Soar to winners | Soar to methodology

Unlocking alternative

There’s by no means been a extra conducive time for insurance coverage brokers to enroll and be a part of a community.

Modifications in distribution have had a major influence, as brokers deal with digital growth, together with knowledge taking part in a much more essential function within the business as the ability of AI is harnessed. Networks supply brokers the possibility to pool knowledge and stay on the business’s forefront by having the ability to make the most of social media and branding at scale.

Some networks permit brokers to take all their fee for a month-to-month payment, whereas others choose to function a no-fee mannequin and break up fee. Incentives to enroll with a community are being additional compounded within the US by political choices.

Swiss Re’s Sigma report states, “US tariffs are more likely to enhance insurance coverage claims severity within the US, and will dampen insurance coverage demand, particularly within the US and for specialty strains tied to financial exercise (i.e., credit score and surety, marine, and engineering).”

This makes it a logical determination for brokers to affix networks and take strategic shelter, together with different well-recognized advantages reminiscent of model recognition, coaching sources, and consulting providers.

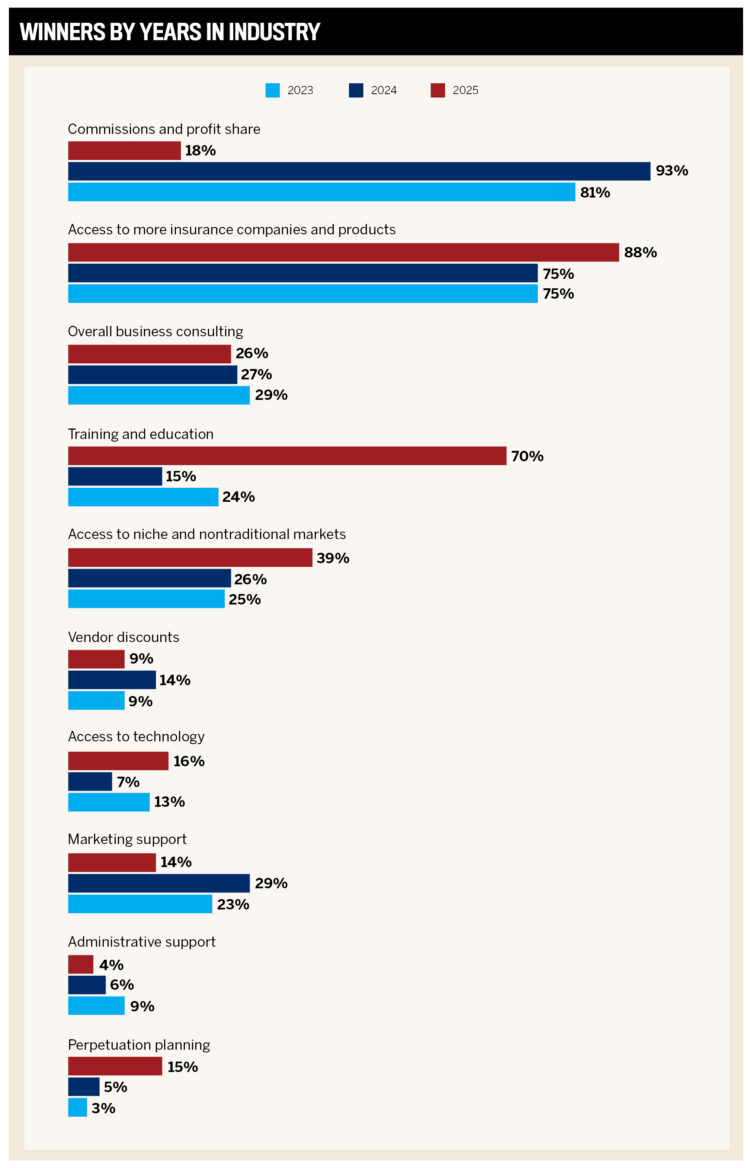

Insurance coverage Enterprise America’s 2025 knowledge reveals that entry to extra insurance coverage corporations and merchandise is the largest motivating issue for brokers to affix networks (88.3 % of brokers in 2025, up from 75 % in 2024 recognized it as their high motive). This once more highlights the turbulence brokers throughout the US are feeling, and a collective want to stay in a powerful place to ship the merchandise their purchasers want.

