Key Factors

- Be sure you totally perceive your school invoice, together with tuition, charges, housing, meal plans, and utilized help to know precisely what’s owed and when.

- Verify that grants, scholarships, and loans are utilized accurately, and establish any discrepancies early.

- Mix financial savings, revenue, monetary help, and fee choices into a practical strategy that minimizes borrowing.

When the school invoice arrives, households usually really feel the load of numbers that all of a sudden flip summary prices into pressing deadlines. Tuition and costs, housing, and meal plans are all specified by black and white, whereas monetary help and scholar loans could or could not align the best way you anticipated.

It may be overwhelming, however a sensible step-by-step plan could make the method manageable. By breaking down the invoice, evaluating it to your scholar’s monetary help award letter, including in outdoors bills, and mapping out the sources of funds, households can create a workable technique that reduces stress and avoids pointless borrowing.

The invoice could also be giant, however with a transparent plan, it turns into one thing you’ll be able to sort out semester by semester.

Would you want to save lots of this?

1. Perceive The Invoice

The faculty invoice ought to be very clear about:

- How a lot is owed for tuition, housing, meal plans, necessary charges, lab charges, medical health insurance and different prices.

- The greenback worth of scholarships and grants which were utilized for that semester.

- The quantity credited to the scholar’s account for Federal Direct Scholar Loans for the semester.

- Fee particulars: due dates, fee strategies, late charge & penalties.

Here is an instance assertion from the College of Southern Indiana:

2. Examine The Invoice To Your Monetary Help Award Letter

Guarantee the worth aligns with the prices and the grants, scholarships, scholar loans and different methods to scale back the worth as outlined within the award letter. Errors occur. Contact the bursar’s workplace if one thing doesn’t look proper or when you want an evidence of the invoice.

A couple of nuances to grasp:

- Work-Research awards don’t scale back the invoice. Work-Research is a part-time job that may pay the scholar as work is carried out, like some other job.

- Federal help in addition to grants and loans from the school are normally disbursed equally over the semesters. A scholar should first settle for the Federal Direct Mortgage after which full the method to get the mortgage earlier than it may be credited to their account. A $5,500 Federal Direct Scholar Mortgage to a freshman in a two-semester program shall be credited $2,750 per semester. The faculty will get the money instantly from the U.S. Division of Training.

- Verify with third-party scholarship suppliers to find out how the scholarship shall be paid, i.e. in a lump sum or disbursed over the semesters.

- Sororities and fraternities ship separate payments for housing and meal fees.

- The second semester invoice will doubtless look quite a bit like the primary semester invoice. When paying for the following semester, will it’s essential to make changes to your plan from the primary semester? Generally there could also be new scholar charges that do not carry ahead to future semesters.

