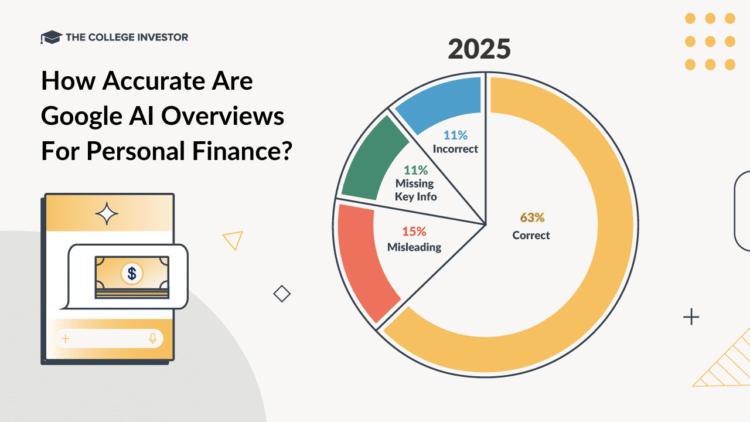

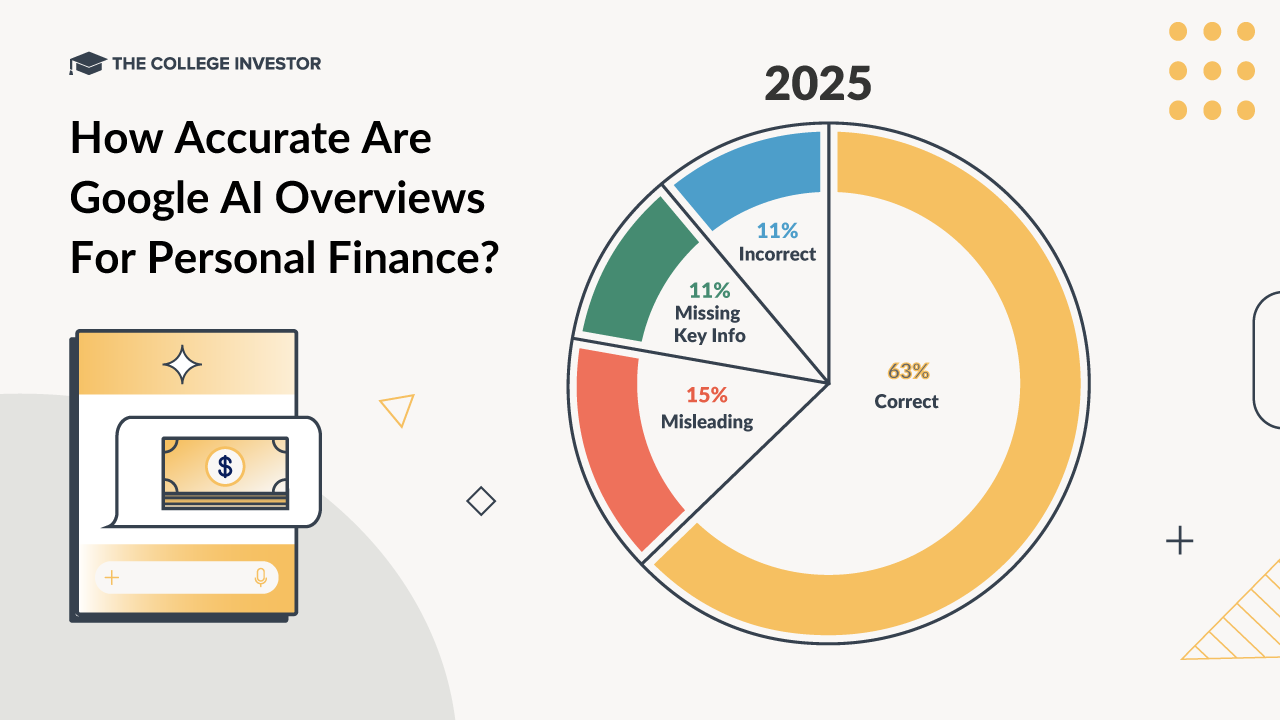

Google AI overviews are deceptive or inaccurate in 37% of finance-related searches, in keeping with The School Investor’s newest evaluation. That is an enchancment from final yr, the place 43% of AI Overviews have been inaccurate – however a one-third error price is troubling relating to private finance.

That is inflicting client confusion, and doubtlessly harming Individuals’ funds. The overviews have been particularly dangerous relating to tax, insurance coverage, and monetary assist associated queries.

What’s Occurring: Over the past a number of years, Google has been rolling out AI-driven solutions in search outcomes. On the high of the search outcomes they present AI Overviews, they usually’re now increasing using AI Mode. The issue is they’re plagued with inaccurate solutions. And consultants say it is a critical problem.

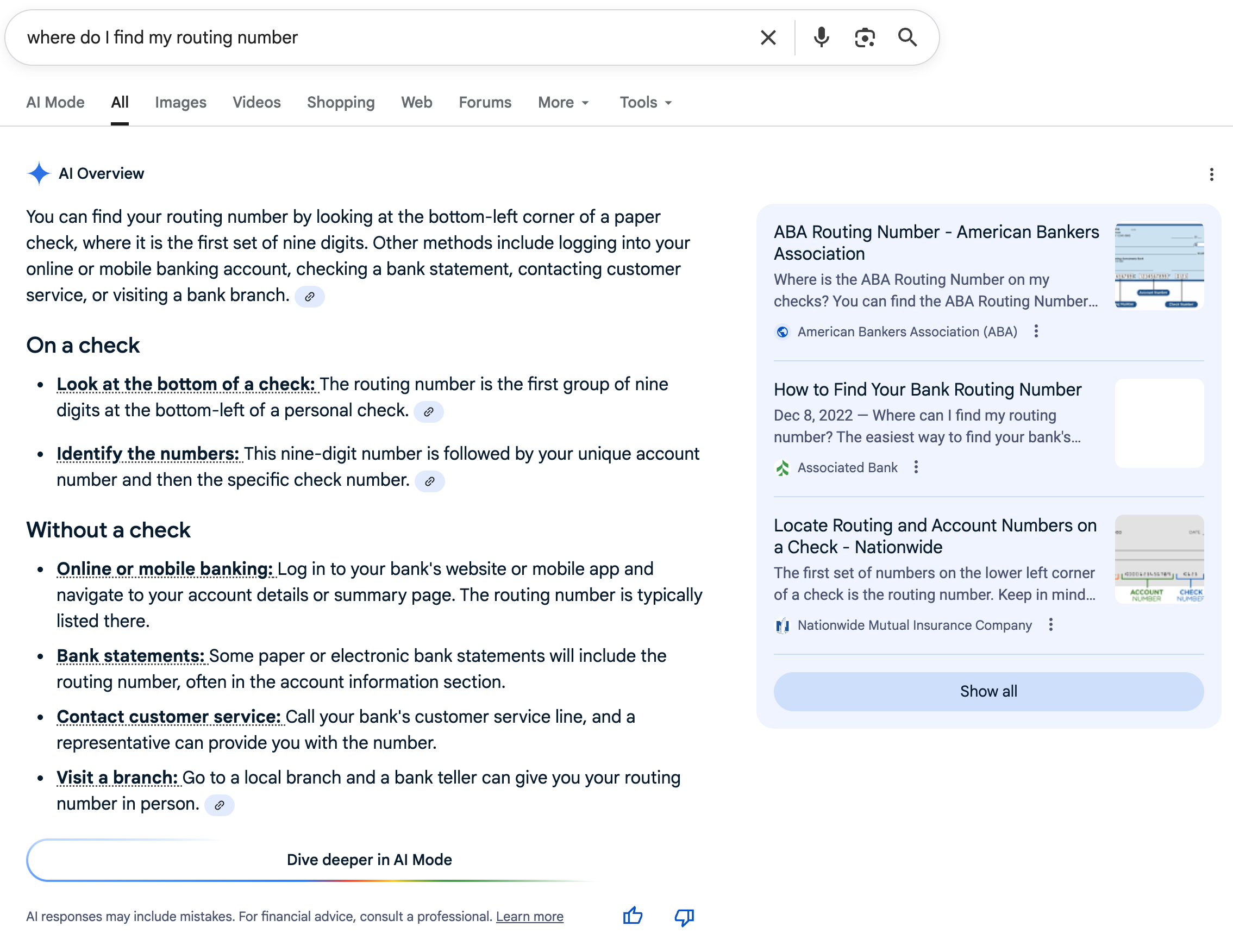

It is essential for searchers to appreciate that Google is solely analyzing the present internet outcomes and attempting to offer a solution primarily based on what it is aware of and what it finds. It hyperlinks to among the sources it finds on the appropriate facet.

Nonetheless, on the finish of the day this data just isn’t vetted by an expert or anybody with data of non-public finance. It might not be correct. Even Google alludes to it with their disclaimer (which is completely different than final yr’s):

Google search screenshot. [Screenshot by The College Investor]

Would you want to save lots of this?

Key Points With Google AI-Overviews And Private Finance

We re-tested 101 private finance-related queries throughout a number of areas of non-public finance, together with banking, credit score, investing, insurance coverage, scholar loans, and monetary assist. You possibly can leap to each question we examined beneath. This was a follow-up to the similar research we did in 2024.

Out of 100 searches, we discovered that Google AI Overviews have been appropriate in 63 cases, and offered deceptive or inaccurate data in 37 cases. Notably, one of many queries not has an AI Overview seem for it – and this question had issue offering an correct outcome final yr.

We labeled the wrong solutions 3 ways:

- 🔶 Deceptive: The AI reply offered could possibly be interpreted in a manner that causes monetary hurt.

- 🔶 Lacking Key Info: The AI reply was semi-correct, but additionally missed key data that might trigger monetary hurt (such a key exceptions or state-based guidelines).

- ❌ Incorrect: The AI reply was merely incorrect, sometimes utilizing outdated or incorrect values or data, which might result in monetary hurt.

We discovered the the AI-Overviews have been fully incorrect in 11 cases. This was solely a marginal enchancment over the 12 incorrect cases final yr. This included points akin to offering outdated data on services (or just making up product names) and outdated data on scholar mortgage compensation plans.

The remaining 26 errors have been both deceptive outcomes or the outcomes have been lacking key data.

