Key Factors

- President Biden forgave greater than $188 billion in scholar loans for over 5 million debtors, the most important quantity of cancellation by any president.

- Regardless of document forgiveness, complete excellent scholar mortgage debt grew from $1.565 trillion to $1.640 trillion throughout Biden’s time period, as new borrowing outpaced reduction.

- Packages like PSLF, Borrower Protection, and Trainer Mortgage Forgiveness delivered billions in reduction, however knowledge on the true affect for particular person debtors stays restricted.

How a lot scholar mortgage debt has truly been forgiven? The quantity is staggering: greater than $188 billion erased for over 5 million debtors throughout President Biden’s presidency, the most important wave of scholar mortgage forgiveness in historical past.

However the story doesn’t finish there. Regardless of document ranges of forgiveness, America’s scholar mortgage stability nonetheless grew, climbing from $1.565 trillion to $1.640 trillion.

The rationale: new borrowing and curiosity proceed to outpace the reduction offered. That paradox raises essential questions on what forgiveness actually means, who advantages, and the way a lot it adjustments the larger image.

Though there’s some details about the overall quantity of scholar mortgage forgiveness and discharge, there’s little or no details about the precise affect on particular person debtors. For instance, Public Service Mortgage Forgiveness (PSLF) requires the borrower to make 120 month-to-month funds in an income-driven compensation plan earlier than the remaining debt is forgiven. It’s unclear how a lot of the unique debt and accrued curiosity is finally canceled on common.

This text breaks down the place forgiveness got here from: together with Public Service Mortgage Forgiveness, Borrower Protection, Trainer Mortgage Forgiveness, and extra, and why the numbers don’t at all times match what debtors really feel of their day-to-day lives.

Understanding these particulars issues, as a result of the way forward for forgiveness is shifting underneath the One Large Stunning Invoice Act (OBBBA) and new guidelines for scholar mortgage compensation.

Would you want to avoid wasting this?

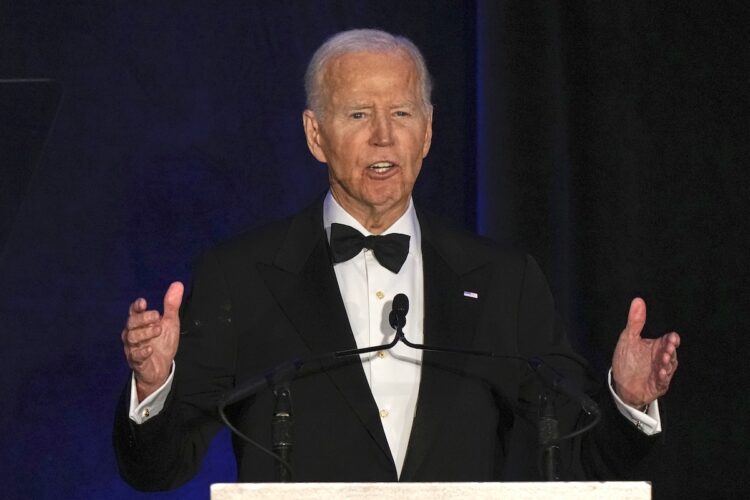

President Biden Forgave Extra Debt Than Any Different President

President Biden forgave greater than $188 billion in scholar loans to greater than 5 million debtors, greater than every other president. He did this by making present scholar mortgage forgiveness applications extra environment friendly and automatic.

Nevertheless, timing did work to his favor – with Public Service Mortgage Forgiveness lastly hit its stride in 2024. This system began in 2009, however required 10 years of qualifying funds. Nevertheless, to be eligible, it required Direct Loans and qualifying compensation plans. Most new college students did not begin taking Direct Loans till 2010 (then had 4 years of school), and compensation plans like PAYE did not begin till 2014. So, the primary “large wave” of debtors hitting 10 years occurred in 2024. And in October 2024, the 1 million PSLF borrower mark was hit.