IBA surveyed brokers nationwide to realize their insights into the capabilities of networks and alliances. Respondents rated their networks throughout 10 standards together with advertising assist, entry to area of interest markets, and vendor reductions, with the main performers awarded 5-Star standing.

How IBA’s 5-Star Networks and Alliances 2025 stand out

Cementing service relations

Strategic Company Companions (SAP) has fostered shut relationships with carriers serving to brokers even by way of difficult occasions. The agency has earned $300 million of aggregated premium from the zero it started with in 2020, together with a community of 36 businesses.

“This stays a relationship enterprise,” says managing director John Tiene. “And so, whereas there’s turbulence, our capability to work with our service companions who know us has been essential to sustaining the power of our brokers to proceed to recruit new purchasers, get them positioned, and care for their current purchasers. That partnership makes all of the distinction.”

“The agent aggregates their premium up by way of the contract, there’s no loss ratio or penalties. Our job is to handle the e-book and the profitability on a macro degree whereas the agent takes care of the purchasers”

John TieneStrategic Company Companions

One other 5-Star winner, Good Selection, has been working with service companions to know tips on how to keep away from stress factors.

“Over the previous 12 to 18 months, we’ve been popping out of one of many hardest markets that the insurance coverage business has confronted, so there have been challenges, but additionally a number of alternative, which we’re enthusiastic about,” says Ashley Wingate, government vp of gross sales and distribution.

Good Selection has three verticals:

-

private strains

-

industrial strains

-

specific markets

And consequently, the corporate is cautious of oversaturation. Wingate says, “We work with our service companions to see the place they wish to develop and be somewhat bit extra surgical about that.”

The community has signed on over 1,400 new businesses over the previous yr, which follows eight years in succession of 1,000+ additions. Wingate attributes this to the shut connections with carriers throughout the nation and the power to seek out enticing charges for brokers.

“We’re capable of negotiate high fee constructions, high contingency bonuses with service companions, and rather less premium requirement,” he notes.

“For us to achieve success, we wish to have as many companions as we are able to that strategically are aligned

with us”

Ashley WingateGood Selection

Having constructed agency connections with related carriers, Fortified, additionally a 5-Star community, has made its brokers a precedence for carriers.

CEO Joe Craven highlights how property and extra legal responsibility proceed to be challenges within the market. Nevertheless, Fortified’s profile allows it to cope with any exterior noise.

“The largest profit is from our dimension and the relationships that we have now,” he says. “The underwriters know who we’re. They’re going to place us on the high of the stack in lots of circumstances due to the quantity that we ship them. They know our profitability, in order that they usually wish to work with us, understanding that they’re going to get the correct accounts on the books.”

ISU Steadfast is energetic throughout the 51 jurisdictions and a few carriers it really works with have been unable to get ample charges filed by way of the division of insurance coverage over the previous few years. This has meant ISU has moved a major quantity of enterprise to intermediaries, wholesalers, MGAs, London, and so on. However now the state of affairs has reversed.

“My greatest problem is, can I deliver enterprise again to the admitted carriers from the intermediaries?,” says CEO Dan McCarthy.

Nevertheless, there was no lack of deal with delivering for the community’s members.

“The aim is to assist the agent shield their consumer with the most effective worth within the market. We make these carriers accessible in order that when smaller brokers want to cost it in opposition to 20 carriers, they don’t need to undergo 20 appointments,” provides McCarthy. “As an alternative, they’ll make the most of the ISU Steadfast service stock to compete in opposition to a center market or bigger company.”

Flexibility

One quarter of brokers with out networks surveyed by IBA in 2025 mentioned that perceived lack of independence was their high motive for not becoming a member of a community.

McCarthy highlights that brokers prioritize autonomy, and this pertains to why ISU Steadfast solely chooses to do enterprise with brokers who show historic development of 10–12 %.

He explains, “An agent that turns into a member is 100-percent owned by that company. We don’t carry any possession. Little or no, if something, is dictated to them, aside from they need to pay us a payment each month.”