In comparison with The School Investor’s 2024 AI Overview Examine, it improved it is solutions in 18 AI Overviews, however obtained worse in 14 AI Overviews. This reveals that each the search outcomes and associated AI Overviews proceed to alter – however the underlying AI expertise can not seem to get it proper.

When Google Will get It Proper

Typically, the AI Overviews have been appropriate for fundamental 101-level questions, akin to “what’s” or “easy methods to”. That they had essentially the most appropriate solutions when masking fundamental private finance subjects, together with banking and getting out of debt.

In comparison with final yr, they considerably elevated the “robustness” of solutions. Lots of the enhancements we noticed have been queries that have been beforehand Lacking Key Info, and now the AI Overview covers the nuances.

When Google Will get It Incorrect

AI Overviews struggled essentially the most with recency and nuance – which is most of non-public finance. Many of the incorrect solutions concerned navigating adjustments to scholar loans and monetary assist, One Massive Stunning Invoice tax subjects, investing subjects, and insurance coverage.

The largest space of decline was when it got here to precise services or products choices. Final yr it appeared to create its personal listicle of solutions. This yr, it was making up merchandise or service names in two of our queries, and continued to get rates of interest flawed. For main monetary establishments, this can be a huge compliance problem.

What Stunned Us The Most

Final yr, the outcomes have been fairly sturdy on trending information. This yr, we observed that many solutions have been “hedging their bets”, and whereas offering quite a lot of data, they did not actually reply the questions.

It was stunning that there have been no enhancements (and truly declines) in evaluating banking merchandise. Checking rates of interest on financial savings accounts looks as if a fairly straightforward process. We do it on a regular basis. However Google appears to fail at it.

The quantity of spam within the AI overviews appeared to have elevated from final – from photographs linking to bizarre overseas spam domains, or parasite content material hosted on .edu domains.

We additionally noticed quite a lot of YouTube movies have been being pulled in to the outcomes, which was completely different than final yr.

What Google Is Saying

A Google Spokesperson advised The School Investor, “The overwhelming majority of AI Overviews are factual and we’ve continued to make enhancements to each the helpfulness and high quality of responses, together with for monetary queries the place we now have a fair increased bar for accuracy. We additionally inform individuals when it’s essential to hunt out skilled recommendation or to confirm the knowledge offered.”

When sharing among the examples from this research, the spokesperson mentioned “When points come up – like if our options misread internet content material or miss some context – we use these examples to enhance our programs, and we take motion as applicable underneath our insurance policies.”

Why Does This Matter For You

If you seek for monetary data on-line, you are usually on the lookout for assist with choices that instantly have an effect on your cash – easy methods to repay your scholar loans, methods to decrease insurance coverage prices, or easy methods to select the appropriate financial savings account. If these solutions are flawed, the implications could be critical.

An AI-generated reply that misstates tax guidelines could lead on you to file incorrectly and owe additional taxes and penalties. A foul suggestion about refinancing scholar loans might price you mortgage forgiveness. Even one thing so simple as outdated bank card particulars might push you towards a product that not exists or carries completely different charges.

In contrast to data from an authorized monetary planner, a authorities web site, or trusted retailers akin to The School Investor, Google’s AI solutions aren’t reviewed by consultants. They’re stitched collectively from internet content material which may be outdated, incomplete, deceptive, or flat-out flawed.

That issues as a result of extra Individuals now depend on their digital units as their first cease for monetary recommendation. When the search engine that most individuals use begins presenting unverified data as truth, it doesn’t simply waste your time — it could actually price you actual cash.

The federal government has additionally been centered deceptive and misleading AI. The FTC introduced it was going after a wide range of AI scams, California simply handed a host of recent restrictions on AI, and there was an improve in UDAAP enforcement in misleading banking and finance promoting.

With regards to your cash, actual human experience nonetheless issues — as a result of getting it flawed can price you greater than only a click on.

AI Overviews

All AI overviews have been categorized as follows:

- ✅ Right – The AI reply offered can be appropriate and useful, and wouldn’t trigger monetary hurt.

- 🔶 Deceptive – The AI reply offered could possibly be interpreted in a manner that causes monetary hurt.

- 🔶 Lacking Key Info – The AI reply was appropriate, but additionally missed key data that might trigger monetary hurt (such a key exceptions).

- ❌ Incorrect – The AI reply was merely incorrect, sometimes utilizing outdated or incorrect values or data, which might result in monetary hurt.

Normal Private Finance

These are subjects associated to normal private finance, akin to banking, budgeting, and credit score. It was attention-grabbing to see well timed subjects generate AI overviews, such because the Chase Glitch.

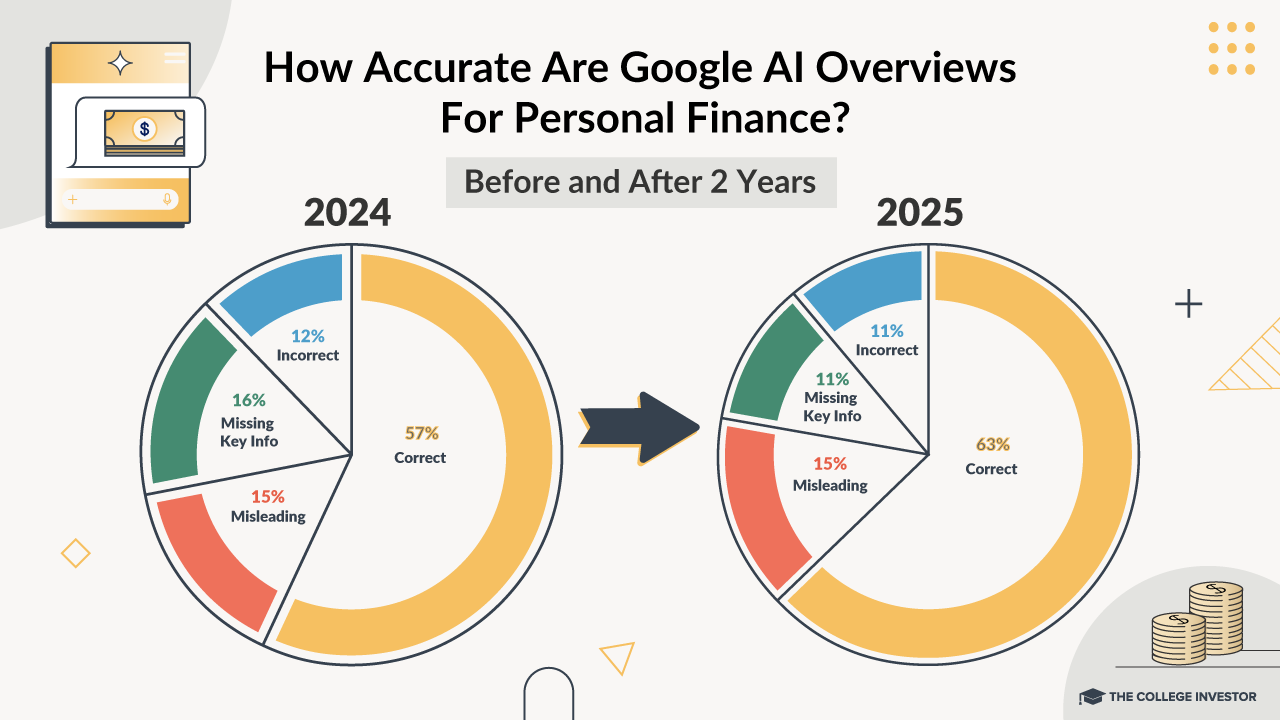

Verdict: Right

Google search screenshot of question “The place do I discover my routing quantity”? [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “How Do I Pay With Money?” [Screenshot by The College Investor]

Verdict: Right

Notable that the AI pulls in some weblog spam from the College of Wisconsin – Madison within the sidebar.

Google search screenshot of question “What If I Do not Pay My Payments?” [Screenshot by The College Investor]

Verdict: Right

As a facet be aware, discover the picture that was used from an internet site referred to as Service provider Price Consulting with out credit score or hyperlinks to their web site within the AI overview.

Final yr, this similar question linked to The Stability with out credit score or attribution. Odd that this one question needs to drag a picture when many others do not.

Google search screenshot of question “What’s a wire switch?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “What’s the debt snowball methodology?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “How Does A Credit score Card Work?” [Screenshot by The College Investor]

Verdict: Right

One other picture taken from the Remitly web site with none credit score. Lot’s of cash switch spam websites on the hyperlinks.

Google search screenshot of question “How Does A Examine Work?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “What Was The Chase Glitch” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “Why Is It Dangerous To Simply Make The Minimal Cost On A Credit score Card?” [Screenshot by The College Investor]