This desk exhibits the totals forgiven, as of January 15, 2025, based mostly on U.S. Division of Schooling press releases. The U.S. Division of Schooling underneath the Biden Administration printed press releases very continuously, at any time when that they had a big quantity of forgiveness. This yielded a continuing drumbeat of latest forgiveness bulletins.

|

Program |

{Dollars} (Billions) |

Variety of Debtors |

Common per Borrower |

|---|---|---|---|

|

Public Service Mortgage Forgiveness (PSLF) |

$78.5 |

1,069,000 |

$73,396 |

|

IDR Fee Rely Adjustment |

$56.5 |

1,400,000 |

$40,357 |

|

Borrower Protection And Closed College Discharge |

$34.5 |

1,945,880 |

$17,708 |

|

Complete And Everlasting Incapacity |

$18.7 |

633,000 |

$29,542 |

|

SAVE Accelerated Forgiveness |

$5.5 |

414,000 |

$13,285 |

|

TOTAL |

$193.6 |

5,461,880 |

$35,449 |

|

Complete Exluding SAVE |

$188.1 |

5,047,880 |

$37,449 |

Greater than 40% of the overall scholar mortgage cancellation was via the Public Service Mortgage Forgiveness (PSLF) program.

Regardless of all of the forgiveness, there was extra federal scholar mortgage debt excellent when he left workplace than when he began. Complete scholar mortgage debt excellent elevated from $1.565 trillion to $1.640 trillion.

It’s because new borrowing exceeded the quantity forgiven. For the reason that begin of the pandemic, there was greater than $80 billion of latest borrowing every year and about $15 billion in progress in paying down debt. That yields a web enhance of $65 billion per yr earlier than subtracting the $47 billion in annual forgiveness.

Total, the mortgage forgiveness throughout the Biden Administration represented greater than 10% of the variety of debtors and {dollars} of federal scholar loans.

Public Service Mortgage Forgiveness (PSLF)

Public Service Mortgage Forgiveness (PSLF) forgives the borrower’s remaining federal scholar mortgage debt after the borrower makes 120 qualifying funds whereas working full-time in a public service job. Qualifying compensation plans embrace income-driven compensation plans and the commonplace 10-year compensation plan. Qualifying employers embrace authorities employers and 501(c)(3) organizations. Solely Direct Loans are eligible for forgiveness (not FFEL or Perkins).

As of July 31, 2025, a cumulative complete of $85.5 billion in loans to 1,155,400 debtors has been discharged via the Public Service Mortgage Forgiveness (PSLF) program (Excel File). That’s a median of $74,000 per borrower.

Of the overall, 421,600 debtors acquired $33.1 billion in forgiveness via PSLF, 7,300 acquired $0.3 billion in forgiveness via TEPSLF and 758,800 acquired $52.1 billion in forgiveness via the Restricted PSLF Waiver (PDF File) that ended on October 31, 2022.

An extra 2.5 million debtors have eligible employment and complete excellent stability of $224.9 billion in debt, a median of $87,700 per borrower. The stability could lower by the point they obtain forgiveness as they proceed to make funds via income-driven compensation plans.

Of debtors who’ve utilized from June 30, 2024 to July 31, 2025, 57% work for a authorities employer and 43% to a 501(c)(3) employer. 37% of purposes had been closed or cancelled with out receiving forgiveness. 5% of the purposes had been closed due to employer eligibility points.

A exact calculation of the affect of the PSLF shouldn’t be doable with at the moment out there knowledge from the U.S. Division of Schooling. Calculating the share of the unique mortgage stability that’s finally forgiven by PSLF would require details about the unique mortgage stability, the rate of interest and the annual revenue and household dimension.

However, a back-of-the-envelope estimate suggests that as a lot as half to 3 quarters of the unique mortgage stability plus subsequent accrued curiosity is finally forgiven.

Trainer Mortgage Forgiveness

Trainer Mortgage Forgiveness (TLF) gives scholar mortgage forgiveness for extremely certified lecturers in low-income elementary and secondary faculties. As much as $17,500 in mortgage forgiveness is offered after 5 years of full-time instructing in math, science and particular schooling. As much as $5,000 in mortgage forgiveness is offered for lecturers in different topic areas.

As of February 2025, a cumulative complete of $4.2 billion of Trainer Mortgage Forgivneess (TLF) has been acquired by 486,300 debtors from FY2009 via FY2024. That’s a median of $8,542 per borrower.

The typical per borrower has elevated from $7,963 in FY2009 to $10,238 in FY2023 and $9,681 in FY2024.

It is essential to notice that many lecturers profit from PSLF, and you can’t “double-dip” advantages (although the will be earned sequentially).