Brokers can select from ISU Steadfast’s wide-ranging service choice and tailor it to their wants, whereas a 30-day discover of departure permits them to decide out of their contract with out charges.

“Folks don’t go away ISU Steadfast until they promote their company. If I look again over 5 years, I in all probability can discover lower than 5 that left for a motive aside from they offered their company”

Dan McCarthyISU Steadfast

Good Selection leads with its accommodating strategy contract, which is non-exclusive and one-year lengthy with no charges, permitting brokers to retain possession of their e-book and profit from top-tier commissions and bonuses.

Wingate explains, “We’re getting a larger share of the brand new businesses which can be approaching board, as a result of they’re recognizing the chance to their enterprise in the event that they signal the flawed contract. When you write a chunk of enterprise, we break up commissions, however we have now pores and skin within the recreation collectively.”

In the meantime, these becoming a member of Strategic Company Companions profit from a zero-commission partnership that emphasizes a profit-sharing system.

“We don’t contact commissions; the commissions go from the service to the agent. Brokers want the fee as a result of it’s what pays their payments,” explains Tiene. “They pay a small payment they usually get a big chunk of their revenue sharing. However as a result of it’s aggregated, all our brokers make extra in profit-sharing contingency income than they ever may on their very own.”

Understanding brokers

One of the best networks have crafted a reciprocal mannequin, the place they adapt and hone their focus to what members need.

SAP spends time understanding its brokers’ enterprise; it explores issues to find if they’re centered on sure niches or perceive what service relationship may assist them develop.

“It truly is one-on-one with the company as a result of each company is somewhat completely different. We’re not a community that throws codes at an agent and goes, ‘Right here’s extra carriers to work with,’” says Tiene. “If there’s no alignment, then it’s not ever going to work.”

A typical assist system that SAP gives is for company homeowners who’re often one of many largest producers of recent enterprise however produce other managerial duties. This leads to restricted time and the community offers them a blueprint to take their company to the subsequent degree. They take away impediments by taking up the executive burden, permitting these agent homeowners to spend extra time with purchasers.

Tiene says, “It’s wonderful how rapidly they’ll transfer alongside and scale, and it’s additionally our capability to deliver sources that they’ll use to assist them transfer ahead.”

And he underlines how accessible they’re to brokers, irrespective of the state of affairs.

“They will name us any time of the day or night time in the event that they’ve acquired an issue. All people’s acquired my mobile phone and the numbers of our consultants, and we are going to deal with it instantly.”

Fortified is conscious of how brokers are being impacted as beforehand it wasn’t very troublesome to get an umbrella over $10 million.

“There must be and must be greater than only a income profit to our members. They need to have a whole resolution to assist them run their company on a day-to-day foundation”

Joe CravenFortified

“Many of the carriers received’t write greater than 5 now, and a whole lot of them received’t even write that. It’s due to the surprising verdicts that we’re seeing throughout the nation and the strain that’s placing on the carriers from a profitability standpoint,” says Craven.

Attributable to Fortified’s dimension and profitability, it can lean on companions to assist write larger limits.

Craven provides, “We even have nice relationships with wholesalers that may assist fill within the holes after we want extra protection.”

That dimension permits the community to roll the premium up, which will get brokers into significantly better profit-sharing tiers. In lots of circumstances, Fortified even negotiates further fee or further overrides as a result of the accomplice carriers see worth from a profitability and development standpoint.

Fortified, with 70 members throughout 10 states, offers brokers the benefit of having the ability to faucet into a various data base. No matter points could come up, there’s a great probability that one in all their members has expertise and might supply an answer.

“One in every of my favourite tales is we had an agent who got here throughout a municipal airport and acquired the chance to cite it, however had by no means written any aviation. However we had one other member who was an skilled in writing aviation, and we had been capable of put these two collectively.”

To reply to its members’ wants, ISU has constructed its personal industrial API score engine much like Tarmika and Semsee, which all its brokers get entry to. Attributable to working immediately with carriers and writing billions of {dollars} with them, ISU needed a direct relationship by constructing its personal engine.

McCarthy explains, “This yr, we’ve achieved nicely over 10,000 transactions by way of our personal API-based score engine. We wish to assist our members shield their purchasers in one of the simplest ways attainable, so we put it into the engine that goes out to a number of industrial carriers, after which they’ll current the most effective worth package deal again to their consumer.”