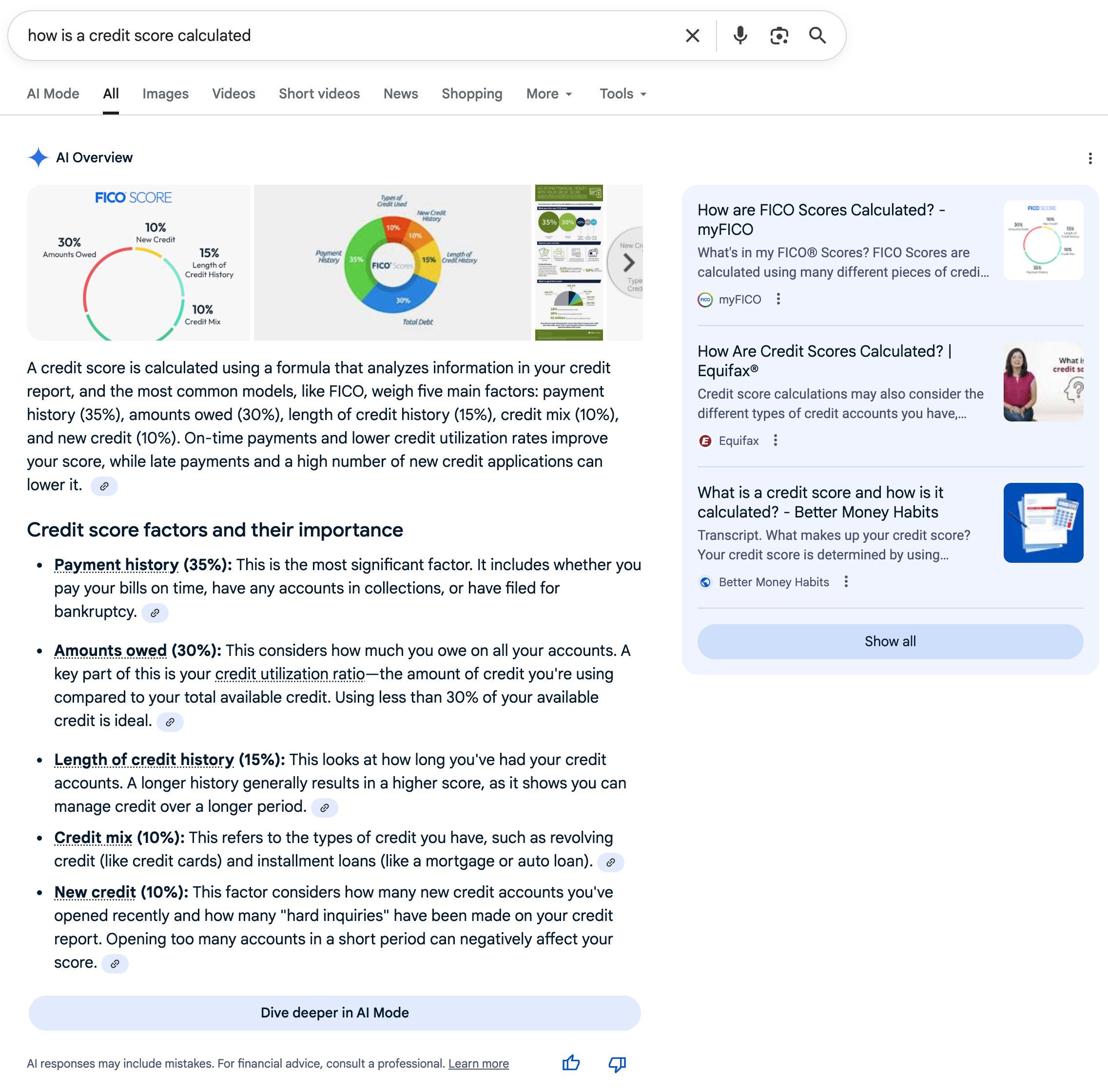

Verdict: Right

Whereas it pulls in FICO and Vanguard scores, the photographs are all from spammy domains, some ending in .in.

Google search screenshot of question “How Is A Credit score Rating Calculated?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “What Is Thought of Dangerous Credit score?” [Screenshot by The College Investor]

Verdict: Incorrect

This was sort of an enchancment, however nonetheless a miss in comparison with final yr. In case you keep in mind final yr, this question Google tried to offer an inventory that ranked Wells Fargo #1, and adopted it up with an inventory of the biggest banks.

This yr, it drops it is personal rating in change for the 4 advert spots earlier than the AI Overview (and naturally, earlier than the content material), and now the AI overview does not truly reply the question however simply so you possibly can open an checking account at banks and credit score unions.

There are lot’s of free checking account choices and lists that may be offered right here. This can be a miss.

Google search screenshot of question “The place To Open A Checking Account?” [Screenshot by The College Investor]

Verdict: Incorrect

We have been going to go away this one as deceptive, however then we learn the listing… the final financial institution does not exist – I am actually curious how the AI reworked Sallie Mae financial institution into Sally Might (and it hyperlinks to a YouTube listicle – however the Youtuber has an accent so I am questioning if it was utilizing voice).

General, this does not assist readers discover the greatest place to open a financial savings account, although you can argue that it is appropriate in that these banks do permit individuals to stroll right into a department or open an account.

Besides Uncover Financial institution is stopping on-line deposits quickly because of it is merger with Capital One. After which it notes UK choices.

All in all, a nasty response.

Google search screenshot of question “The place To Open A Financial savings Account?” [Screenshot by The College Investor]

Verdict: Incorrect

Final yr, this tried to offer it is personal listing of 12-month CD charges (that was outdated).

This yr, it makes up a brand new financial institution referred to as Hustle Digital Credit score Union. There may be credit score union referred to as HUSTL, which is a division of Vantage West Credit score Union. However there’s one other downside – they do not supply a 4.5% APY 12-month CD. They presently supply a 4.10% APY 12-month CD.

Google search screenshot of question “The place To Open A 12-Month CD?” [Screenshot by The College Investor]

Verdict: Incorrect

We price this incorrect as a result of the primary blue hyperlink, Capital One, does not assist you to open an auto mortgage on-line. The so-called “Auto Navigator” they point out connects you with sellers the place you may get pre-qualified by way of then.

It seems to not perceive the question, or is continuous to favor sure huge manufacturers.

Google search screenshot of question “The place Can I Open An Auto Mortgage On-line?” [Screenshot by The College Investor]

Taxes

These are subjects associated to taxes. These subjects are regarding to us essentially the most as a result of they’ve giant monetary implications for incorrect or deceptive solutions.

Verdict: Deceptive

We marked this deceptive as a result of there isn’t a 2024-2025 tax yr. There’s a 2024 tax yr, and a 2025 tax yr.

Granted, the IRA contribution limits remained the identical in each 2024 and 2025 – however we needed to do a double-take. And that is strategy to fundamental to mess up.

Google search screenshot of question “What Is The IRA Contribution Restrict?” [Screenshot by The College Investor]

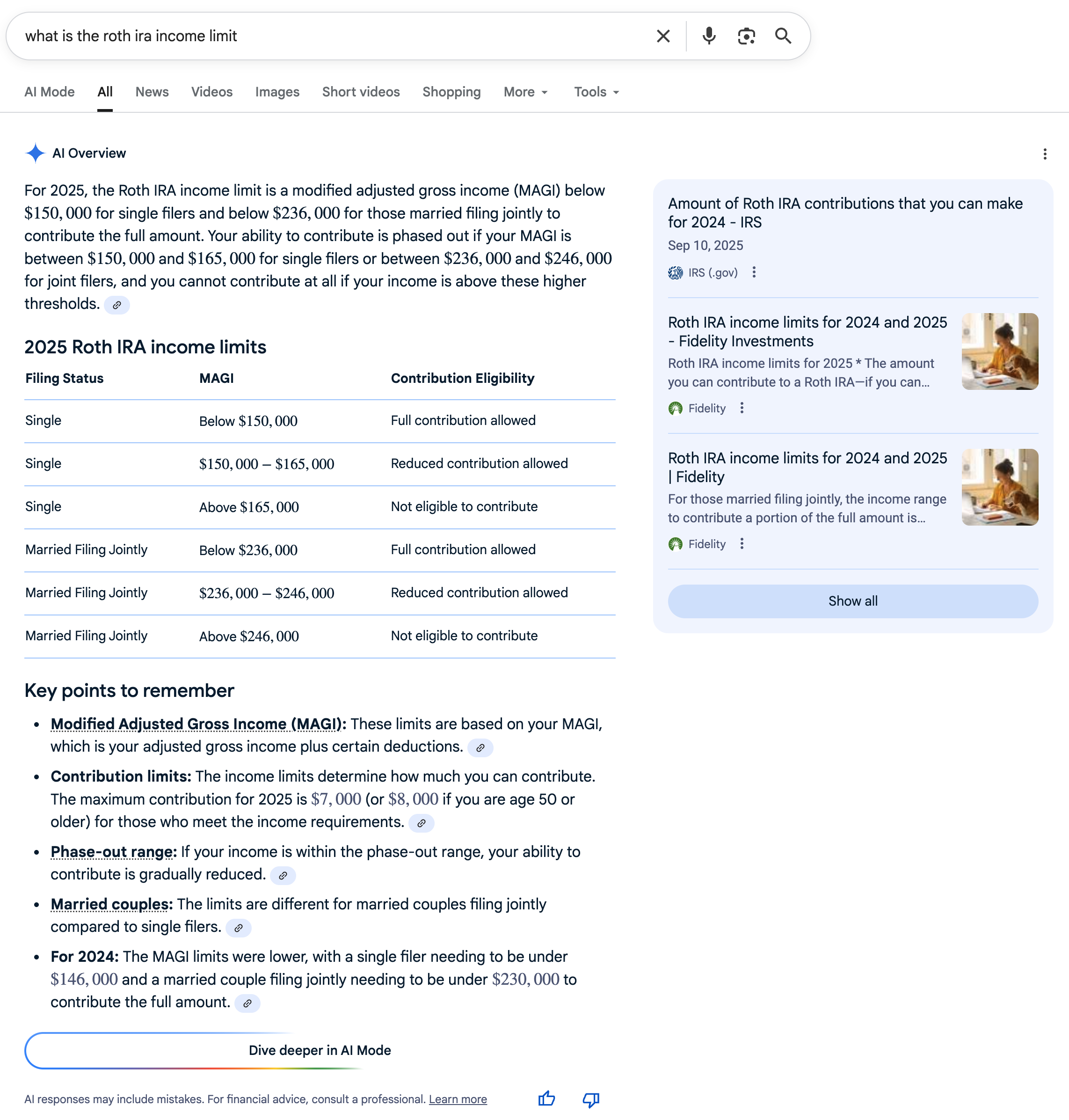

Verdict: Right

Final yr this overview incorrectly said the decrease restrict. This yr, the AI pulls in a pleasant little chart.

Google search screenshot of question “What Are The Roth IRA Revenue Limits?” [Screenshot by The College Investor]

Verdict: Right

As a facet be aware for this question, it will not present an AI overview except you specify a yr.

Google search screenshot of question “What Is The HSA Contribution Restrict?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “What Is The 401k Contribution Restrict?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “What Is The 529 Plan Contribution Restrict?” [Screenshot by The College Investor]

Verdict: Deceptive

This AI overview of qualifying 529 plan bills was a bit of higher than final years, it at the least hedged with eligible Okay-12 training 529 plan bills with (as much as annual limits – that is altering within the latest OBBBA).

But it surely continues to disregard that each one states do not conform with federal guidelines, and is blended messaging on standardized take a look at charges, which additionally simply modified.

Google search screenshot of question “What Are Certified 529 Plan Bills?” [Screenshot by The College Investor]

Verdict: Deceptive

The reply as to if you should utilize a 529 plan for elementary college is “perhaps”, relying in your state. The AI Overview leads with “Sure”, which is deceptive, nonetheless, it does point out that some states could tax this.