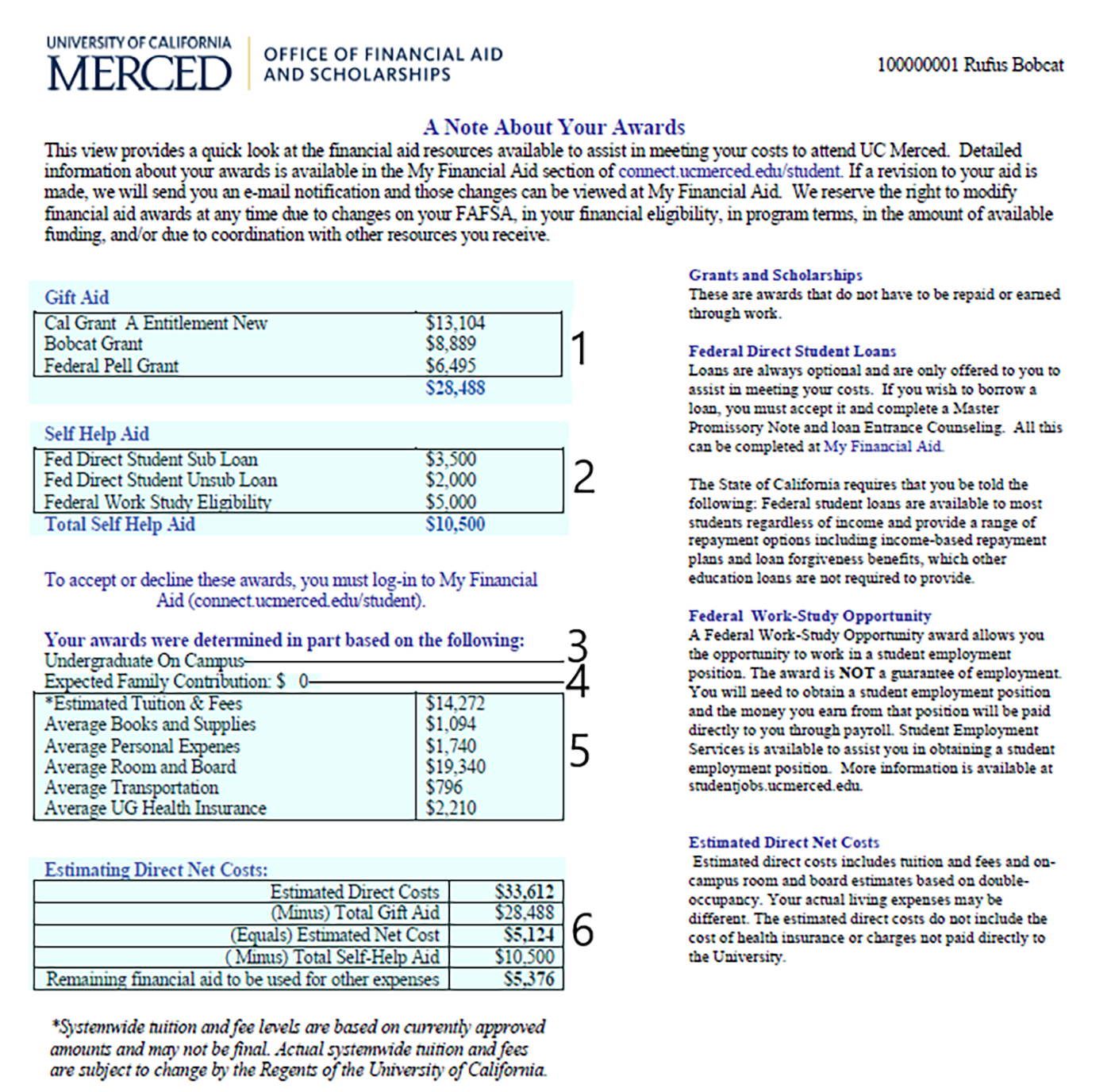

Bear in mind, here is a pattern monetary help award that ought to look much like what you’d have acquired again within the Spring:

3. Add Different Bills

Along with the charges outlined on the invoice, there shall be different prices through the semester:

- Transportation. Journey to and from campus for drop-off, Dad or mum’s Day, Thanksgiving, and finish of the semester provides up. Planning and setting journey alerts for reductions on air fares and accommodations can lower your expenses! And bear in mind, transportation is by no means a qualifying 529 plan expense.

- Miscellaneous college bills. Textbooks, computer systems, course supplies, provides and so forth.

- Supplemental meals, leisure, and miscellaneous bills. Working with college students to determine a price range for these discretionary bills will assist college students lay the inspiration for monetary success sooner or later.

Some households additionally take into account buying insurance coverage to guard in opposition to surprising occasions:

- Tuition insurance coverage for withdrawals from college for documented medical occasions. GradGuard affords reimbursement when a scholar can’t full an educational time period as a consequence of an unexpected, lined accident, damage or different lined purpose.

- Renter’s Insurance coverage for housing and private belongings. Understand that many “regular” owners and renters insurance coverage corporations do not cowl dorm rooms – so be sure you discover a supplier that does.

