The 52-week financial savings problem has gained various reputation as a means to economize throughout the 12 months, nevertheless it’s not the one cash problem on the market. Typically, it’s simpler to get began with smaller quantities. That’s the place the 365 day cash problem is available in.

The 52-week financial savings problem has gained various reputation as a means to economize throughout the 12 months, nevertheless it’s not the one cash problem on the market. Typically, it’s simpler to get began with smaller quantities. That’s the place the 365 day cash problem is available in.

Historical past of the Problem

There was a girl who stated she beloved the idea of the 52-week cash problem, however she couldn’t do it. She defined that every week when she wanted to place apart the cash for that week, she would panic.

The primary couple of months have been okay as a result of the greenback quantities have been low, however as they began to extend, the weekend turned a time of terror as a result of she knew she wanted to place away cash that she didn’t have. She ended up giving up as a result of the problem was inflicting extra stress than it was price. She requested me if there was a distinct problem which may have the ability to assist her.

It turned clear what she wanted. She appreciated the idea however dreaded when it was time to place cash away as a result of she didn’t have it when the week ended. What she wanted was a problem that pressured her to economize earlier than it was gone. She additionally wanted to avoid wasting smaller greenback quantities. Doing it this manner would assist in order that she didn’t panic. The 365-day cash problem was born.

How the 365 Day Cash Problem Works

The idea of the problem is easy. There are one year within the 12 months. Day-after-day earlier than you exit, you must pay your self first. This step is vitally necessary. The girl panicked as a result of she didn’t have the cash on the finish of every week. What she wanted to do was pay herself first.

How you can Incorporate the 365 Day Cash Problem Into Your Life

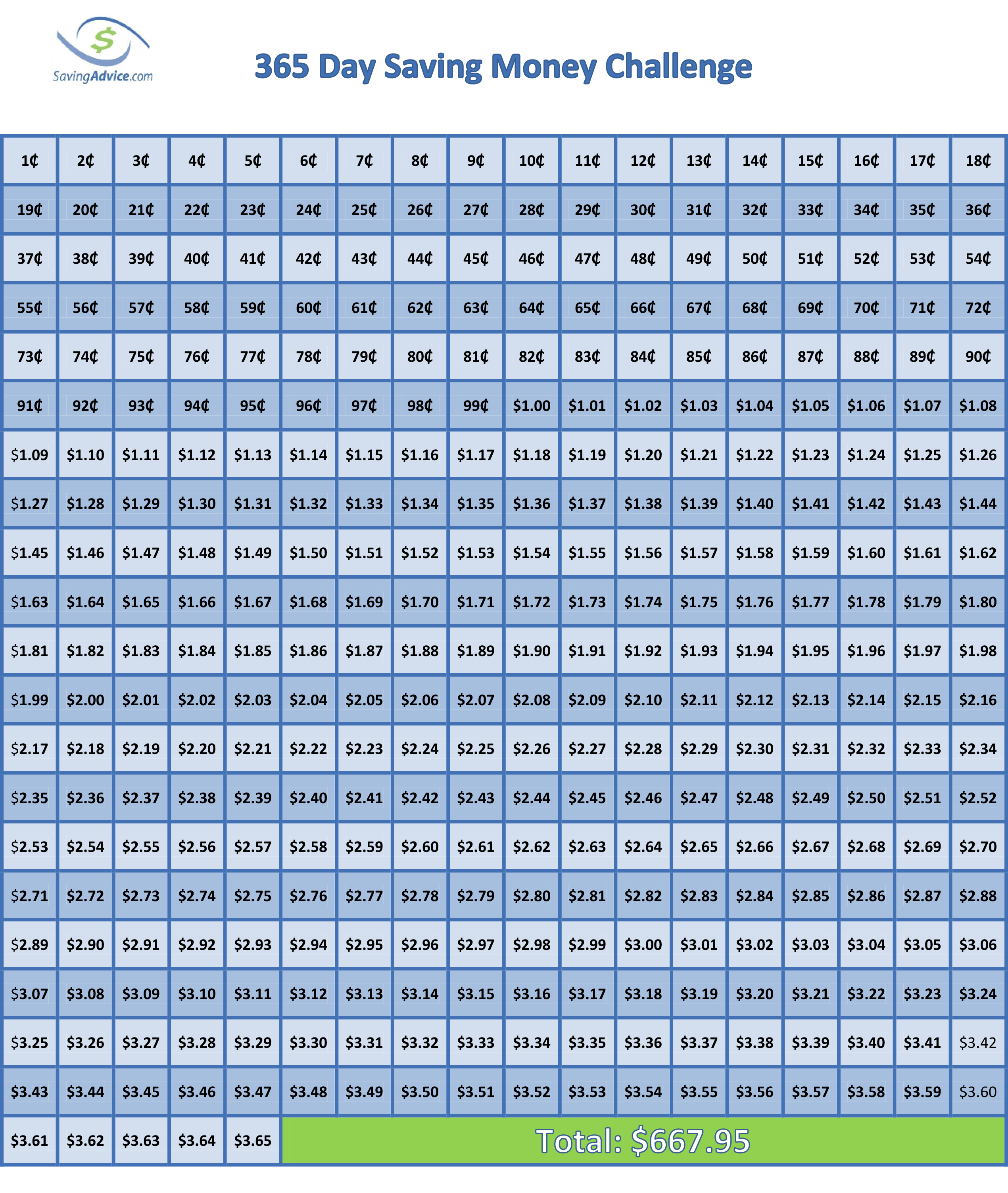

One of the best ways to do that is be quaint – really print out the problem graph. After printing out the problem sheet, you must place it someplace the place you’ll see it every morning – someplace like on the mirror in your lavatory. It must be in a visual place the place you will notice it on daily basis, so that you’ll be much less more likely to overlook about it.