Sooner or later adjustments, it additionally does not point out that it may be used for greater than tuition as nicely.

Google search screenshot of question “Can You employ a 529 plan for elementary college?” [Screenshot by The College Investor]

Verdict: Incorrect

This reply fully ignores that one-third of states (together with states like California and Colorado) don’t permit this. In contrast to the elementary college question, this reply doesn’t embody the exceptions within the bullet factors. The underside line is there are very particular 529 plan to Roth IRA rollover guidelines.

If California residents have been to do that, they’d faces taxes and penalties.

Google search screenshot of question “Can You Use A 529 Plan For A Roth IRA?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “Does California Have A 529 Plan Penalty?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “How a lot do I have to take for an RMD?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “Is It Authorized To Pay My Baby?” [Screenshot by The College Investor]

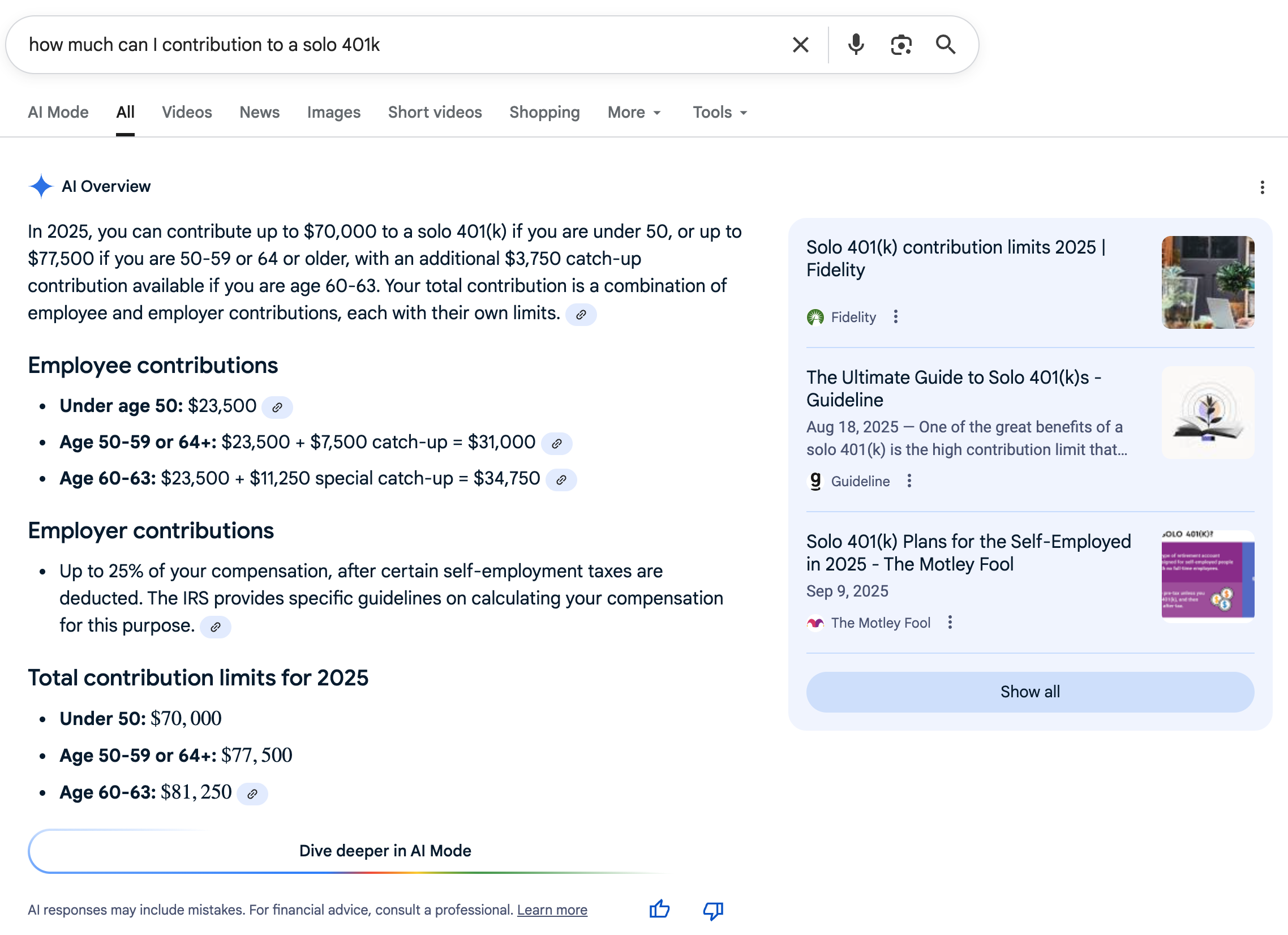

Verdict: Lacking Key Info

The utmost quantity you possibly can contribute to a solo 401k is $70,000 technically, the the actual quantity could be very nuanced.

The desk is a useful enchancment, however the employer contributions do not clarify the precise variables primarily based on enterprise construction and revenue.

Google search screenshot of question “How A lot Can I Contribute To A Solo 401k?” [Screenshot by The College Investor]

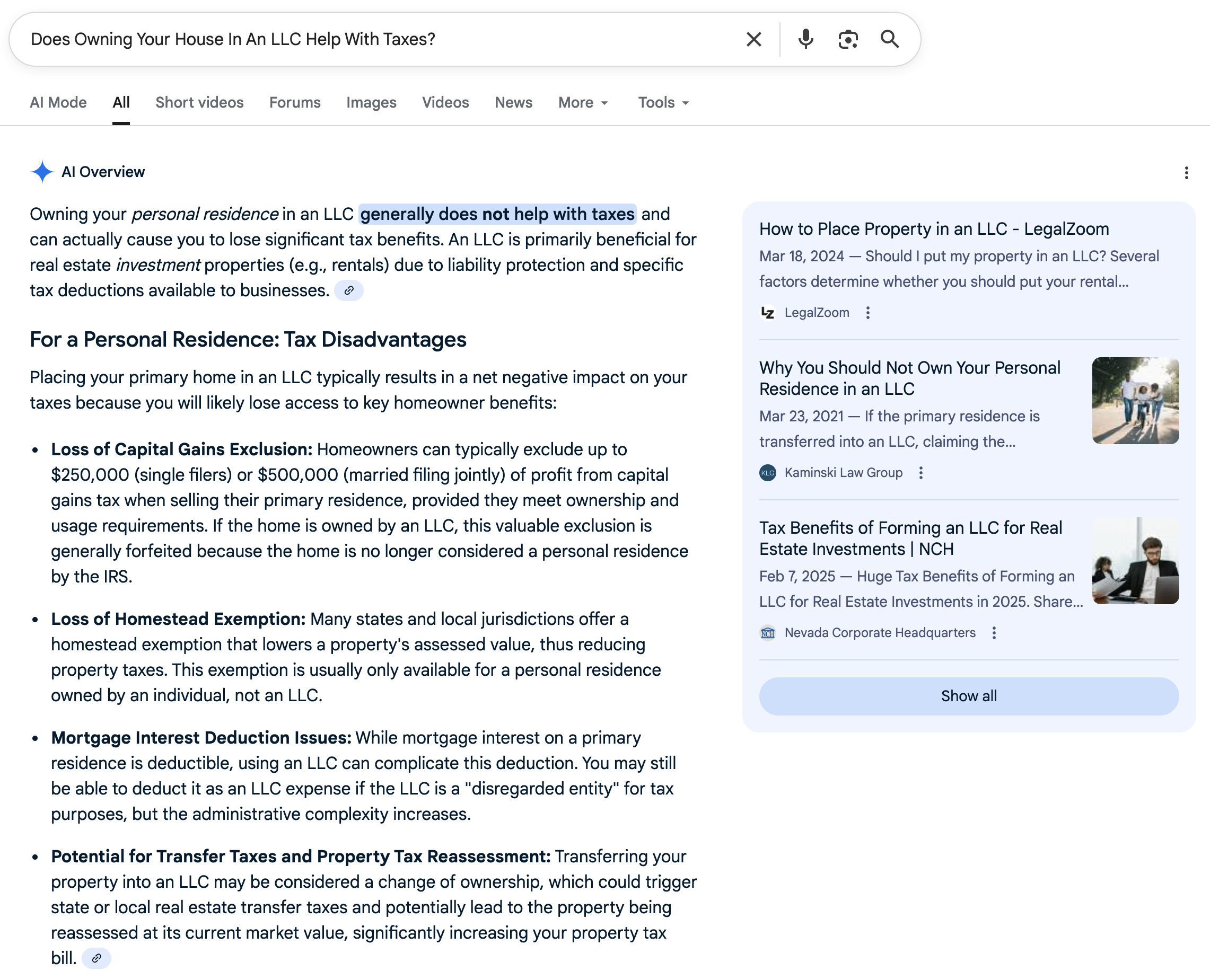

Verdict: Right

This one is a large enchancment over final yr. Final yr it mentioned “Sure”. This yr, it truly mentioned no and shared the reason why.