Borrower Protection To Compensation Discharges

The Borrower Protection to Compensation Discharge cancels a borrower’s federal scholar mortgage debt if their school engaged in fraud or false and deceptive info in regards to the school’s academic applications, expenses or employability of graduates. The fraud should have affected the scholar’s choice to enroll within the school or borrow federal scholar loans. Along with discharging the borrower’s remaining federal scholar mortgage debt, the borrower will obtain a refund of mortgage funds they’ve already made.

Information offered by the U.S. Division of Schooling in response to a FOIA request exhibits that 22% of borrower protection claims contain public or personal non-profit faculties and 78% contain personal for-profit faculties. The approval charge for borrower protection claims is 50% for personal non-profit faculties and 23% for personal for-profit faculties.

The U.S. Division of Schooling has additionally printed a checklist of three,379 faculties (Excel File) as of June 30, 2025 which have acquired a complete of 979,580 borrower protection to compensation complaints. Solely 5% of the complaints have been denied or closed, however 47% are nonetheless pending.

The highest 25 faculties acquired 46% of the complaints. 88% of the highest 25 faculties are for-profit.

The complaints are inclined to parallel the geographic distribution of school college students, with 13% of the complaints regarding California faculties, 9% Florida faculties, 9% Texas faculties, 6% Georgia faculties, 5% Illinois faculties, and 4% Ohio faculties.

The typical quantity discharged is an estimated $23,000 per borrower.

Closed College Discharges

The Computerized Closed College Discharge report (Excel File), which was final up to date in June 2022, experiences a cumulative complete of 153,100 debtors eligible for discharge of $1,889,800,000 in scholar loans as a consequence of attendance at a college that closed. About 5% of the discharges had been nonetheless pending.

The typical quantity discharged was $12,344 per borrower.

Loss of life And Incapacity Discharges

Based mostly on knowledge from the federal price range, loss of life and incapacity discharges signify an estimated 0.7% to 1.3% of excellent federal scholar mortgage debt every year. That is roughly $1.6 billion in scholar loans cancelled every year as a consequence of loss of life or complete and everlasting incapacity.

Complete and everlasting incapacity discharge processing has skilled delays in 2025 as a consequence of system upgrades, so the information from earlier this yr could also be skewed.

Affect Of OBBBA On Scholar Mortgage Forgiveness

The OBBBA laws has made a number of adjustments that may scale back the quantity of scholar mortgage forgiveness.

- The laws impacts Public Service Mortgage Forgiveness (PSLF) by changing the 4 income-driven compensation plans with only one. The brand new Compensation Help Plan (RAP) has greater funds than underneath the SAVE compensation plan, which has been repealed. Funds underneath RAP could also be decrease than underneath Revenue-Based mostly Compensation (IBR) for low- and moderate-income debtors, however the funds are greater for debtors with revenue over about $75,000. You’ll be able to see a full RAP vs. IBR breakdown right here.

- The RAP plan forgives the remaining debt after 30 years of funds, longer than the 20 or 25 years required for forgiveness underneath IBR.

- Debtors of Guardian PLUS loans usually are not eligible for the RAP plan, which successfully ends the eligibility for PSLF for brand spanking new dad or mum debtors.

- The laws repeals the Grad PLUS mortgage. The Grad PLUS mortgage had an annual restrict as much as the total price of attendance minus different help acquired, with no mixture limits. Though the laws compensates by growing the combination Federal Direct Stafford mortgage limits for graduate college students {and professional} faculty college students, these limits are low sufficient that they might shift some borrowing from federal scholar loans to non-public scholar loans. Non-public scholar loans are ineligible for mortgage forgiveness.

- The laws delays the efficient date of the 2022 Borrower Protection to Compensation laws and closed faculty discharge provisions, thereby reverting to earlier, extra restrictive guidelines for brand spanking new loans.

As well as, the Trump administration has quickly paused IBR forgiveness and has created a backlog for processing IDR Plan Request types and PSLF Buyback Possibility software types.

The Trump administration has additionally proposed altering the definition of qualifying employer for PSLF to exclude employers that have interaction in a “substantial unlawful function” even when the employer is a authorities company or 501(c)(3) non-profit group. These adjustments may additional restrict scholar mortgage forgiveness.

Do not Miss These Different Tales:

Editor: Robert Farrington

The publish How A lot Scholar Mortgage Debt Is Really Forgiven? appeared first on The School Investor.