With a agency understanding of the school’s prices, an affordable estimate of different prices, and the quantity of economic help a scholar acquired, you’re able to pay the invoice. You now understand how a lot you will want instantly and good projections of extra prices for the primary and second semesters.

4. Know The Supply Of Funds That Are Obtainable

Absent profitable the lottery, a GoFundMe web page, or some discovered “free” cash when the school invoice arrives, these are the sources of funds to pay the complete school invoice:

- Monetary help from the federal authorities within the type of Pell and different grants, work-study, and Federal Direct Scholar Loans

- Monetary help from the school, most frequently within the type of institutional grants and scholarships

- Scholarships from third events

- Dad or mum and scholar financial savings in 529 or different school financial savings or brokerage accounts

- Tuition Fee Plans

- Parental revenue

- Scholar revenue through the semester from work-study or a part-time job

- Dad or mum loans and/or loans co-signed by the mother or father and scholar

- Presents from household and pals

You may additionally have been informed to think about different sources together with loans out of your retirement account, bank cards, dwelling fairness loans, and insurance coverage insurance policies. Though these could also be a part of your plan, every have drawbacks to think about:

- Retirement financial savings are typically thought of enticing as a result of you’ll be able to “borrow from your self” and pay the curiosity again to your retirement account. That’s true, nevertheless it may additionally take an enormous chunk out of your account at a essential time when your nest egg ought to be constructing earlier than retirement. If the compensation plan falls aside, you may imperil your monetary future: you’ll be able to’t borrow for retirement.

- Bank cards cost rates of interest usually two or thrice the charges out there for scholar and mother or father loans. If you wish to pay to get frequent flyer factors or money again, you’ll want to make the fee in full the following month to keep away from extreme charges. Utilizing bank cards to pay for faculty could also be the costliest solution to fund an schooling!

- Tax advantages don’t scale back the school invoice so you shouldn’t rely on them to supply money for the primary yr.

- Insurance coverage merchandise are advanced and never usually go-to automobiles to pay present school payments.

5. Make A Particular Plan To Pay For Every Semester

Now’s the time to establish which sources of funds can be found to you and the way a lot of every you’ll use to pay for faculty.

Though there isn’t any hard-and-fast rule of thumb on how one can pay for faculty, some imagine that the price of school ought to be lined:

- 1/3 by monetary help

- 1/3 by financial savings

- 1/3 by scholar loans

That’s nice in idea, nevertheless it’s a bit late now that the invoice has arrived. Here is some knowledge from a current examine on how households pay for faculty, and you’ll see it is a pie:

Listed here are a number of sensible concerns when developing your plan to pay the school invoice:

- There isn’t a “proper” reply or silver bullet to assemble the optimum plan as a result of there are various shifting unknowns from now till commencement. Moreover, costs are likely to rise yearly after the primary yr as properly – tuition and housing prices have been rising anyplace from 4-8% per yr.

- The primary-year plan must be modified every year as prices and different phrases change. As an illustration, the rate of interest on scholar loans will change based mostly on market circumstances and your credit score historical past. Did the charges go up or down? Likewise, your financial savings could also be bolstered or diminished based mostly on ever-changing circumstances within the monetary markets.

- Financial savings: Allocating school financial savings to every yr of school may very well be so simple as dividing by 4 (assuming a 4-year program that’s accomplished in 4 years) or allocating smaller or bigger proportions for every year. Understanding how the financial savings plan works is necessary. As an illustration, 529 Plan withdrawals should be used for “Certified Instructional Bills.” QEPs cowl just about all school bills and as much as $10,000 of scholar loans per scholar, however it’s essential to make sure the withdrawal is for a QEP or you could face a penalty for an unqualified withdrawal. Additionally, understanding the method for making a professional withdrawal is necessary. Contact your 529 plan supplier properly earlier than you want the money!

- Fee Plans: Most schools provide a fee plan that, in impact, advances money to the school that can assist you cowl a portion of the invoice, for a one-time charge. You’ll be able to then use present revenue every month to repay the fee plan firm. It is a good way to make use of present earnings to scale back the scale of a mother or father or scholar mortgage.