Google search screenshot of question “Does Proudly owning Your Home In An LLC Assist With Taxes?” [Screenshot by The College Investor]

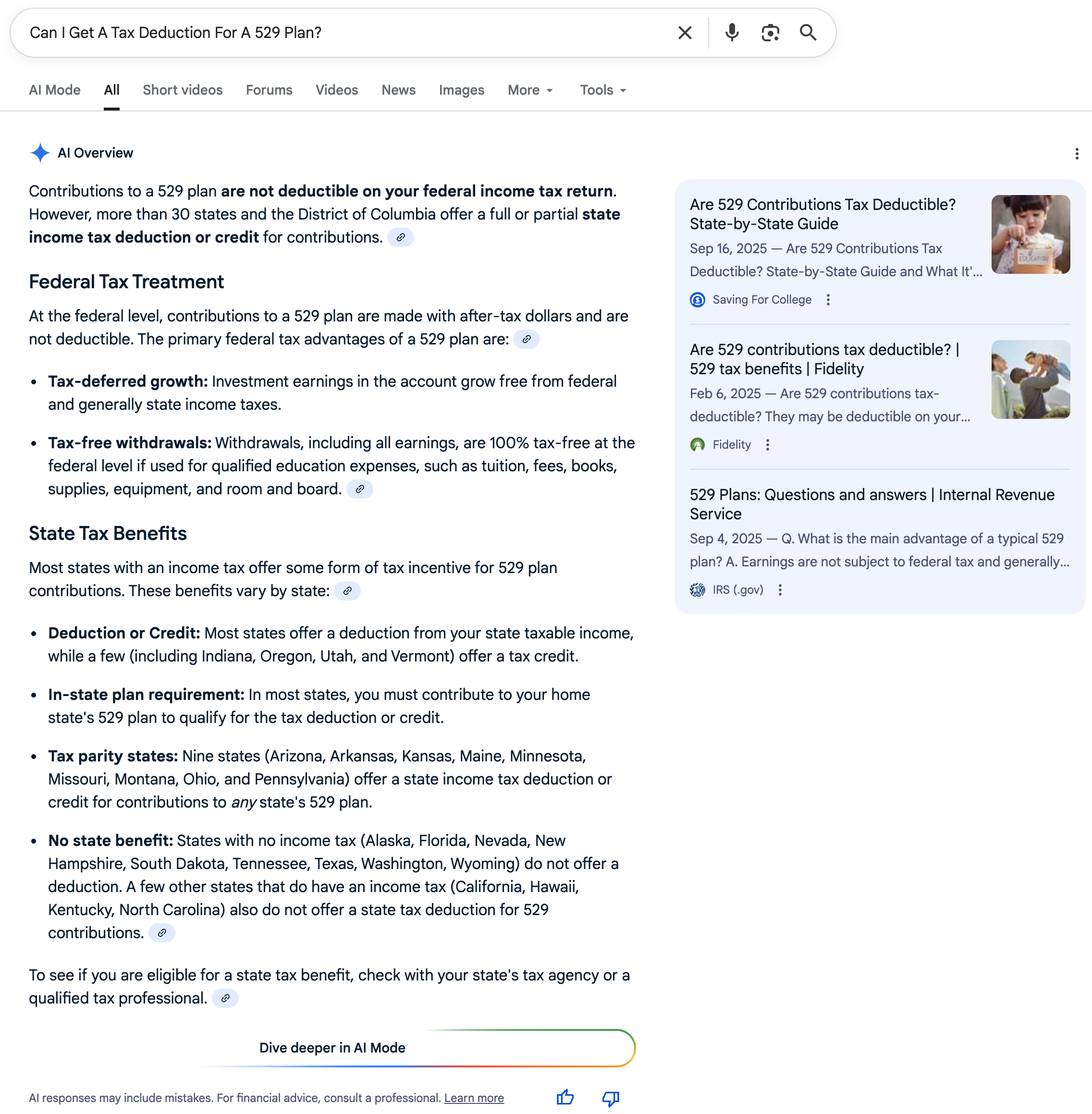

Verdict: Incorrect

Whereas the sentence is appropriate that you aren’t getting a Federal tax deduction, 34 states presently supply a tax deduction or tax credit score to a 529 plan. That is talked about in bullet level three, however for the reason that precise sentence is “No”, we view this as incorrect.

Google search screenshot of question “Can I Get A Tax Deduction For A 529 Plan?” [Screenshot by The College Investor]

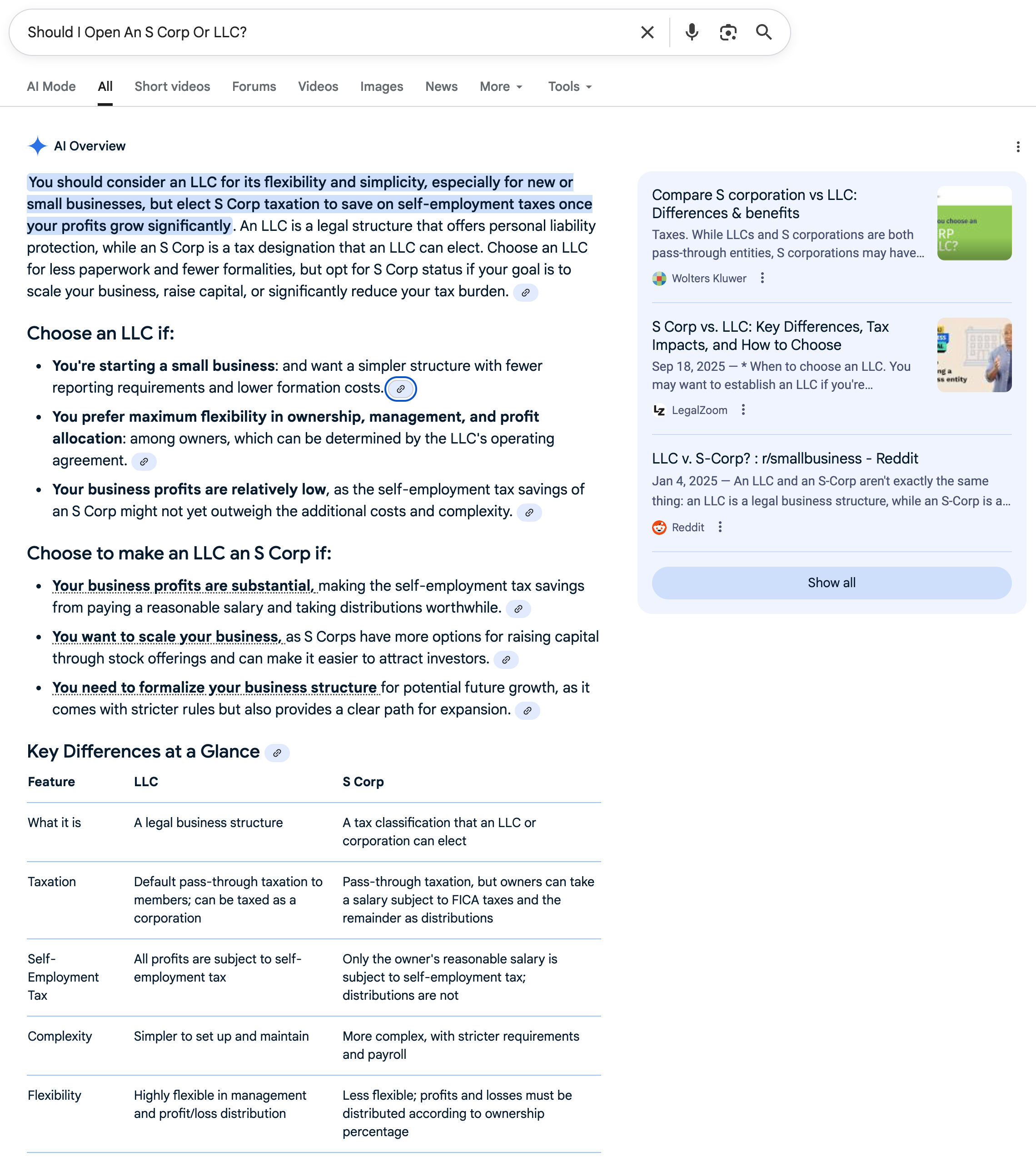

Verdict: Deceptive

It did higher this yr in comparison with final yr, however we additionally view this reply as very complicated – particularly for somebody who does not perceive the distinction or perhaps noticed this on social media.

Google search screenshot of question “Ought to I Open An S Corp Or LLC?” [Screenshot by The College Investor]

Verdict: Right

This was a major enchancment over the reply from final yr, which obtained it flawed.

Google search screenshot of question “Do I Want An LLC For Rental Property?” [Screenshot by The College Investor]

Verdict: Right

This was one other huge enchancment from final yr, when it mentioned “Sure” – however the appropriate reply is almost at all times “No”.

Google search screenshot of question “Ought to I Have My Rental Property In An S Corp?” [Screenshot by The College Investor]

Investing

These are subjects associated to investing and funding autos.

Verdict: Lacking Key Info

The method for a backdoor Roth IRA, whereas appropriate, misses many components of the method and does not spotlight any pitfalls that get quite a lot of buyers in hassle. Messing up the backdoor Roth IRA can result in taxes and penalties.

Additionally, be aware the infographic from The White Coat Investor, which isn’t linked within the AI Overview, and is now outdated.

Google search screenshot of question “What Is The Backdoor Roth IRA?” [Screenshot by The College Investor]

Verdict: Lacking Key Info

This details about the Mega Backdoor Roth IRA can also be semi-correct, however misses quite a lot of key data and pitfalls. It additionally focuses on employer-sponsored plans, when most individuals benefiting from this can be Solo 401k plans.

Lastly, discover the picture from Investopedia with none credit or mentions. This text additionally had a number of spam hyperlinks in AI overview.

Google search screenshot of question “What Is The Mega Backdoor Roth IRA?” [Screenshot by The College Investor]

Verdict: Right

This data on the wash sale rule is appropriate and a pleasant enchancment versus final yr’s AI overview.

Google search screenshot of question “What Is The Wash Sale Rule?” [Screenshot by The College Investor]

Verdict: Deceptive

Final yr it mentioned you needed to have earned revenue. This yr it leaves eligibility obscure. Both manner, it is a easy query that does not want this a lot nuance.

Google search screenshot of question “How Do I Open A Roth IRA?” [Screenshot by The College Investor]

Verdict: Deceptive

The primary sentence says you will need to first be enrolled in a Excessive Deductible Well being Plan (HDHP). Whereas that is true to contribute, that is not true to open one. And there are situations the place you wish to open one and should not have a HDHP. For instance, for those who left your job and wish to rollover your previous HSA to a brand new HSA supplier.

And the variety of HSA suppliers is comparatively restricted.

Google search screenshot of question “How Do I Open An HSA?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “Can I Use A Roth IRA To Pay For School?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “Can I Make investments If I am Underneath 18?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “How A lot Cash Do I Want To Begin Investing?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “What’s The Distinction Between Saving And Investing?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “Are Municipal Bonds Taxable?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “Can You Commerce Choices In Your IRA?” [Screenshot by The College Investor]

Verdict: Lacking Key Info

There are quite a lot of nuances right here which are simply lacking from this AI overview, and the taxes implications could be harsh.

Google search screenshot of question “Can I Withdraw From My Roth IRA Early?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “How Do Expense Ratios Work?” [Screenshot by The College Investor]

Verdict: Right

Facet be aware, we expect it is fairly daring of Google to attempt an clarify this idea in an AI Overview.