The system works by ISU’s score engine feeding a packet to the carriers’ servers, which reply and provides a quote or a declination. At the moment, it has about 40 completely different product choices.

“The following part will likely be including surplus strains transactions to our engine, which we’re engaged on so we will help an agent who’s engaged on a industrial consumer full 75 or 80 % of all their transactions,” says McCarthy. “The explanation we’re doing that type of factor is that our mother or father firm, ISU Steadfast in Australia, did precisely this and is writing billions of {dollars} by way of its engines.”

Appreciative of the payment members can afford, ISU has tiered pricing. If brokers have issues, they’re linked with their native relationship supervisor, who acts as an envoy for ISU.

McCarthy says, “They coach or give them a approach by way of the problem. If they can not resolve it, then they transfer it as much as the degrees to a different individual inside our group who can remedy it.”

Staying in touch

With a presence in 48 states, Good Selection’s territorial managers usually go to brokers.

Wingate says, “They and our state administrators go to 1000’s of brokers throughout the nation, attending to know them personally, what their wants are, and the way they will help.”

Coaching and schooling moved up IBA’s significance rankings in 2025 in comparison with 2024 (from sixth to second), demonstrating brokers’ elevated need to make full use of a community’s capabilities.

Fortified gives a producer growth program to foster integral abilities that businesses can use to improve their producers’ talents.

“The brokers can use somewhat little bit of this system or all of it, relying on what they want,” Craven explains. “In the event that they need assistance discovering producers, we’ve acquired nice companions who will help recruit folks to the businesses. In the event that they need assistance financing, we’ve acquired a number of completely different arms that may assist them finance these new producers.”

Embracing tech instruments

Good Selection facilitates shut connections with tech suppliers, together with Simple Hyperlinks, a comparative rater that secures discounted costs for brokers.

“We like to make use of our relationship and our dimension to barter cheaper pricing for our brokers than if they simply reached out,” says Wingate. “The coaching expertise now that carriers have is top-notch. We come alongside and accomplice with them to bridge the hole and convey our agent to that coaching and host Good Selection trainings and webinars.”

ISU Steadfast goals so as to add an AI-powered underwriter within the latter levels of 2025, a functionality that may lower agent quoting occasions drastically.

“If I’m a retail agent, I can add a pile of paperwork,” McCarthy says. “The AI will learn all of the paperwork and pre-fill the quote system to make it even sooner and extra environment friendly for an agent. As an alternative of a human sitting there typing for 15 to 18 minutes, it simply occurs in a blink.”

Discovering tailor-made tech options is a precedence for Craven and Fortified.

“There’s a whole lot of time and vitality being spent on gathering as a lot data to assist our brokers be on the entrance fringe of this new expertise.”

Fortified’s member portal is a distinction maker for brokers, as carriers can submit data that brokers can use to find out which merchandise work finest for his or her state of affairs.

“It permits me to submit data that’s worthwhile to our members with regard to our manufacturing, our progress towards targets,” Craven provides. “There’s a complete host of data that they’ll entry. Contact details about different members, so forth, that’s all there in a single easy-to-access place within the portal.”

SAP can be exploring AI and is holding a expertise convention for brokers to discover new capabilities in 2025.

Tiene says, “One in every of my brokers is experimenting with bots, the place the bot goes to the service web site, pulls the cancellation discover again to the company, attaches it to the file, after which pushes out notifications to the consumer.”

-

Networks that domesticate robust service relationships and present broad market entry permit brokers to stay resilient in turbulent markets.

-

The significance of coaching and schooling surged in 2025 (69.68 % of brokers cited it as a high profit, up from 15.44 % in 2024). Main networks spend money on growth packages, empowering brokers to leverage new instruments and keep aggressive.

-

Offering consulting, administrative assist, and hands-on steerage helps businesses scale, remedy issues, and adapt to market modifications.

- Acrisure Affiliate Brokers Community

- FirstChoice, a MarshBerry Firm

- Pacific Crest Providers

- SBMP

ALL-STARS

- FirstChoice, a MarshBerry Firm