Key takeaways

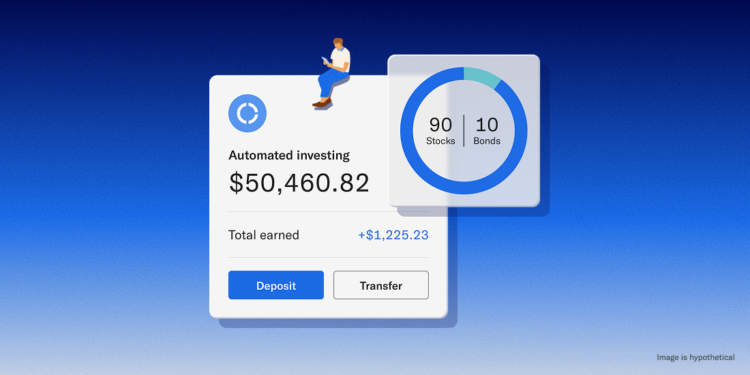

- Portfolio building is only the start. Betterment’s automated investing is designed that can assist you handle danger, maximize returns, and reduce leg work.

- Tax-smart options make it easier to maintain extra of what you earn. Totally-automated Tax Coordination and tax-loss harvesting hunt down efficiencies arduous to duplicate by hand.

- Navigation helps maintain your objectives on monitor. Automated rebalancing, easy glide paths, and recurring deposits make it simpler to remain the course by way of market ups and downs.

- Peace of thoughts is a part of the return. Automation frees up time and headspace, letting you reside your life as an alternative of worrying about your portfolio.

With the arrival of self-directed investing at Betterment, you may select from 1000’s of particular person shares and ETFs by yourself, together with the exact same funds we analysis and choose for our curated portfolios.

So if now you can purchase the identical low-cost investments, why pay somebody (i.e., us) to handle them for you?

It’s a good query, and to assist reply it, it helps to grasp why our portfolio building is only the start of the story.

It isn’t simply the Betterment portfolio you see immediately, however the one you see tomorrow (and within the weeks, months, and years that comply with) that captures the total worth of our experience and know-how. The continued optimization and evolution of your portfolio, in different phrases, is the place our automated investing actually shines.

Typically the advantages are tangible. Typically they’re emotional. However no matter the way you body it, we’re continually working within the background to ship worth in three huge methods.

- Tax financial savings: conserving extra of what you earn

- Navigation: conserving your investing on-track

- Calm: conserving your sanity—and your spare time

1. Tax financial savings: conserving extra of what you earn

Some of the dependable methods to extend your returns is decreasing the taxes owed in your investments. And this is the primary approach Betterment’s managed portfolios can repay. Our buying and selling algorithms take tax optimization to a stage that’s virtually not possible to duplicate by yourself.

Take our Tax Coordination characteristic, which makes use of the pliability of our portfolios to find belongings strategically throughout Betterment conventional IRAs/401(ok)s, Roth IRAs/401(ok)s, and taxable accounts. This mathematically-rigorous spin on asset location can assist extra of your earnings develop tax-free.

Then there’s our fully-automated tax-loss harvesting, a characteristic designed to unlock cash to speculate that will’ve in any other case gone to Uncle Sam. Our know-how often scans accounts to determine harvesting alternatives, then goes to work. It’s how we harvested practically $60 million in losses for purchasers in the course of the tariff-induced market volatility of Spring 2025.

It’s additionally an enormous motive why practically 70% of shoppers utilizing our tax-loss harvesting characteristic had their taxable advisory price lined by possible tax financial savings.1 And with the upcoming addition of direct indexing to Betterment’s automated investing, our harvesting capabilities will solely proceed to develop.

1

2. Navigation: conserving your investing on-track

It’s straightforward to veer off-course when managing your individual investing. Life occurs, calendars replenish, and the subsequent factor you already know, your portfolio begins to float.

Once you pay for automated investing, nonetheless, you not solely get our steerage upfront, you profit from know-how designed to get you to your vacation spot with much less effort. As markets ebb and movement, for instance, we robotically rebalance your portfolio to take care of your required danger stage. And the “glide path” that robotically lowers your danger as your purpose nears? It simply occurs in eligible portfolios. No analysis or calendar reminders wanted.

Our administration additionally helps steer your investing towards a time-tested path to long-term wealth. Most of our portfolios are globally diversified so you’re taking benefit when abroad markets outperform. And we encourage recurring deposits so you purchase extra shares when costs are low.

Our administration additionally helps steer your investing towards a time-tested path to long-term wealth. Most of our portfolios are globally diversified so you’re taking benefit when abroad markets outperform. And we encourage recurring deposits so you purchase extra shares when costs are low.

Current analysis by Morningstar helps quantify the worth of this “dollar-cost averaging” strategy. They discovered traders misplaced out on roughly 15% of the returns their funds generated due largely to leaping out and in of the market. Betterment prospects utilizing recurring deposits, in the meantime, earned practically 3% larger annual returns.2 It seems it’s simpler to remain the course with a bit assist.

2

3. Calm: Protecting your sanity—and your spare time

Our automation can prevent time—two hours for every rebalance alone3—however the worth of automating your investing is extra than simply time saved. It’s high quality time spent. How a lot of your finite power, in different phrases, are you spending worrying about your cash? We are able to’t erase all your anxiousness, however our workforce and our tech can empower you to construct wealth with confidence and ease, with an emphasis on the benefit.

3

Between market volatility and a relentless barrage of scary headlines, the world is traumatic sufficient proper now. There’s no use so as to add portfolio optimization and maintenance to the record. That’s, after all, except you get pleasure from it. However many people don’t. The vast majority of Betterment prospects we surveyed mentioned they maintain most of their belongings in managed accounts, with self-directed investing serving as a aspect outlet for exploration. That’s why we provide each methods to speculate at Betterment.

The payoff is private

Investing efficiency and worth are sometimes measured right down to the hundredth of a proportion level. That’s “zero level zero one p.c” (0.01%), often known as a “foundation level” or “bip” for brief. Right here at Betterment, it’s our mission to make each one of many 25 bips we mostly cost price it. We measure our portfolio’s efficiency after these charges, so that you see what you’ve actually earned. And we don’t cease there. With direct indexing and absolutely paid securities lending coming quickly to automated investing, you’ll get much more methods to make your cash work more durable.