Google search screenshot of question “How Do I Make investments In Shares?” [Screenshot by The College Investor]

Verdict: Deceptive

This can be a higher AI Overview than final yr, however nonetheless leaves individuals questioning why? Mix that with the highest outcome on the appropriate sidebar which is blogspam (Deskera is an HR weblog) and quite a lot of outdated content material items (akin to greatest locations in 2024), it leaves you questioning…

Google search screenshot of question “The place To Open An IRA?” [Screenshot by The College Investor]

Verdict: Right

Not a nasty listing, it is nearly like they took actual writer’s lists of the greatest brokerage companies.

Google search screenshot of question “The place To Open A Brokerage Account?” [Screenshot by The College Investor]

Verdict: Lacking Key Info

This isn’t a nasty listing, but it surely does not let you know why you need to open an account at any of those locations. It is also lacking (however actually not mentioning) ThinkorSwim, which is extensively thought to be the very best instrument – albeit it is part of Charles Schwab.

Google search screenshot of question “The place To Open An Choices Buying and selling Account” [Screenshot by The College Investor]

Pupil Loans

These are subjects associated to scholar loans. It was attention-grabbing to see a mixture of each outdated data, and a few first rate solutions for present queries.

Final yr, it appeared they have been blocking sure queries:

AI Overview Not Out there For This Search. [Screenshot by The College Investor].

This yr, it seems they’ve eliminated that particular block, and the reply is fairly good:

Can The President Forgive Pupil Loans Question. [Screenshot by The College Investor].

Verdict: Right

A a lot improved reply this yr.

Google search screenshot of question “How To Get Pupil Loans?” [Screenshot by The College Investor]

Verdict: Right

Sure, you could be fired for scholar loans underneath quite a few conditions, and this AI Overview obtained it proper this yr.

Nonetheless, there’s quite a lot of blogspam within the outcomes and outdated content material over 10 years previous.

Google search screenshot of question “Can You Get Fired For Pupil Loans?” [Screenshot by The College Investor]

Verdict: Incorrect

I used to be so hopeful this was going to be mounted…and it sort of was, then it was nonetheless flawed. Final yr, it clearly mentioned “Sure, you possibly can apply for REPAYE” however the issue is that plan does not exist any longer.

This yr, whereas it accurately mentioned “No, you possibly can not apply for REPAYE”, it adopted it up by saying it was changed by SAVE and you’ll apply for SAVE (which is inaccurate as SAVE is not an eligible compensation plan both).

If solely Google knew (or cared) that sources like The School Investor offered correct and up to date scholar mortgage data…

Google search screenshot of question “Can I Apply For The REPAYE Reimbursement Plan?” [Screenshot by The College Investor]

Verdict: Lacking Key Info

That is appropriate, but it surely’s lacking the One Massive Stunning Invoice Act adjustments that the ICR plan is being phased out. When you can technically enroll immediately (that is ending in late 2027), you may be compelled to alter plans in 2028 for those who keep in ICR.

Google search screenshot of question “Can I Apply For The ICR Reimbursement Plan?” [Screenshot by The College Investor]

Verdict: Right

Good enchancment right here over final yr.

Google search screenshot of question “Can I Apply For Public Pupil Mortgage Forgiveness?” [Screenshot by The College Investor]

Verdict: Deceptive

Whereas the primary sentence is appropriate “your loans have been positioned into forbearance because of court docket orders…” the remainder of the reply begins to have a number of incorrect or deceptive statements.

For instance, the SAVE forbearance just isn’t over – it has been prolonged and can stay probably by way of 2028. Nonetheless, curiosity is accuring.

Debtors additionally haven’t got to decide on a brand new compensation plan but. There’s quite a lot of nuance in leaving the SAVE plan. The irritating half is that the official sources aren’t offering a lot steerage, and primarily based on the hyperlinks it is clear that is what Google is pulling in.

Google search screenshot of question “Why Are My Pupil Loans In Forbearance Due To SAVE?” [Screenshot by The College Investor]

Sure, a processing forbearance counts for PSLF. This reply seems to attempt to hedge it is guess by together with varied different durations which will or could not rely for PSLF.

Google search screenshot of question “Does A Processing Forbearance Rely For PSLF?” [Screenshot by The College Investor]

Verdict: Right

This AI overview was dominated by bizarre web site blogspam within the hyperlinks.

Google search screenshot of question “Does Working In A Medical Group Rely For PSLF?” [Screenshot by The College Investor]

Verdict: Right

This improved over final yr.

Google search screenshot of question “Do I Have To Apply For PSLF Each 12 months?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “Can I Get Pupil Mortgage Forgiveness As A Instructor?” [Screenshot by The College Investor]

Verdict: Right

This reply is eerily just like our personal article on Nursing Pupil Mortgage Forgiveness.

Google search screenshot of question “Can I Get Pupil Mortgage Forgiveness As A Nurse?” [Screenshot by The College Investor]

Verdict: Right

We have been impressed on the nuance of this reply on taxes and scholar mortgage forgiveness. Only a few sources are getting this appropriate.

Google search screenshot of question “Is Pupil Mortgage Forgiveness Taxable?” [Screenshot by The College Investor]

Verdict: Lacking Key Info

Whereas it obtained this reply appropriate final yr, this yr it ignored the state taxes and PSLF – despite the fact that it obtained the nuance within the above query.

Google search screenshot of question “Is Public Service Mortgage Forgiveness Taxable?” [Screenshot by The College Investor]

Verdict: Lacking Key Info

When you “can” consolidate your scholar loans at these occasions, you can even do it different occasions. And the question was “when”, which suggests does it make sense to. Moreover, the outcome does not spotlight particulars like PSLF credit, curiosity capitalization, and entry to compensation plans. That is particularly essential with the new PSLF weighted common rule.

Google search screenshot of question “When To Consolidate My Pupil Loans” [Screenshot by The College Investor]

Verdict: Right

It usually obtained the statue of limitations on scholar loans appropriate, however we’re shocked it did not present the desk by state.

Google search screenshot of question “Is There A Statute Of Limitations On Pupil Loans” [Screenshot by The College Investor]

Verdict: Right

It was good to see this appropriate in gentle of assortment exercise resuming on Federal scholar loans.

Google search screenshot of question “Can Pupil Loans Garnish Your Wages?” [Screenshot by The College Investor]

Insurance coverage

These are subjects associated to insurance coverage. We focus on life insurance coverage and associated merchandise, but additionally householders and different forms of insurance coverage.

Verdict: Deceptive

That is an enchancment over final yr, however we hate the truth that Google would ever point out insurance coverage as an funding car. With that mentioned, among the different causes hedge the reality as nicely.

Google search screenshot of question “Is Time period Life Insurance coverage Price It?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “When Ought to I Get Life Insurance coverage?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “What Eventualities Ought to A Younger Individual Get Life Insurance coverage?” [Screenshot by The College Investor]

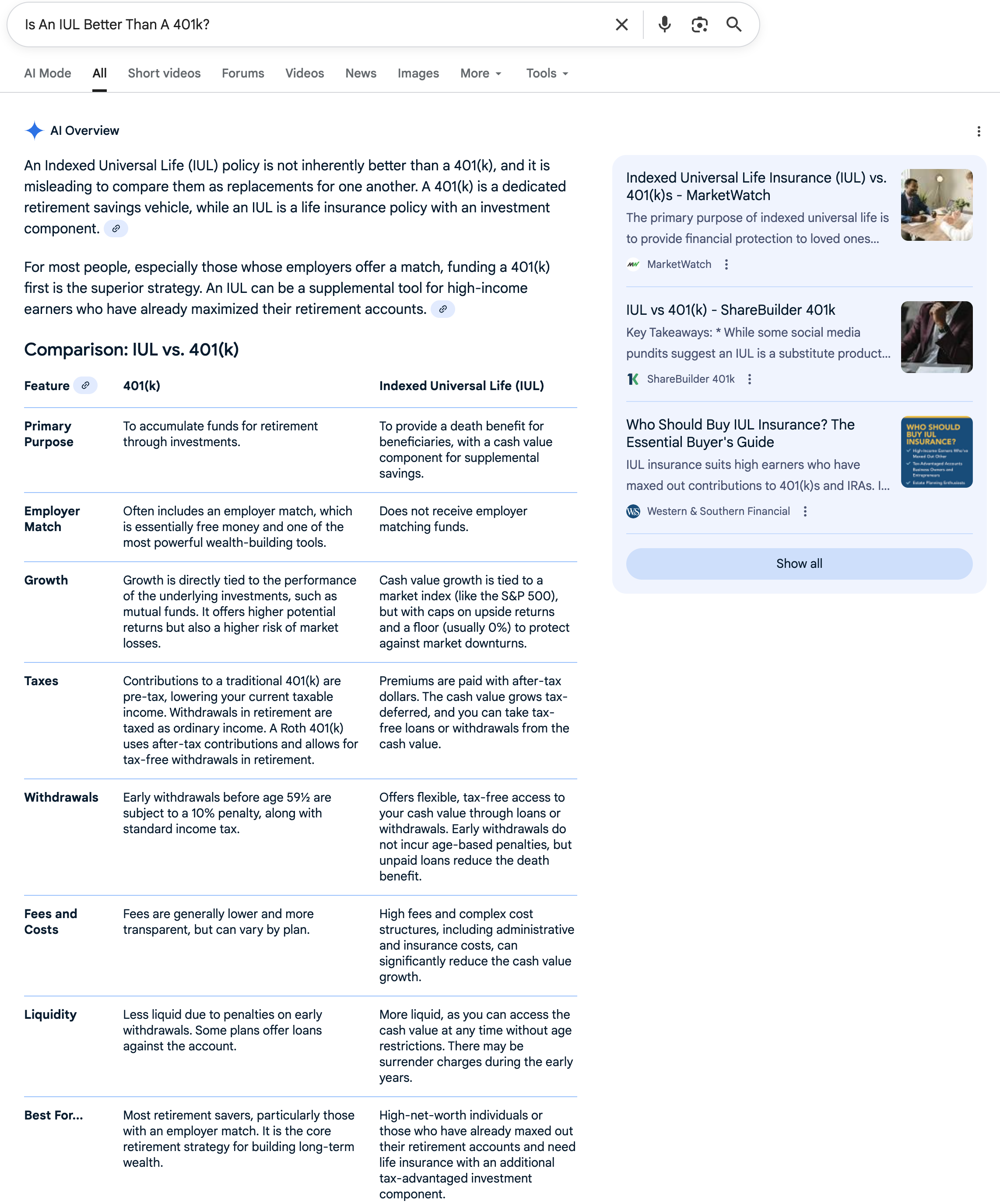

Verdict: Right

We have been impressed to see the AI Overview deal with this comparability the way in which it did.

