetheless, all of them present primarily the identical service; they help you pay later to your services or products.

The normal sort of deferred cost plan is often tied to a particular retailer bank card with a “no funds, no curiosity” promotion, typically for furnishings, home equipment or electronics. Relying on the supply, you can be required to make funds through the no curiosity interval. Nonetheless, most of the time, you might be allowed to skip funds solely with out triggering curiosity fees as long as the steadiness is paid in full earlier than the promotional grace interval ends.

Some bank card suppliers supply instalment plans that allow you to convert eligible purchases or components of your steadiness right into a structured mortgage repaid over a set variety of months. Whereas there may very well be a price, the rate of interest is often decrease than what you’ll pay by carrying the steadiness in your card and every instalment is just added to your minimal month-to-month cost. Nonetheless,

might terminate the plan and trigger any discounted rate of interest to finish as nicely. And since the instalment quantity is carried in your bank card, it nonetheless counts towards your general steadiness and reduces your accessible credit score.

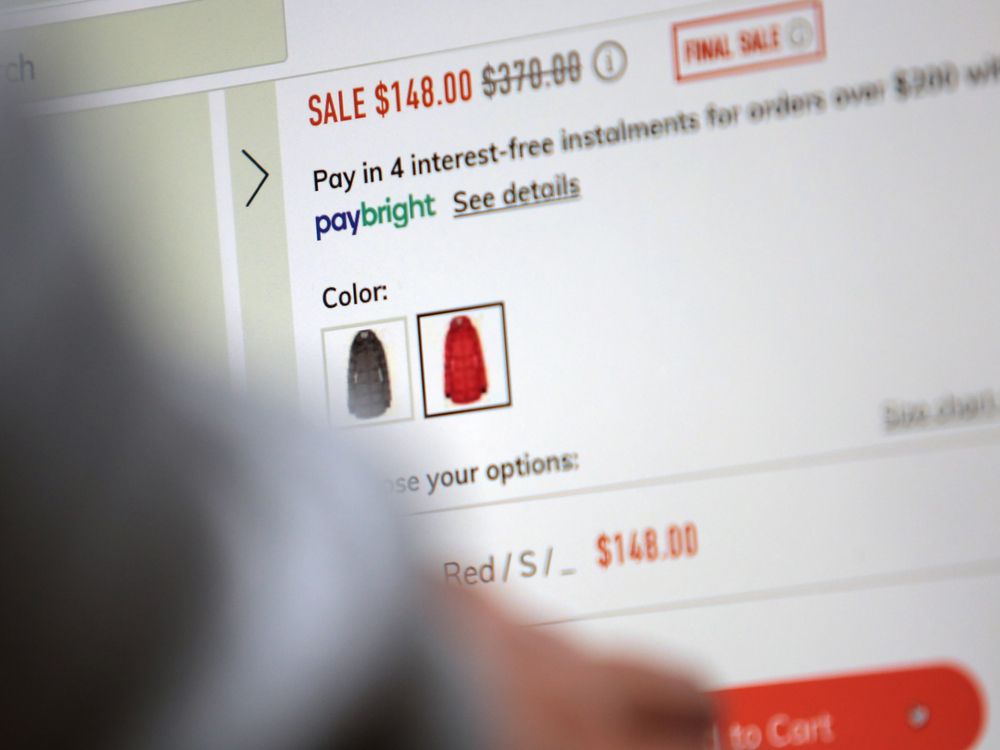

The preferred BNPL choice in the present day comes into play proper on the checkout, whether or not you might be buying on-line or in-person. These cost providers usually help you cut up your buy into three or 4 equal month-to-month instalments. To be permitted, many suppliers run a gentle credit score test, which doesn’t have an effect on your credit score rating, earlier than asking to your consent to robotically debit your checking account or bank card for the longer term funds. With a sensible price range there will be advantages to spreading out your funds. The dangers, nonetheless, are simple.

The professionals and cons of BNPL cost providers

The comfort of utilizing providers equivalent to Klarna, Afterpay, Affirm, Sezzle or PayPal Holdings Inc.’s Pay in 4 has grown rapidly because the pandemic. By spreading funds out, BNPL plans supply the pliability to handle massive or sudden bills extra simply, with out incurring the identical curiosity fees as you’ll with a bank card.

BNPL providers can even aid you plan your spending for upcoming or deliberate purchases for those who create a stable compensation plan beforehand. With no clear technique to account for the funds

, it’s simple to lose monitor of a number of plans, every with totally different phrases, situations and compensation necessities.

BNPL plans are nonetheless debt, not free cash, and may develop into a problematic monetary behavior, particularly for those who attempt to maximize

contained inside the BNPL providers. Cost suppliers encourage frequent use with rewards and loyalty incentives, providing reductions at retailers who supply their service to their prospects. Making funds on time, reaching sure spending targets or partaking with options of their app can result in further gives or membership upgrades, establishing a sample of incentivized spending that some might evaluate to on-line playing.

Earlier than signing up for any plan, it is very important rigorously learn the superb print, ideally by reviewing the phrases on the cost service’s web site, fairly than making choices whereas standing on the checkout counter. This method provides you time to make clear something that is perhaps unclear, rethink your buy or look into different cost strategies as a result of commonly utilizing BNPL plans might cover underlying points with spending habits and cash administration. This might result in missed funds, expensive charges, curiosity fees and

harm to your credit score rating

.

Lacking funds, particularly with 12- to 18-month no cost gives, will be expensive as a result of curiosity is often charged on the total steadiness retroactive to the date of buy. Whereas BNPL might seem easier than bank cards, bank cards present constant billing, higher shopper safety and assist construct credit score when used responsibly.

BNPL plans can be found for all the pieces from meals supply to style and residential enchancment objects, making deferred funds much more enticing. Nonetheless, returning an merchandise purchased with BNPL, and receiving a full refund, usually doesn’t cease the cost plan. Because of this, it may be irritating to proceed paying for an merchandise you now not have.

Utilizing BNPL plans assumes that your revenue stays secure as a way to make the funds on time. In case your revenue instantly decreases, you can miss funds and discover it difficult to recuperate financially.

As with every instrument, the trick with utilizing BNPL plans properly is to verify the funds match inside your price range. Have a plan for the way you’ll end

, and for those who run into hassle, attain out to your monetary establishment or a non-profit credit score counsellor for assist earlier than your scenario will get worse.

Mary Castillo is a Saskatoon-based credit score counsellor at Credit score Counselling Society, a non-profit group that has helped Canadians handle debt since 1996.