Betterment has quite a lot of processes in place to assist restrict the affect of your investments in your tax invoice, relying in your scenario. Let’s demystify these highly effective methods.

We all know that the medley of account sorts could make it difficult so that you can determine which account to contribute to or withdraw from at any given time.

Let’s dive proper in to get an extra understanding of:

- What accounts can be found and why you may select them

- The advantages of receiving dividends

- Betterment’s highly effective tax-sensitive options

How are totally different funding accounts taxed?

Taxable accounts

Taxable funding accounts are usually the best to arrange and have the least quantity of restrictions.

Though you’ll be able to simply contribute and withdraw at any time from the account, there are trade-offs. A taxable account is funded with after-tax {dollars}, and any capital beneficial properties you incur by promoting property, in addition to any dividends you obtain, are taxable on an annual foundation.

Whereas there isn’t a deferral of earnings like in a retirement plan, there are particular tax advantages solely accessible in taxable accounts similar to lowered charges on long-term beneficial properties, certified dividends, and municipal bond earnings.

Key Issues

- You desire to the choice to withdraw at any time with no IRS penalties.

- You already contributed the utmost quantity to all tax-advantaged retirement accounts.

Conventional accounts

Conventional accounts embrace Conventional IRAs, Conventional 401(okay)s, Conventional 403(b)s, Conventional 457 Governmental Plans, and Conventional Thrift Financial savings Plans (TSPs).

Conventional funding accounts for retirement are typically funded with pre-tax {dollars}. The funding earnings acquired is deferred till the time of distribution from the plan. Assuming all of the contributions are funded with pre-tax {dollars}, the distributions are absolutely taxable as strange earnings. For traders below age 59.5, there could also be an extra 10% early withdrawal penalty except an exemption applies.

Key Issues

- You anticipate your tax charge to be decrease in retirement than it’s now.

- You acknowledge and settle for the potential for an early withdrawal penalty.

Roth accounts

This contains Roth IRAs, Roth 401(okay)s, Roth 403(b)s, Roth 457 Governmental Plans, and Roth Thrift Saving Plans (TSPs).

Roth sort funding accounts for retirement are all the time funded with after-tax {dollars}. Certified distributions are tax-free. For traders below age 59.5, there could also be strange earnings taxes on earnings and an extra 10% early withdrawal penalty on the earnings except an exemption applies.

Key concerns

- You anticipate your tax charge to be larger in retirement than it’s proper now.

- You anticipate your modified adjusted gross earnings (AGI) to be under $140k (or $208k submitting collectively).

- You want the choice to withdraw contributions with out being taxed.

- You acknowledge the potential for a penalty on earnings withdrawn early.

Past account sort selections, we additionally use your dividends to maintain your tax affect as small as doable.

4 methods Betterment helps you restrict your tax affect

We use any extra money to rebalance your portfolio

When your account receives any money—whether or not by a dividend or deposit—we routinely determine the best way to use the cash that can assist you get again to your goal weighting for every asset class.

Dividends are your portion of an organization’s earnings. Not all corporations pay dividends, however as a Betterment investor, you nearly all the time obtain some as a result of your cash is invested throughout 1000’s of corporations on the earth.

Your dividends are a necessary ingredient in our tax-efficient rebalancing course of. Whenever you obtain a dividend into your Betterment account, you aren’t solely earning profits as an investor—your portfolio can be getting a fast micro-rebalance that goals to assist hold your tax invoice down on the finish of the 12 months.

And, when market actions trigger your portfolio’s precise allocation to float away out of your goal allocation, we routinely use any incoming dividends or deposits to purchase extra shares of the lagging a part of your portfolio.

This helps to get the portfolio again to its goal asset allocation with out having to unload shares. This can be a refined monetary planning method that historically has solely been accessible to bigger accounts, however our automation makes it doable to do it with any dimension account.

