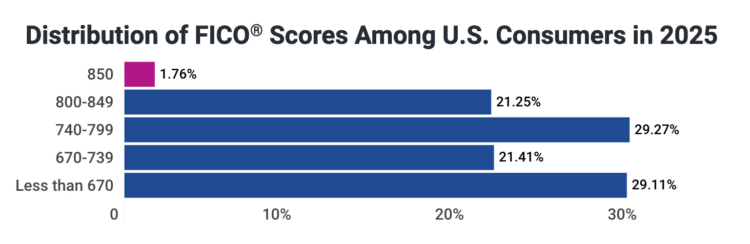

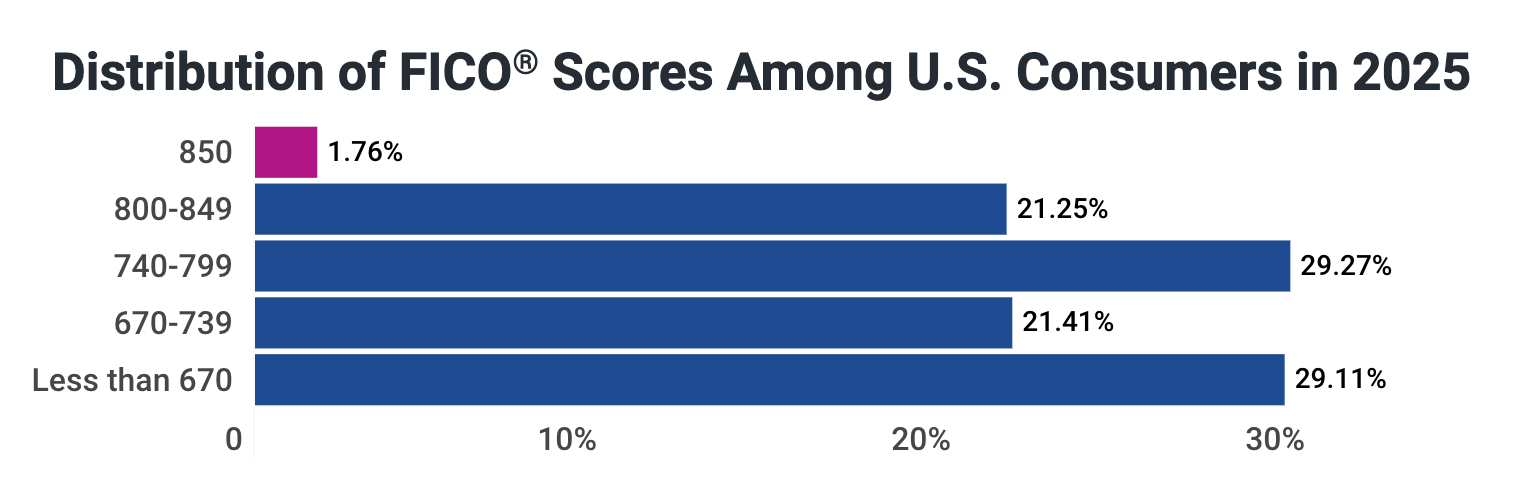

About one-fifth of individuals have an “Distinctive” rating of 800-850. Learn the way many attain that excellent rating.

Reply: 1.76%

Questions:

- What components go into calculating your credit score rating?

- What are the advantages of a excessive credit score rating, even when it’s not an ideal 850?

- What different traits (like age or debt stability) may be shared by folks with an ideal credit score rating? Clarify your reasoning.

Click on right here for the ready-to-go slides for this Query of the Day that you should use in your classroom.

Behind the numbers (Experian):

“These with an 850 FICO® Rating have the identical common traits present in prior years: decrease balances total, aside from mortgage balances, that are solely barely greater than these of all customers…

Habits you would replicate to see a rating enhance embody:

These with distinctive credit score, FICO® Scores of 800 and above, will probably obtain the identical phrases as somebody with an ideal rating of 850—all else being equal. Even these with FICO® Scores barely beneath 800 could obtain the identical phrases as those that have reached the highest of the credit score rating scale.”

About

the Writer

Kathryn Dawson

Kathryn (she/her) is happy to affix the NGPF staff after 9 years of expertise in schooling as a mentor, tutor, and particular schooling instructor. She is a graduate of Cornell College with a level in coverage evaluation and administration and has a grasp’s diploma in schooling from Brooklyn School. Kathryn is wanting ahead to bringing her ardour for accessibility and academic justice into curriculum design at NGPF. Throughout her free time, Kathryn loves embarking on cooking initiatives, strolling round her Seattle neighborhood together with her canine, or lounging in a hammock with a e book.