Key Factors

- The USA authorities faces a partial authorities shutdown beginning October 1, 2025 until Congress can go a spending invoice.

- There have been 20 funding gaps and 4 full authorities shutdowns within the final 50 years.

- The final shutdown occurred in December 2018 and January 2019.

Everyone seems to be speaking concerning the potential authorities shutdown looming in two weeks: a battle of partisan politics, the 800,000+ jobs which have might be furloughed, the irritation of not having the ability to go to a nationwide park. However what is going on to occur to your funding portfolio?

It is robust to offer a definitive reply to what is going on to occur, however we are able to make some very educated guesses. Let’s begin with some historical past.

Would you want to save lots of this?

The Historical past of Authorities Shutdowns and the Inventory Market

Listed below are a few fast stats on the historical past of presidency shutdowns:

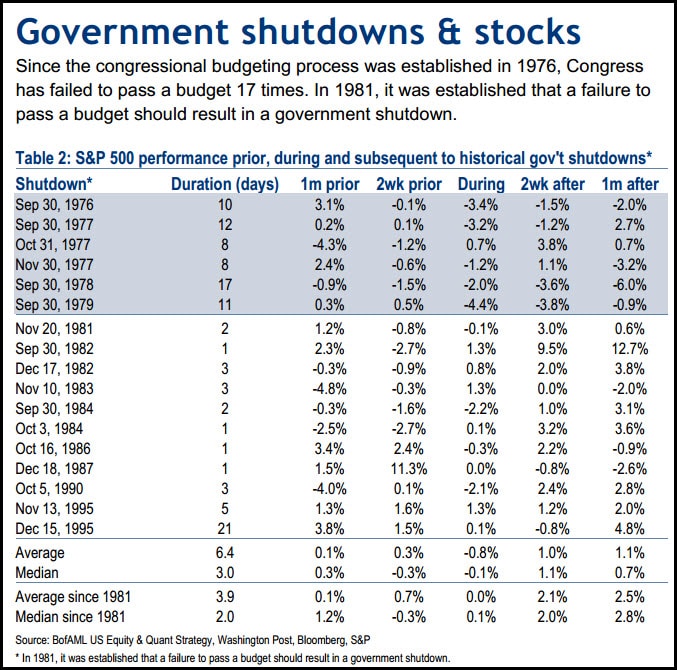

- The longest authorities shutdown was the final shutdown in 1995 and it lasted 21 days.

- The typical authorities shutdown lasts for six.4 days, the median shutdown has been 3 days.

- The final authorities shutdown occurred in December 2018 by January 2019.

And here is what occurs to the inventory market throughout these shutdowns:

- Since 1981, the inventory market is flat, on common, throughout authorities shutdowns.

- Within the weeks main as much as a authorities shutdown, the market can also be flat — a median return of 0.3%, however a median return of −0.3%.

- Nevertheless, since 1981, the inventory market has averaged returns better than 2% after the shutdown ends.

This is a historical past of the inventory market and all authorities shutdowns:

How This Authorities Shutdown is Totally different

There are a number of explanation why this authorities shutdown is totally different than previous ones. These causes are what makes this shutdown scarier than previous authorities shutdowns:

We Are Going through A Interval Of Stagflation

First, we do not have the identical company progress (and financial progress) that we had up to now authorities shutdowns. For instance, in 1995, we had been experiencing 8% EPS (earnings per share) progress charges, whereas this yr has simply been at 2%. Plus, that time period noticed one of many greatest bull markets in latest historical past emerge after the shutdown. It was the beginning of the tech bubble, and large modifications had been occurring throughout the financial system.

Plus, we’re additionally dealing with rising inflation within the wake of tariffs. We have additionally been driving a protracted bull marketplace for years.

It would not paint an awesome image.

The Reliance on Authorities Spending

Second, the financial system is extraordinarily reliant on authorities spending. Proper now, cash is flowing at a a lot freer fee than within the historical past of this nation. With low cost cash, and authorities support for firms nationwide, the financial system is extra depending on the federal government than at any time up to now.

For instance, the federal funds fee was 5.50% in 1995 (over the past shutdown), and it is 0% now. In 1995, GDP progress was 2.5%, and it is the identical this yr — however it’s taking a boatload of free cash to realize it. This simply highlights that dependence on the federal government to maintain the financial system afloat.

Client Dependence on Social Welfare Applications

Lastly, there are extra shoppers depending on authorities social welfare applications than at some other time in historical past. From Social Safety and Medicare, to meals stamps and SNAP, shoppers are extra depending on authorities applications than ever earlier than. It is a direct results of the Nice Recession, but additionally from the combined financial progress (and employment progress) that we have been experiencing.

This worries me for a number of causes. First, many federal advantages might stopped being paid due to the shutdown. This can instantly impression the pocketbooks of shoppers, and will result in even decrease financial progress through the quarter (and even throughout fourth-quarter vacation spending).

Second, even the advantages circuitously stopped by the shutdown are the identical advantages being debated on in Congress. This might end in them being resulted in a compromise, and will additional injury the financial system long-term.

What Ought to Traders Do?

All of this stuff level to a authorities shutdown that can have a special long-term impression on the financial system and inventory market. I believe there shall be a way more damaging impression from this shutdown, in comparison with previous shutdowns, just because that is simply one other gust within the good storm.

The proper storm brewing for the top of the yr contains these elements:

- Low financial progress.

- Tempered retail hiring and shopping for on account of shopper spending fears.

- The federal government shutdown.

- Rising inflation.

I would not be shocked if this shutdown, mixed with rising inflation, ship the financial system into an official recession. As such, traders ought to brace for the potential of a recession.

This implies a number of issues:

- Purchase-and-hold traders ought to keep the course, and possibly make investments extra throughout a downturn.

- Sector traders ought to have a look at shopper staples and utilities.

- It might be an excellent time to lock in any positive aspects you may have for the yr.

Do not Miss These Different Tales:

The publish How A Authorities Shutdown Will Have an effect on Your Investments appeared first on The School Investor.