Google search screenshot of question “Is Listed Common Life Insurance coverage Higher Than A 401k?” [Screenshot by The College Investor]

Verdict: Deceptive

Whereas it touches on among the negatives of an IUL, it current it as there’s a 50/50 comparability, when the fact is that an IRA is healthier 99% of the time.

Google search screenshot of question “Is An IUL Higher Than An IRA?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “Are Annuities Higher Than CDs?” [Screenshot by The College Investor]

Verdict: Deceptive

The reply began so promising, however then continued to encourage individuals verify their dad or mum’s householders coverage. That is usually a nasty thought for scholar dorm room insurance coverage as a result of claims could be pricey for the mother and father long-term insurability.

Google search screenshot of question “Can You Get Renters Insurance coverage For Your Dorm Room?” [Screenshot by The College Investor]

Verdict: Right

They mounted this reply! Final yr it mentioned you can, and now it is extra correct.

Google search screenshot of question “Can You Choose Out Of Automotive Insurance coverage?” [Screenshot by The College Investor]

Verdict: Incorrect

It obtained this one proper final yr, however this yr it fully misses that you’re not required to have householders insurance coverage if you do not have a mortgage.

Google search screenshot of question “Can You Choose Out Of Owners Insurance coverage?” [Screenshot by The College Investor]

Verdict: Deceptive

This was a greater reply final yr. Now it continues to say that you could be want it or need it, although it might not be required.

Google search screenshot of question “Is Flood Insurance coverage Required?” [Screenshot by The College Investor]

Verdict: Right

This reply was higher final yr as nicely, because it begins to hedge its response to when earthquake insurance coverage is required.

Google search screenshot of question “Is Earthquake Insurance coverage Required?” [Screenshot by The College Investor]

Verdict: Deceptive

The reply was usually good, however the one blue hyperlink within the AI Overview was to an Indian web site that could not assist with US insurance coverage (or was spam or a rip-off).

Google search screenshot of question “The place To Open A Time period Life Insurance coverage Coverage?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “The place To Open An Listed Common Life Insurance coverage Coverage??” [Screenshot by The College Investor]

Verdict: Right

One other taken picture from Revolutionary Retirement Methods for this AI Overview.

Google search screenshot of question “What Is A Life Insurance coverage Coverage Illustration” [Screenshot by The College Investor]

House Possession And Mortgage

Listed here are some subjects associated to dwelling possession and mortgages. We additionally included subjects associated to dwelling shopping for.

Verdict: Right

Google search screenshot of question “Do I Qualify For An FHA Mortgage?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “Can I Get Rid Of PMI?” [Screenshot by The College Investor]

Verdict: Right

This was a pleasant enchancment on the nuances of escrow accounts.

Google search screenshot of question “Do I Have To Have An Escrow Account?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “Ought to I Have A House Inspection?” [Screenshot by The College Investor]

Verdict: Lacking Key Info

This could be a pricey mistake to easily state “sure”. Moreover, some states have non-refundable earnest cash.

Google search screenshot of question “Can I Get My Earnest Cash Again If I Cancel A Deal?” [Screenshot by The College Investor]

Verdict: Right

This can be a significantly better reply than final yr.

Google search screenshot of question “How A lot Earnest Cash Do I Have To Put Down?” [Screenshot by The College Investor]

Verdict: Lacking Key Info

I do not assume it understands the question in relationship to the newest adjustments from the NAR Lawsuit.

Google search screenshot of question “Do I Have To Pay The Sellers Fee?” [Screenshot by The College Investor]

Verdict: Right

However discover the picture that was used from Investopedia and never cited.

Google search screenshot of question “What Is A House Fairness Funding” [Screenshot by The College Investor]

Monetary Help And Paying For School

Listed here are some monetary subjects referring to paying for school, together with concerning the FAFSA and different monetary assist instruments.

Verdict: Right

This was an enchancment over final yr – it is appropriate. It is also good to see them hyperlink to my Forbes piece instantly.

Google search screenshot of question “When Does The FAFSA Open?” [Screenshot by The College Investor]

Verdict: Lacking

This AI Overview was eliminated between final yr and this yr. Here is what an SAI is for those who’re curious.

Verdict: Incorrect

This data is inaccurate as this can be a truth that may be verified. In reality, the AI Overivew proves itself flawed – USC is the second-most costly faculty. Vassar School is the primary (and you’ll see the worth listed within the final bullet is increased than USC’s).

The right listing of the most costly faculties is right here, primarily based on tuition.

Google search screenshot of question “What Is The Most Costly School In America?” [Screenshot by The College Investor]

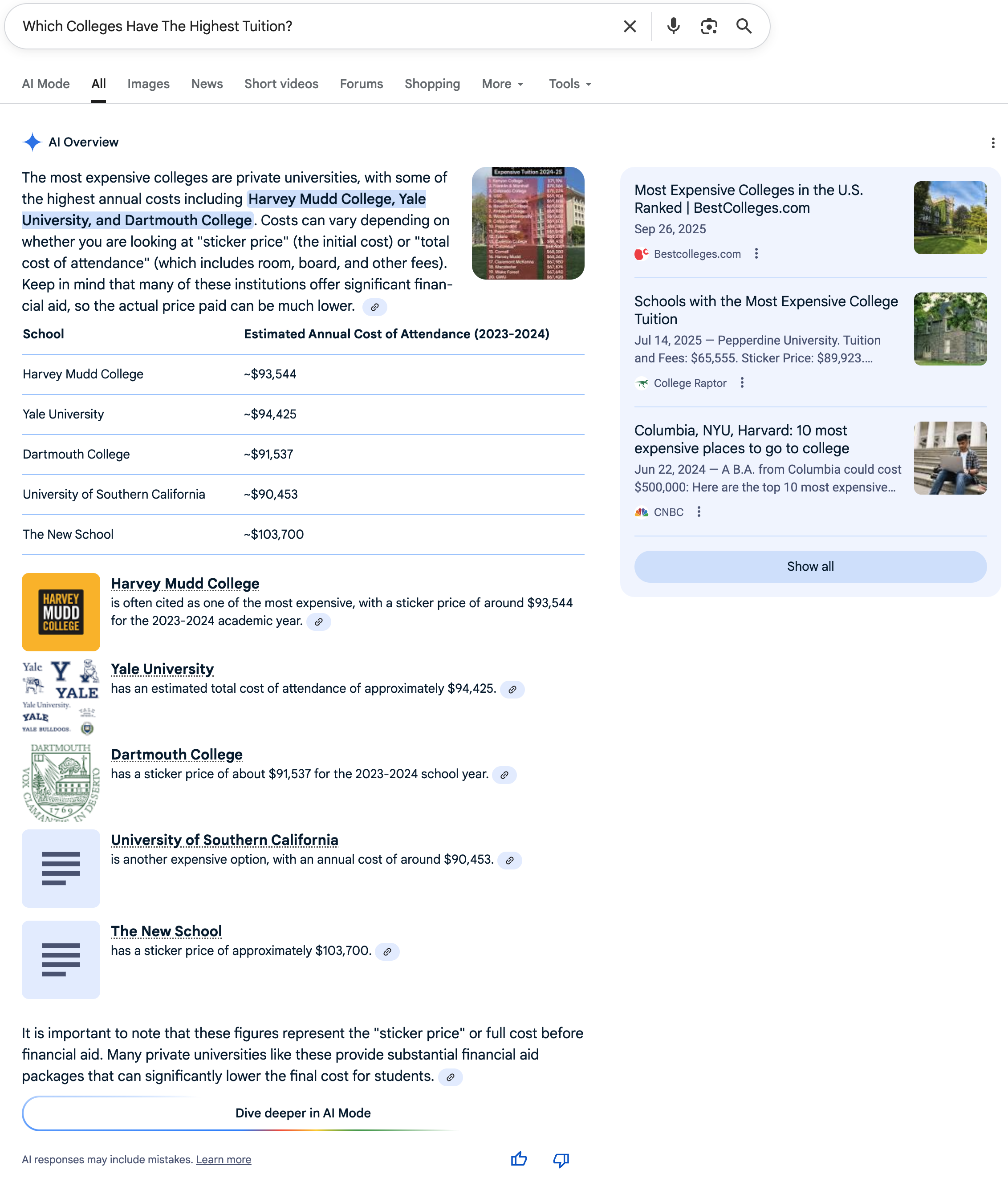

Verdict: Incorrect

Once more, the reply offered by the AI Overview was incorrect and easily offered an identical outcome. This time as an alternative of utilizing “Tuition” it seems to make use of complete price of attendance.

Right here is the right listing of faculties with the very best tuition. Vassar School tops the listing this yr.

Google search screenshot of question “Which Faculties Have The Highest Tuition?” [Screenshot by The College Investor]

Verdict: Right

Fairly good reply about monetary assist packages.

Google search screenshot of question “How Does Monetary Help Work?” [Screenshot by The College Investor]

Verdict: Right

That is one other good reply about having to repay grants and the nuance concerned.

Google search screenshot of question “Do You Have To Pay Again Grants?” [Screenshot by The College Investor]

Verdict: Deceptive

You at all times get an FSA ID with out your mother and father. It seems to combine up submitting the FAFSA and getting an FSA ID.

Final yr, it answered this query accurately.

Google search screenshot of question “Can I Get An FSA ID With out My Mother and father?” [Screenshot by The College Investor]

Verdict: Deceptive

Whereas the reply does break down the standards for submitting impartial for FAFSA, we see this as one of many largest errors that households make submitting the FAFSA. It additionally makes use of the flawed yr for the FAFSA (it is pulling in final yr’s knowledge right here).

The reply is “No” for many undergraduate college students.

Google search screenshot of question “Can I File As Unbiased For FAFSA?” [Screenshot by The College Investor]

Verdict: Lacking Key Info

This reply obtained worse than final yr. Whereas the primary sentence is true, it is lacking key data akin to: if the coed is impartial, the 529 plan counts as their asset. And if the 529 plan is owned by a grandparent or different relative, it is not counted in any respect.

