Key Factors

- Larger schooling persistently lowers unemployment danger. Federal knowledge present that individuals with a bachelor’s diploma or greater have unemployment charges roughly half these of people with solely a highschool diploma.

- Unemployment deferments are altering for brand new debtors. The One Huge Lovely Invoice Act of 2025 repeals unemployment and financial hardship deferments beginning July 1, 2026, leaving solely restricted forbearance as an choice.

- Debtors may have new methods in case of job loss. Since forbearance shall be capped at 9 months inside a 24-month interval, debtors going through long-term unemployment will possible want to change into an income-driven reimbursement plan.

The nationwide unemployment fee has inched as much as 4.3%, a shift that satisfied the Federal Reserve to chop rates of interest for the primary time since December 2024. However headlines in regards to the general labor market solely inform a part of the story.

Whenever you break down unemployment charges by schooling stage, a hanging sample emerges: folks with faculty levels face considerably decrease probabilities of shedding their jobs in contrast with those that by no means earned one.

For many years, knowledge from the Bureau of Labor Statistics has proven a transparent development—extra schooling normally means steadier employment – highlighting one other profit within the ongoing debate of whether or not faculty is price it.

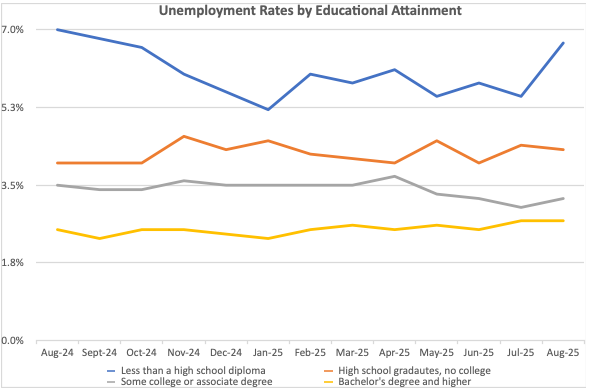

Highschool dropouts at the moment are experiencing unemployment charges greater than double these of bachelor’s diploma holders. On the identical time, people with just some faculty or an affiliate diploma sit someplace within the center, underscoring the sharp variations tied to academic attainment.

The hole issues for extra than simply paycheck stability. It influences how households climate financial downturns, how possible debtors are to default on their pupil loans, and the way shortly staff can get better from recessions. Whereas the pandemic quickly upended the image, unemployment charges for school graduates normalized far sooner than for different teams, highlighting as soon as once more the protecting impact of upper schooling.

Wanting on the unemployment charges by diploma stage supplies extra perspective. Faculty graduates not solely earn extra, however they’re additionally much less prone to lose their jobs.

Would you want to save lots of this?

Unemployment By Academic Attainment

There is a clear development: unemployment charges lower with will increase in schooling stage. Simply as faculty graduates are much less prone to default on their pupil loans, as in contrast with faculty dropouts, they’re additionally a lot much less prone to be unemployed.

Information from the Bureau of Labor Statistics supplies the unemployment charges by academic attainment for folks age 25 and older.

- Highschool dropouts: 6.7%

- Highschool graduates with no faculty: 4.3%

- Highschool graduates with some faculty: 3.2%

- Bachelor’s diploma or greater: 2.7%

This chart exhibits how the unemployment charges for folks age 25+ have modified over the past 12 months. The unemployment charges for folks with much less schooling are way more unstable than the unemployment charges for folks with extra schooling. The unemployment charges for folks with Bachelor’s levels didn’t change since final month, whereas the unemployment charges for highschool dropouts elevated from 5.5% to six.7%, a giant bounce.

Supply: Mark Kantrowitz evaluation of Bureau of Labor Statistics Information

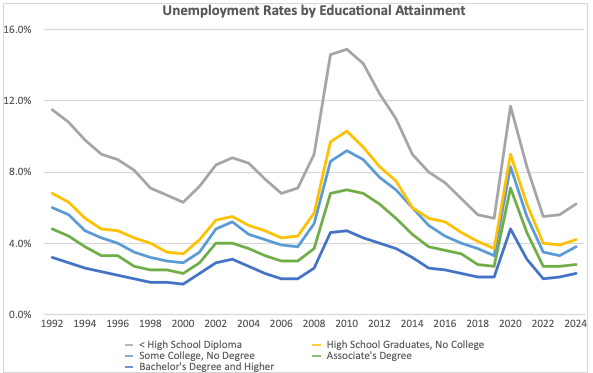

This chart exhibits annual unemployment charges by academic attainment from 1992 to 2024. It demonstrates that the unemployment charges persistently lower as academic attainment will increase.

Supply: Mark Kantrowitz evaluation of Bureau of Labor Statistics Information

An analogous chart revealed by the Bureau of Labor Statistics exhibits that unemployment charges have a tendency to extend throughout recessions and reduce afterward for all diploma ranges.

As proven within the unemployment charges chart, unemployment charges elevated considerably in 2020 and 2021 throughout all academic ranges, because of the pandemic. It began in April 2020 and normalized by November 2021, 20 months later, for Bachelor’s diploma recipients.