Every morning if you rise up, you must pay your self some quantity earlier than you do the rest. The fee could be wherever between a single penny to $3.65. Upon getting made that fee to your self, you “x” out the field in your chart. Your subsequent fee the next morning could be any of the remaining quantities on the desk. You proceed to do that each morning for the whole 12 months. When completed, you’ll have saved $667.95. Even higher, you’ll have shaped the important monetary behavior of paying your self first, which will likely be an asset for the remainder of your life.

365 Day Cash Problem

Flexibility Is Key

Some individuals have hassle with a cash problem as a result of every week, the quantity you need to save will increase. By December, you’re paying greater than every other month within the problem. Sadly, that’s additionally if you probably have essentially the most bills because of the holidays. With the 365 Day Cash Problem, you select how a lot to place apart every day. If February is a lightweight month for payments, choose the upper each day totals to avoid wasting. Then, in December, it can save you the smaller quantities when you’ve got much less wiggle room in your price range.

Get In The Behavior of Paying Your self

Research have proven that it could actually take as little as three weeks or so long as 254 days to type a behavior. Due to this fact, it’s necessary to make saving as simple as doable for so long as doable. Making funds to your self or transferring the funds for a 12 months satisfies all the necessities to make a behavior. As your revenue grows, persevering with this behavior will make it easier to construct wealth. By the top of the 12 months, saving cash will likely be a pure a part of your day.

Benefits of the Problem

There are just a few benefits to this financial savings problem.

The Quantities to Save Are Attainable for Any Funds

The primary is that you just’re beginning with such small quantities that anybody, it doesn’t matter what their present monetary state of affairs, can take part. If all you are able to do is pay absolutely the minimal quantity every day for the primary month, you’re solely out $4.65 for 30 days.

You Finish the 12 months with a Good Starter Emergency Fund

Moreover, $668 is a superb begin to an emergency fund. Much more necessary than that, you’ll put your self within the place to avoid wasting way more cash within the following years. In the event you saved your cash in a high-interest financial savings account, you’d earn compound curiosity for an excellent larger stability.

Different Challenges You Would possibly Need to Attempt

In order for you extra of a problem, improve the each day values. If you wish to strive one other substitute, listed below are some problem articles that may be a greater match:

- Twice a Month (Bi-Month-to-month) Cash Problem

- Month-to-month Cash Problem

- 52 Week Cash Problem Options

- 52 Week Financial savings Problem Variation

- 52 Week Make Cash Problem

- 52 Week Cash Problem For Children

They have been all written again in 2013, however they similar fundamental thought applies for all of them immediately.

Discovering Money For the 365 Day Cash Problem

The primary few days of the problem are simple. You simply save a couple of pennies a day. Nonetheless, because the problem progresses, you’ll want to avoid wasting bigger quantities. To do that, you would possibly want to seek out some extra cash. If that is your state of affairs, listed below are just a few, newer concepts to get you began.

- Promote Your Private Knowledge: The regulatory panorama has modified for the reason that 2000s. Now its doable to promote your knowledge on-line and get compensated for it. Sometimes knowledge brokers need issues like your buy historical past, net looking historical past, and demographic info. That is usually offered to massive firms which use it for promoting. Good firms to contemplate are: Nielsen Opinion Rewards, and Savvy Join. You’ll get 2 to 4 {dollars} per thirty days from every, nevertheless it’s passive.

- Take Surveys: It is a sluggish technique to earn cash, nevertheless it works. This generally is a viable technique in case you have restricted time, however need a couple of dollars to fulfill your financial savings problem aim. The very best survey app is 1Q. It pays 25 cents per query, has brief questionnaires, and pays proper after you reply the query. It’s price signing up for.

- Promote Your Spare Web Bandwidth: You most likely have extra web bandwidth than you’re utilizing. Attempt promoting it. Good apps are Earn App and HoneyGain.

The web is stuffed with cash making actions, so I gained’t say way more right here. As a substitute, learn these hyperlinks:

The saving recommendation boards has a wonderful, basic thread on methods to make extra cash.

Adam Froy has an fascinating record of modern methods to earn cash on-line – it’s not your mom’s web anymore.

Lastly, if want to seek out money for the 365 Day Cash Problem, don’t overlook about good previous thrift. Spending lower than you earn, comparability buying and utilizing coupons are all nice methods to make extra cash.

Last Ideas

You’ll have determined to not take part in cash challenges earlier than as a result of the quantities have been too excessive towards the top of the problem. Nonetheless, that’s not so with the 365 Day Cash Problem. Irrespective of your price range, this problem must be attainable. On the finish of the 12 months, you’ll have developed the financial savings behavior, and also you’ll have a great starter emergency fund to point out for it.

Learn Extra

- $5 Invoice Cash Problem

- Take the 365 Day Dime Problem Like a Financial savings Professional

- 10 Causes Everybody Wants an Emergency Fund

- Ten Cash Saving Ideas For The Funds Acutely aware Geek

Come again to what you’re keen on! Dollardig.com is essentially the most dependable cash-back website on the internet. Simply enroll, click on, store, and get full cashbacok!

Jeffrey pressure is a contract creator, his work has appeared at The Avenue.com and seekingalpha.com. Along with having authored hundreds of articles, Jeffrey is a former resident of Japan, former proprietor of Savingadvice.com and knowledgeable digital nomad.