Key Factors

- Many debtors are navigating whether or not to go away the SAVE plan, or whether or not they need to stay in forbearance.

- Public Service Mortgage Forgiveness (PSLF) eligible debtors and really low-income debtors could also be higher served by transferring to Revenue-Based mostly Reimbursement (IBR) now.

- The Reimbursement Help Plan (RAP), set to launch in 2026, will provide a 3rd alternative for debtors ready.

For months, federal scholar mortgage debtors enrolled within the SAVE plan have confronted a call: ought to I depart SAVE now, or ought to I wait out the forbearance longer?

The Division of Schooling, after all, has been very forceful of their messaging encouraging debtors in SAVE to vary reimbursement plans now. Alternatively, the One Massive Stunning Invoice Act (OBBBA) gave a extra measured timeline – probably till 2028 to make the change. Moreover, the OBBBA applied a brand new reimbursement plan known as the Reimbursement Help Plan (RAP), however that does not go stay till 2026.

Nelnet, one of many main mortgage servicers, has even began transferring borrower’s SAVE forbearance dates out till 2028.

The uncertainty has left many debtors asking the identical query: ought to I depart SAVE now, or wait to see what occurs? For many, the selection will depend on monetary circumstances, forgiveness timelines, and long-term reimbursement objectives. However it might be uncommon for any borrower to need to stick round till 2028. Most ought to have a transparent path no later than mid-2026.

Would you want to save lots of this?

@thecollegeinvestor Replying to @Mogirlygirl ✌️ Shouls you keep within the SAVE plan till 2028? Most likely not, and right here’s why. #studentloans #studentloanforgiveness #studentloandebt #saveplan ♬ unique sound The School Investor

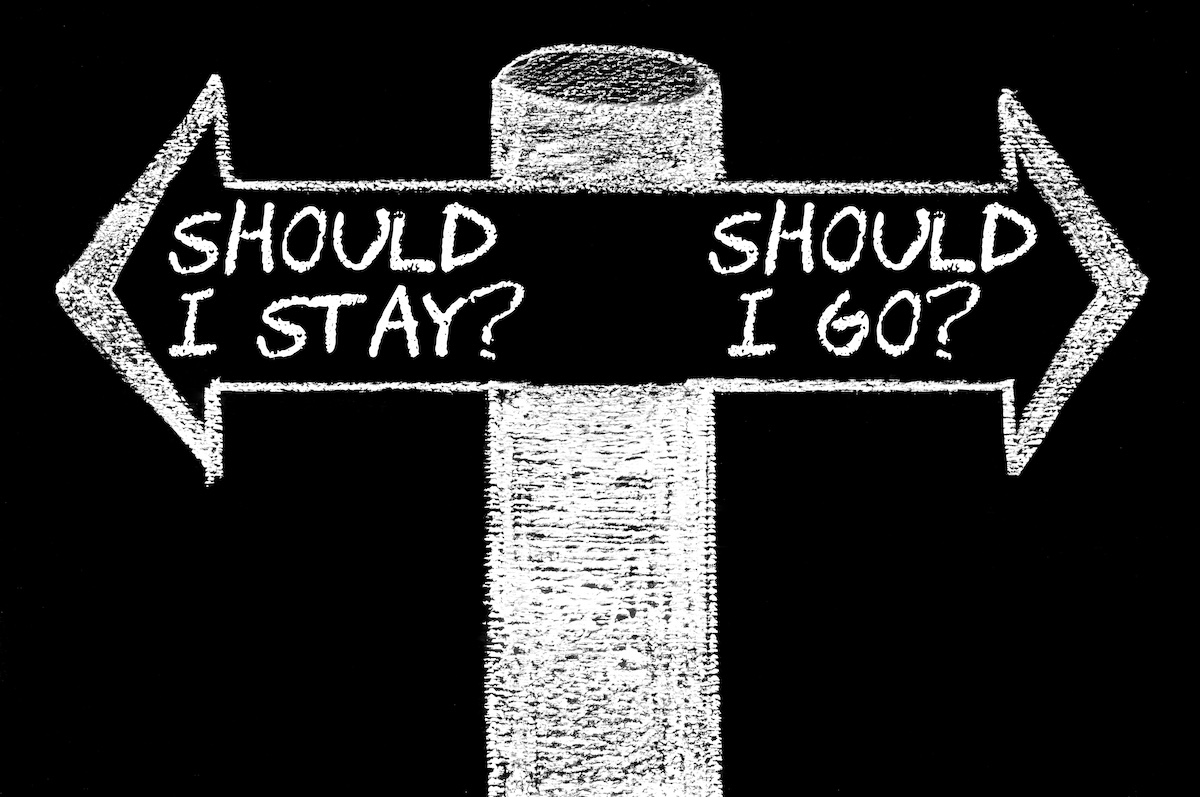

The Reimbursement Plan Choices To Go away SAVE

Debtors who select to vary reimbursement plans out of SAVE at present have three foremost reimbursement paths:

1. Customary Reimbursement Plans

These embrace Customary, Prolonged, or Graduated reimbursement. Customary reimbursement is simple: 10 years of mounted month-to-month funds till the debt is gone (this might be longer if you happen to consolidated).

Prolonged and Graduated permit for longer phrases or smaller funds early on.

All three of those plans full repay the mortgage through the mortgage time period.

2. Revenue-Based mostly Reimbursement (IBR)

IBR stays a viable possibility, particularly for debtors with modest incomes. Submit-2014 debtors pay 10% of discretionary revenue, whereas pre-2014 debtors pay 15%.

Importantly, IBR qualifies for PSLF, making it enticing to public service staff.

For these with low incomes, month-to-month funds can stay at $0, whereas nonetheless counting towards forgiveness. For debtors with low incomes on SAVE, this might be a compelling choice to resume “qualifying funds” whereas additionally holding a low cost.

It is also essential to notice that switching now would use your 2024 tax return (assuming you filed one). In case your revenue has elevated in 2025, this might be time to vary to journey out a yr of decrease funds earlier than they rise based mostly in your present revenue.

3. Reimbursement Help Plan (RAP)

Scheduled for 2026, RAP goes to be the latest reimbursement plan and units your month-to-month cost at $10 as much as 10% of your Adjusted Gross Revenue (AGI).

The RAP plan could also be a extra compelling possibility for debtors versus IBR – particularly for decrease or center revenue debtors.

You should use our free Reimbursement Help Plan (RAP) calculator to know what your month-to-month cost can be.

If RAP does have a considerably decrease cost, it might be worthwhile to stay within the SAVE forbearance and easily change to RAP instantly when it is stay subsequent yr.

Who Ought to Go away Now?

Some teams profit from leaving SAVE instantly:

- PSLF Debtors: Public service workers working towards PSLF want qualifying funds counted. Until RAP is a compelling decrease cost, debtors going for PSLF are greatest served resuming funds once more.

- Low-Revenue Debtors: These eligible for $0 month-to-month funds beneath IBR don’t have anything to lose by switching now, since they protect PSLF eligibility or forgiveness timelines.

- Debtors Close to Forgiveness: If only some months stay for PSLF, switching to PSLF now versus ready for PSLF buyback is probably going the faster transfer. Plus, the maths is probably going going to be the identical!

Why You May Wait

There are circumstances the place ready nonetheless is smart.

If RAP is the decrease cost possibility for you, ready just a few extra months to maneuver into RAP instantly is smart.

At that time, staying in SAVE might solely make sense for these in excessive monetary misery. As soon as RAP is stay, we all know all of the reimbursement choices. We additionally know all of the pathways to mortgage forgiveness. Ready round in forbearance serves no goal.

If you cannot afford both IBR or RAP funds, now could be the time to work in your price range and plan accordingly, as a result of you’ll have to resume cost finally (or find yourself in scholar mortgage default – which is magnitudes worse).

What Occurs Subsequent

The Division of Schooling ought to be rolling out the brand new RAP plan subsequent summer time. When that occurs, all choices shall be out there to debtors to obviously make a alternative.

Nelnet’s newest forberance strikes lasting till 2028 shouldn’t be interpreted as a assure. Moreover, it actually would not make monetary sense to attend that lengthy. If you cannot afford your funds beneath IBR or RAP, make the strikes you want now.

For many debtors on SAVE, try to be switching to a brand new reimbursement plan now, or no less than planning to when RAP goes stay subsequent yr. There actually shouldn’t be anybody “using it out” deliberately.

Do not Miss These Different Tales:

Editor: Colin Graves

The put up Leaving The SAVE Plan: Choices For Debtors appeared first on The School Investor.