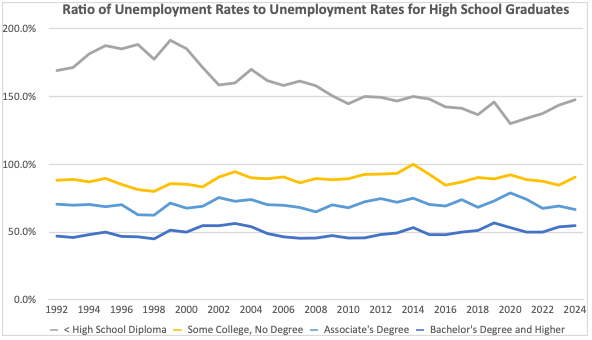

Ratio Of Unemployment Charges

To get rid of a few of the volatility, we will calculate the ratio of the unemployment charges for every diploma stage to the unemployment charges for highschool graduates, as proven on this chart. Many of the volatility in unemployment charges disappears, apart from individuals who have lower than a highschool diploma. Folks with a Bachelor’s diploma or extra superior diploma have half the unemployment charges of individuals with only a highschool diploma.

Supply: Mark Kantrowitz evaluation of Bureau of Labor Statistics Information

The Future Of Unemployment And Financial Hardship Deferments

The unemployment and financial hardship deferments are supposed to offer monetary reduction to debtors who lose their jobs.

- The unemployment deferment suspends the borrower’s reimbursement obligation for debtors receiving unemployment advantages, or who’re in search of and unable to acquire full-time work (outlined as 30+ hours per week that’s anticipated to final for at the very least 3 months).

- The financial hardship deferment suspends the borrower’s reimbursement obligation for debtors who’re receiving public help, who’re serving within the Peace Corps, who’re working full time (30+ hours per week) however incomes lower than the federal minimal wage ($7.25 per hour) or who’ve revenue lower than 150% of the poverty line for his or her household measurement and state.

Each of those deferments are supplied as much as a most of three years in increments of as much as one yr.

The unemployment deferment was added by the Larger Schooling Amendments of 1986 and the financial hardship deferment was added by the Larger Schooling Amendments of 1992. The One Huge Lovely Invoice Act of 2025, nevertheless, repealed each deferments for brand new debtors as of July 1, 2027. Debtors who lose their jobs must use a basic forbearance, which shall be restricted to 9 months out of each 24 months.

The common length in unemployment is 24.3 weeks, based on the Bureau of Labor Statistics (BLS). The median length, nevertheless, was 9.8 weeks, suggesting that some folks have a really lengthy length of unemployment, mentioning the typical. Solely 27.7% have a length of unemployment of 27 weeks or extra, with 11.5% having a length of 27 to 51 weeks and 16.3% having a length of a yr or extra.

This implies that 9 months of basic forbearance needs to be ample for about three-quarters of unemployed debtors. Debtors with longer-term unemployment might want to change into an income-driven reimbursement plan.

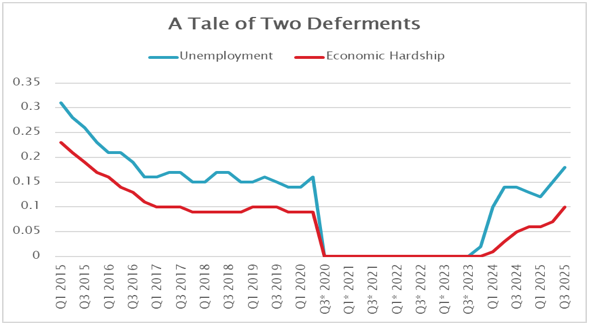

This chart exhibits the utilization of the 2 deferments (in hundreds of thousands of debtors) over the past decade. Using these deferments dropped to zero in the course of the pandemic’s cost pause. Use of those deferments correlates with adjustments in unemployment charges in any other case.

Supply: Mark Kantrowitz evaluation of Federal Pupil Help Information

Ultimate Ideas

The most recent knowledge reinforces a long-standing sample: schooling stays one of the crucial dependable safeguards towards unemployment. These with bachelor’s levels or greater are much less uncovered to labor market swings than these with solely a highschool diploma.

However as pupil mortgage coverage shifts, notably with the repeal of unemployment and hardship deferments for brand new debtors, college students and graduates alike might want to weigh the soundness of their profession prospects towards the truth of reimbursement.

The broader message is obvious. A level might decrease the percentages of joblessness, but it surely doesn’t make anybody immune. Debtors needs to be ready to navigate new reimbursement guidelines in the event that they expertise a spell of unemployment, utilizing instruments resembling income-driven reimbursement when non permanent reduction via deferment or forbearance now not exists.

For at present’s college students and up to date graduates, that mixture of schooling and planning will matter most in turning a level into long-term monetary safety.

Do not Miss These Different Tales:

Editor: Robert Farrington

The submit Unemployment Charges By Schooling Degree appeared first on The Faculty Investor.