- Scholar Loans:

Scholar and mother or father loans ought to be the final resort, not the primary possibility, to pay for faculty. Federal Direct Loans are the most effective deal on the town for undergraduates as a result of there isn’t any required credit score test, all college students are eligible for a mortgage, and the compensation phrases are favorable. In case your plan to pay the invoice requires a mother or father or mother or father/scholar co-signed mortgage, you’ll want to store round and don’t robotically assume the Federal Dad or mum Plus Mortgage supplies the bottom rate of interest and finest phrases for you.

Instance

Let’s assume the whole school tuition and costs on the invoice plus all the opposite prices you may have projected for the educational yr is $50,000: $25,000 for every semester. And your daughter’s monetary help award letter supplied:

- $18,000: Scholarships and grants from the school

- $5,500: Federal Direct Scholar Loans

- $4,000: Federal Pell Grant

- $3,200: Federal Work-Research

As well as, she received your employer’s annual $2,500 scholarship paid within the first semester every year.

How a lot money does she want for every semester?

- First Semester: $ 8,750

($25,000 [cost] – $9,000 [college aid] – $2,750 [Federal Loan] – $2,000 [Pell] – $2,500 [employer scholarship])

- Second Semester: $11,250

($25,000 [cost] – $9,000 [college aid] – $2,750 [Federal Loan] – $2,000 [Pell])

Discover that the Work-Research Award doesn’t scale back the quantity of the invoice. Additionally do not forget that work examine {dollars} must each be earned by working, after which when the kid receives the paycheck, really used for faculty bills.

How is she going to pay these payments? Additional assume:

- She is the beneficiary of a $32,000 529 plan. You resolve to make use of 25% per tutorial yr so $8,000 shall be used the primary yr.

- She saved $4,000 for faculty and can earn $2,500 every summer season working.

- She earns $400/mo from a Work-Research job.

- You’ll be able to pay $350/mo out of your revenue every month through the college yr.

For the $8,750 first semester invoice, she may pay some ways together with:

- Utilizing a fee plan to cowl $2,750 to be paid over 5 months. You pay $350/mo and she or he pays $200/mo.

- Withdrawing $4,000 from the 529 plan.

- Withdrawing $2,000 from her financial savings.

On this case, she would nonetheless have earnings of about $200/mo from the Work-Research job.

For the second semester invoice ($11,250):

- Use the fee plan to cowl $2,750.

- Withdraw $4,000 from the 529 plan.

- Withdraw $2,000 from her financial savings.

- You are taking a personal scholar mortgage for $2,500.

She’s going to proceed to earn $200/mo. from the Work-Research job.

On the finish of the yr, the $50,000 was lined by 9 totally different sources of funds:

- $18,000: Scholarships and grants from the school

- $8,000: Withdrawals from 529 Financial savings Plan

- $5,500: Federal Direct Scholar Mortgage

- $5,500: Fee plans paid every month from present earnings: $2,000 from her Work-Research earnings and $3,500 out of your revenue

- $4,000: Federal Pell Grant

- $4,000: Her financial savings

- $ 2,500: Employer scholarship

- $2,500: Personal scholar mortgage – the final resort to pay for faculty

This plan leaves your daughter with a cushion of $200/mo. for different bills.

Professional Tip: Contemplate reallocating subsequent yr’s projected 529 withdrawal of $8,000 to a really conservative funding possibility.

Ultimate Ideas

Decide which mixture of the next sources of funds will work finest in your scholar: some school and federal help, personal scholarships, fee plans, household financial savings, present revenue and scholar loans.

Refining your plan for every semester and every year will assist decrease loans and enhance the return on the funding in school.

Scholar loans ought to be the final resort, not the primary choice to pay the school invoice.

Do not Miss These Different Tales:

Editor: Robert Farrington

The put up 5-Step Sensible Information To Paying Your School Invoice appeared first on The School Investor.