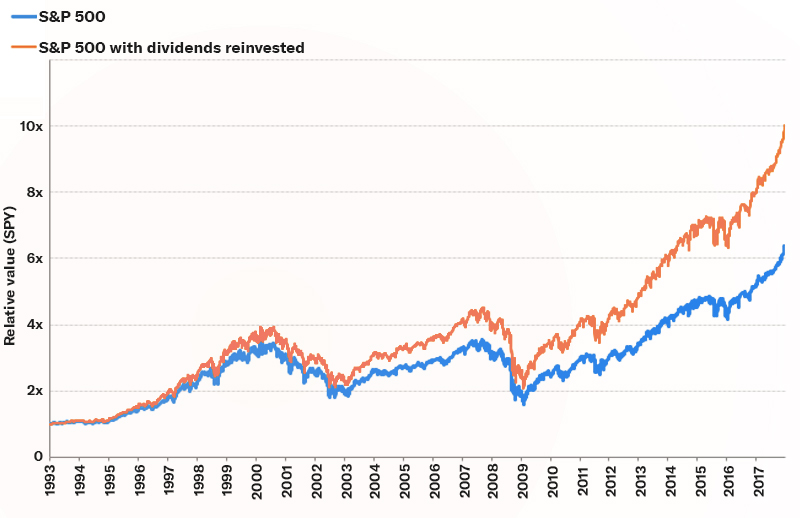

Efficiency of S&P 500 with dividends reinvested

Supply: Bloomberg. Efficiency is supplied for illustrative functions to characterize broad market returns for [asset classes] that will not be utilized in all Betterment portfolios. The [asset class] efficiency just isn’t attributable to any precise Betterment portfolio nor does it replicate any particular Betterment efficiency. As such, it isn’t web of any administration charges. The efficiency of particular funds used for every asset class within the Betterment portfolio will differ from the efficiency of the broad market index returns mirrored right here. Previous efficiency just isn’t indicative of future outcomes. You can’t make investments immediately within the index. Content material is supposed for instructional functions and never meant to be taken as recommendation or a advice for any particular funding product or technique.

We “harvest” funding losses

Tax loss harvesting can decrease your tax invoice by “harvesting” funding losses for tax reporting functions whereas preserving you absolutely invested.

When promoting an funding that has elevated in worth, you’ll owe taxes on the beneficial properties, often called capital beneficial properties tax. Thankfully, the tax code considers your beneficial properties and losses throughout all of your investments collectively when assessing capital beneficial properties tax, which signifies that any losses (even in different investments) will cut back your beneficial properties and your tax invoice.

The truth is, if losses outpace beneficial properties in a tax 12 months, you’ll be able to eradicate your capital beneficial properties invoice solely. Any losses leftover can be utilized to scale back your taxable earnings by as much as $3,000. Lastly, any losses not used within the present tax 12 months will be carried over indefinitely to scale back capital beneficial properties and taxable earnings in subsequent years.

So how do you do it?

When an funding drops under its preliminary worth—one thing that may be very more likely to occur to even the very best funding in some unspecified time in the future throughout your funding horizon—you promote that funding to appreciate a loss for tax functions and purchase a associated funding to take care of your market publicity.

Ideally, you’d purchase again the identical funding you simply offered. In spite of everything, you continue to suppose it’s a great funding. Nevertheless, IRS guidelines forestall you from recognizing the tax loss when you purchase again the identical funding inside 30 days of the sale. So, with the intention to hold your general funding publicity, you purchase a associated however totally different funding. Consider promoting Coke inventory after which shopping for Pepsi inventory.

Total, tax loss harvesting might help decrease your tax invoice by recognizing losses whereas preserving your general market publicity. At Betterment, all you need to do is activate Tax Loss Harvesting+ in your account.

We use asset location to your benefit

Asset location is a technique the place you set your most tax-inefficient investments (normally bonds) right into a tax-efficient account (IRA or 401k) whereas sustaining your general portfolio combine.

For instance, an investor could also be saving for retirement in each an IRA and taxable account and has an general portfolio mixture of 60% shares and 40% bonds. As an alternative of holding a 60/40 combine in each accounts, an investor utilizing an asset location technique would put tax-inefficient bonds within the IRA and put extra tax-efficient shares within the taxable account.

In doing so, curiosity earnings from bonds—which is often handled as strange earnings and topic to a better tax charge—is shielded from taxes within the IRA. In the meantime, certified dividends from shares within the taxable account are taxed at a decrease charge, capital beneficial properties tax charges as an alternative of strange earnings tax charges. Your entire portfolio nonetheless maintains the 60/40 combine, however the underlying accounts have moved property between one another to decrease the portfolio’s tax burden.

We use ETFs as an alternative of mutual funds

Have you ever ever paid capital acquire taxes on a mutual fund that was down over the 12 months? This irritating scenario occurs when the fund sells investments contained in the fund for a acquire, even when the general fund misplaced worth. IRS guidelines mandate that the tax on these beneficial properties is handed by to the top investor, you.

Whereas the identical rule applies to change traded funds (ETFs), the ETF fund construction makes such tax payments a lot much less seemingly. Normally, you will discover ETFs with funding methods which might be related or equivalent to a mutual fund, typically with decrease charges.