Google search screenshot of question “Does A 529 Plan Damage My FAFSA?” [Screenshot by The College Investor]

Verdict: Right

It is humorous that it missed this reply on the earlier query, however accurately answered about Grandparent-owned 529 plans right here.

Google search screenshot of question “Does a Grandparent 529 Plan Rely For FAFSA” [Screenshot by The College Investor]

Verdict: Right

It obtained this flawed final yr, and it is mounted now.

Google search screenshot of question “Does A Roth IRA Rely For FAFSA?” [Screenshot by The College Investor]

Verdict: Right

The CSS Profile does rely retirement accounts just like the Roth IRA in their very own separate space, and faculties could use this data.

Google search screenshot of question “Does A Roth IRA Rely For CSS Profile?” [Screenshot by The College Investor]

Verdict: Right

Google search screenshot of question “The place Do I Get Scholarships” [Screenshot by The College Investor]

Verdict: Right

Discover that they’re utilizing our infographic from this text about grants with out linking to our website.

Google search screenshot of question “The place Do I Get Grants To Pay For School?” [Screenshot by The College Investor]

Professional Opinions

We requested the next inquiries to a panel of consultants to get their views on the problems raised within the research and AI typically. You possibly can learn their bios and responses beneath. Simply click on “Learn Extra” underneath the skilled’s title.

- Do you assume Google AI Overviews are problematic? Why or why not?

- Do you assume that Your Cash or Your Life (YMYL) queries ought to be held to the next normal?

- What do you assume Google must do to enhance?

- Do you assume the typical Google person is aware of that these solutions could also be incorrect?

Do you assume Google AI Overviews are problematic? Why or why not?

I believe Google AI Overviews could be each useful and problematic. They make it straightforward for individuals to seek out fast solutions to their questions however the summaries can miss essential context, and for the navy neighborhood, there are quite a lot of nuances round pay and advantages which are essential.

The overviews could be dangerous as a result of service members and veterans are often the goal of deceptive monetary merchandise due to their regular revenue and worthwhile advantages. AI-generated overviews typically pull from sources that are not reliable or are designed to promote one thing somewhat than educate.

For instance, if a service member searches, “Can I spend money on gold within the Thrift Financial savings Plan?”, the AI Overview may accurately state that it is not an choice within the TSP, but it surely might additionally hyperlink to articles or corporations attempting to get them to purchase gold. The preliminary reply is technically appropriate, however the hyperlinks can steer somebody towards gross sales pitches or dangerous monetary recommendation. That is the place the overviews could be a downside, particularly for many who haven’t got a powerful understanding of non-public finance.

Do you assume that Your Cash or Your Life (YMYL) queries ought to be held to the next normal?

Sure, YMYL queries ought to be held to the next normal. Folks may not use Google to carry out surgical procedure on themselves, however they may usually depend on it to make monetary choices that may have an effect on their lives for years. For instance, if a service member searches “easy methods to get out of debt,” the outcome hyperlinks may result in paid debt consolidation companies as an alternative of exhibiting that free monetary counseling is obtainable on each navy set up. I get wanting fast solutions, however accuracy issues in private finance.

What do you assume Google must do to enhance?

Google can enhance by giving extra weight to genuine sources which have each experience and expertise within the space, particularly in areas like private finance for the navy neighborhood. Monetary recommendation is not one-size-fits-all, and what’s correct for a civilian may not apply to somebody within the navy or a veteran. The outcomes can be extra correct and reliable in the event that they gave precedence to sources which have each monetary experience and actual navy expertise.

Do you assume the typical Google person is aware of that these solutions could also be incorrect?

No, most individuals do not know they’re getting the flawed solutions. Folks flip to Google as a result of they do not have expertise or data in what they’re trying to find. They’re looking as a result of they need assistance. That implies that usually, they assume the reply they get is appropriate and do not know to query it. Except somebody double-checks the knowledge someplace else, they might by no means notice it’s flawed. And most of the people simply desire a fast reply, so they are not digging deeper.

Chirag Shah

Professor, College of Washington

Co-Founder, Heart for Duty in AI Techniques & Experiences (RAISE)

Do you assume that Your Cash or Your Life (YMYL) queries ought to be held to the next normal?

Completely. However the problem is precisely figuring out what qualifies as YMYL queries. Even when one thing just isn’t that, it might have oblique have an effect on on individuals’s life selections. Realizing what we all know concerning the impacts of on-line looking, we must always at all times train warning and maturity in answering queries.

What do you assume Google must do to enhance?

So much! The blind rush to AI-fy every little thing is already hurting individuals and can proceed hurting extra — particularly those that are weak. Take into consideration these youngsters who took their lives after conversations with an AI chatbot or the instances of revenge porn and deepfakes that hang-out many younger ladies. Google has an enormous accountability in doing the appropriate factor somewhat than doing the quick factor. Folks rely on it to offer entry to correct and authoritative data and that’s an enormous accountability. We wish to see higher guardrails, higher instruments for combating misinformation and hallucinations, and higher accountability when issues go flawed. A automobile firm can’t present a defective equipment and blame the driving force when it malfunctions. Google wants to face by what it supplies as an alternative of hiding behind Part 230.

Do you assume the typical Google person is aware of that these solutions could also be incorrect?

No. We now have discovered this by way of many research and interviews that a mean person has blind belief in Google. Except one thing actually stands out as an clearly flawed factor, a mean person just isn’t going to concentrate on incorrectness in Google’s solutions.

Do you assume Google AI Overviews are problematic? Why or why not?

AI overviews could be problematic. They supply a pleasant abstract that’s useful more often than not. Nonetheless, they are often deceptive or typically flat flawed sufficient to trigger potential harm.

For instance, I’ve had purchasers are available pondering they’d qualify for a tax credit score due to an AI reply, solely to seek out out it was incorrect. It has improved a bit, but it surely’s simply not there but.

Do you assume that Your Cash or Your Life (YMYL) queries ought to be held to the next normal?

Your cash or your life queries ought to have the next normal. When an AI supplies a abstract, its tone communicates authority. The problem is far in private finance must be answered with “it relies upon.” There have been purchasers I’ve advised paying off the mortgage is the appropriate factor and others paying it off was the flawed factor. A lot is dependent upon one’s private state of affairs.

What do you assume Google must do to enhance?

Since a lot of non-public finance is dependent upon one’s distinctive state of affairs, Google might prepare the AI to offer professionals/cons to private finance questions and supply various opinions of easy methods to strategy the reply one is querying. This usually leaves a person with lower than desired feeling but it surely appears to be applicable contemplating the potential penalties individuals could face with deceptive or flawed data.

Do you assume the typical Google person is aware of that these solutions could also be incorrect?

I believe the typical Google person believes the solutions given are appropriate however I believe many will take the solutions with a touch of skepticism.

Do you assume Google AI Overviews are problematic? Why or why not?

I believe that they’re advantageous, and slowly getting higher, however the asymptote of their accuracy goes to peak at perhaps 66% given the quantity of misinformation on the market, particularly in shortly altering industries like the school software course of (my trade).

It is a good way to get a quick intestine verify on low-risk issues, however it will be silly for something of significance to rely purely on the AI overview, akin to 5 and 6 determine implications of assorted faculty and finance assist choices.

What do you assume Google must do to enhance?

The algorithm can be asymptotic except they begin permitting customers to VERY simply flag and report flawed data, nearly like an X Group Notice. That will get costly although after which politics and swarms of individuals might get correct data to take it down. I might nearly respect the algorithm persevering with to algo greater than the chance of human collusion on issues.

Do you assume the typical Google person is aware of that these solutions could also be incorrect?

The common Google person can title extra Kardashians than members of Congress or Cupboard members, so in brief, no.

Jeremy Caplan

Director of Educating and Studying, CUNY’s Newmark Graduate Faculty of Journalism

Founder, Surprise Instruments

Mr. Caplan didn’t touch upon the outcomes of the research instantly, however did share commentary on AI and private finance typically:

The search market is changing into extra aggressive as individuals more and more depend on companies like Perplexity, ChatGPT, and different AI platforms, to reply questions.

Any participant enabling search has a powerful incentive to determine methods to enhance the standard and accuracy of responses. The market is transferring so shortly that some product options have been rushed out, however AI competitors will pressure these providing search to make enhancements. If they do not decrease their error charges, shoppers will discover extra dependable alternate options.

NEFE didn’t touch upon the outcomes of the research instantly, however did wish to share some commentary on AI and private finance typically:

Private finance is a rising/evolving space of content material on AI and social media platforms, and it may be interesting as a result of it’s digestible in brief bursts of information and has ease of entry.

Whereas tens of millions of persons are getting recommendation in these boards, you can’t at all times fairly discern or confirm every little thing that’s seen as correct or truthful.

There are sources to spice up one’s monetary acumen, and there are various communities to overtly discuss cash and funds. However every little thing must be taken in as a part of an total technique to your particular person monetary administration—with an understanding of the Private Monetary Ecosystem (this can be a framework that NEFE developed to higher perceive monetary elements associated to well-being).

Monetary training just isn’t a panacea and can’t resolve all financial challenges. There isn’t any one-size-fits-all strategy to constructing wealth or monetary safety shortly. Info obtainable on-line and on social media platforms supplies data, and data is energy. However constructing monetary well-being is a life-long course of that requires persistence and adaptableness.

Monetary data could be very nuanced and ought to be tailor-made to 1’s particular person circumstances and brief bursts of data can not adequately deal with these different wants. Folks ought to:

- Examine sources

- Perceive their monetary values

- Know their monetary targets and priorities

- Seek the advice of trusted household and pals

- Search vetted skilled monetary recommendation after they can

- Take on-line queries and social media with grain of salt and skepticism

- Perceive there isn’t a straightforward, get-rich-quick methods to attain monetary well-being

Methodology

These AI overviews have been collected on October 12 and 13, 2025 utilizing a Chrome browser in incognito mode with a California IP deal with. We centered on main questions in every private finance subject space, together with traits of questions we have seen being requested on social media.

Editor: Colin Graves

The put up 37% of Google AI Finance Solutions Are Inaccurate in 2025 appeared first on The School Investor.