Key Factors

- The Federal Reserve is anticipated to chop rates of interest this week, creating potential alternatives for pupil mortgage debtors to refinance.

- Refinancing may decrease month-to-month funds and whole curiosity prices however carries tradeoffs, particularly for federal mortgage holders.

-

Debtors should weigh the advantages of personal refinancing towards the lack of federal protections like income-driven reimbursement and mortgage forgiveness.

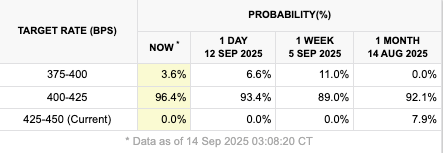

The Federal Reserve is prone to reduce rates of interest this week, marking a shift after years of aggressive hikes. The CME FedWatch Software is at present signaling a 100% likelihood of a Fed price reduce.

For debtors, notably these with personal pupil loans, decrease charges may make refinancing extra engaging. Refinancing permits debtors to exchange present loans with a brand new mortgage, ideally at a decrease rate of interest.

Contemplate a borrower with $50,000 in loans at a mean price of 6.5%. Refinancing to 4.5% would scale back each month-to-month funds and the entire curiosity owed over the lifetime of the mortgage. The influence could be substantial for these with massive balances.

Nevertheless, the choice isn’t easy. For federal mortgage debtors, refinancing with a personal lender means completely giving up entry to federal packages like income-driven reimbursement, Public Service Mortgage Forgiveness, and hardship choices equivalent to deferment. That tradeoff can outweigh the financial savings from decrease charges for a lot of.

Would you want to save lots of this?

When Refinancing Makes Sense

Debtors with excessive rate of interest personal loans ought to all the time be searching for refinancing alternatives, particularly if they will qualify for a set price that’s higher than their present mortgage. Even a one-point discount in price can result in 1000’s in financial savings over time.

It is essential to notice that non-public training loans do not cost origination charges, they usually do not have prepayment penalties. Meaning that you would be able to get a brand new mortgage at anytime with no further prices.

When you at present have a $50,000 mortgage at 9% curiosity, your month-to-month cost is probably going round $633 per thirty days for a ten 12 months time period. When you can drop that price to six%, you decrease your cost to $555 per thirty days.

You may additionally pay considerably much less over the lifetime of the mortgage in consequence.

The one method to know if it can save you on curiosity is to store and evaluate a minimum of 3-5 pupil mortgage refinance lenders.

Who Ought to Not Refinance Their Pupil Loans

Federal pupil mortgage holders face a more durable selection. Those that are assured they gained’t want income-driven reimbursement or forgiveness packages may see refinancing as a method to reduce prices. However for almost all, holding federal protections may very well be extra priceless than shaving a couple of proportion factors off curiosity.

A rule of thumb: debtors in steady, high-income professions with no plans to depend on federal packages could profit most from refinancing. Others ought to consider carefully earlier than giving up versatile reimbursement choices.

Whenever you refinance your federal mortgage, you now have a personal mortgage. Meaning you will not be eligible for income-driven reimbursement plans, pupil mortgage forgiveness packages, and extra.

The Backside Line

Debtors enthusiastic about refinancing their pupil loans ought to take a couple of key steps:

- Test your credit score: Lenders provide their greatest charges for these with robust credit score scores and low debt-to-income ratios.

- Evaluate a number of provides (a minimum of 3-5): Charges and phrases fluctuate extensively, so store round with completely different lenders.

- Resolve on mounted vs. variable charges: A hard and fast price supplies certainty, whereas a variable price may very well be cheaper initially however carry danger if charges climb once more.

- Weigh federal advantages: For federal mortgage holders, the lack of protections have to be a part of the calculation.

For a lot of, refinancing is much less about chasing absolutely the lowest price and extra about discovering steadiness between fast financial savings and long-term flexibility. The bottom charges will all the time go to shorter-term loans.

The potential for falling rates of interest has created new alternatives for pupil mortgage debtors. However refinancing shouldn’t be a one-size-fits-all answer. The advantages are clear for these with personal loans or for debtors sure they gained’t depend on federal packages.

For others, the safety and protections of federal loans could outweigh any financial savings.

Do not Miss These Different Tales:

Editor: Colin Graves

The put up Ought to You Refinance Pupil Loans If Charges Fall? appeared first on The Faculty Investor.