As the college bells ring, so do the money registers.

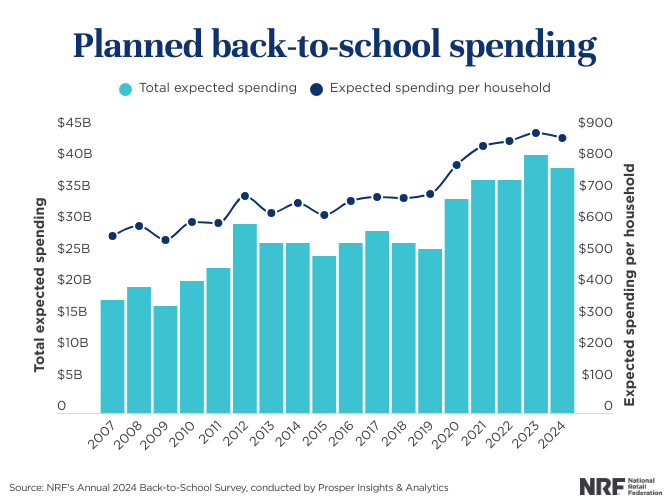

Reply: Households with youngsters in elementary by way of highschool plan to spend a mean of $858.07 on clothes, sneakers, college provides and electronics. (down $874.68 final yr)

Questions:

Questions:

- How may the typical spending differ throughout totally different areas or revenue ranges?

- How can households price range successfully to handle back-to-school bills?

- How may the rise of on-line purchasing have an effect on the quantity households spend on back-to-school gadgets?

Listed here are the ready-to-go slides for this Query of the Day you should use in your classroom.

Behind the numbers (Nationwide Retail Federation):

“Households with college students in elementary by way of highschool plan to spend a mean of $858.07 on clothes, sneakers, college provides and electronics, down from $874.68 in 2024. Regardless of households budgeting much less this yr, barely extra customers are buying attire and electronics, driving anticipated complete spending to $39.4 billion, up from $38.8 billion final yr..”

————–

Need to entry extra Budgeting-focused actions and sources? Take a look at the Budgeting unit web page.

————–

Attend NGPF Skilled Developments and earn Academy Credit by yourself time! Take a look at NGPF On-Demand modules!

About

the Writer

Dave Martin

Dave joins NGPF with 15 years of educating expertise in math and laptop science. After becoming a member of the New York Metropolis Instructing Fellows program and incomes a Grasp’s diploma in Schooling from Tempo College, his educating profession has taken him to New York, New Jersey and a summer season within the north of Ghana. Dave firmly believes that monetary literacy is important to creating well-rounded college students which might be ready for a fancy and extremely aggressive world. Throughout what free time two younger daughters will permit, Dave enjoys video video games, Dungeons & Dragons, cooking, gardening, and taking naps.