Netflix inventory costs have dropped within the final 6 months. Is that sufficient to tank a long-term funding?

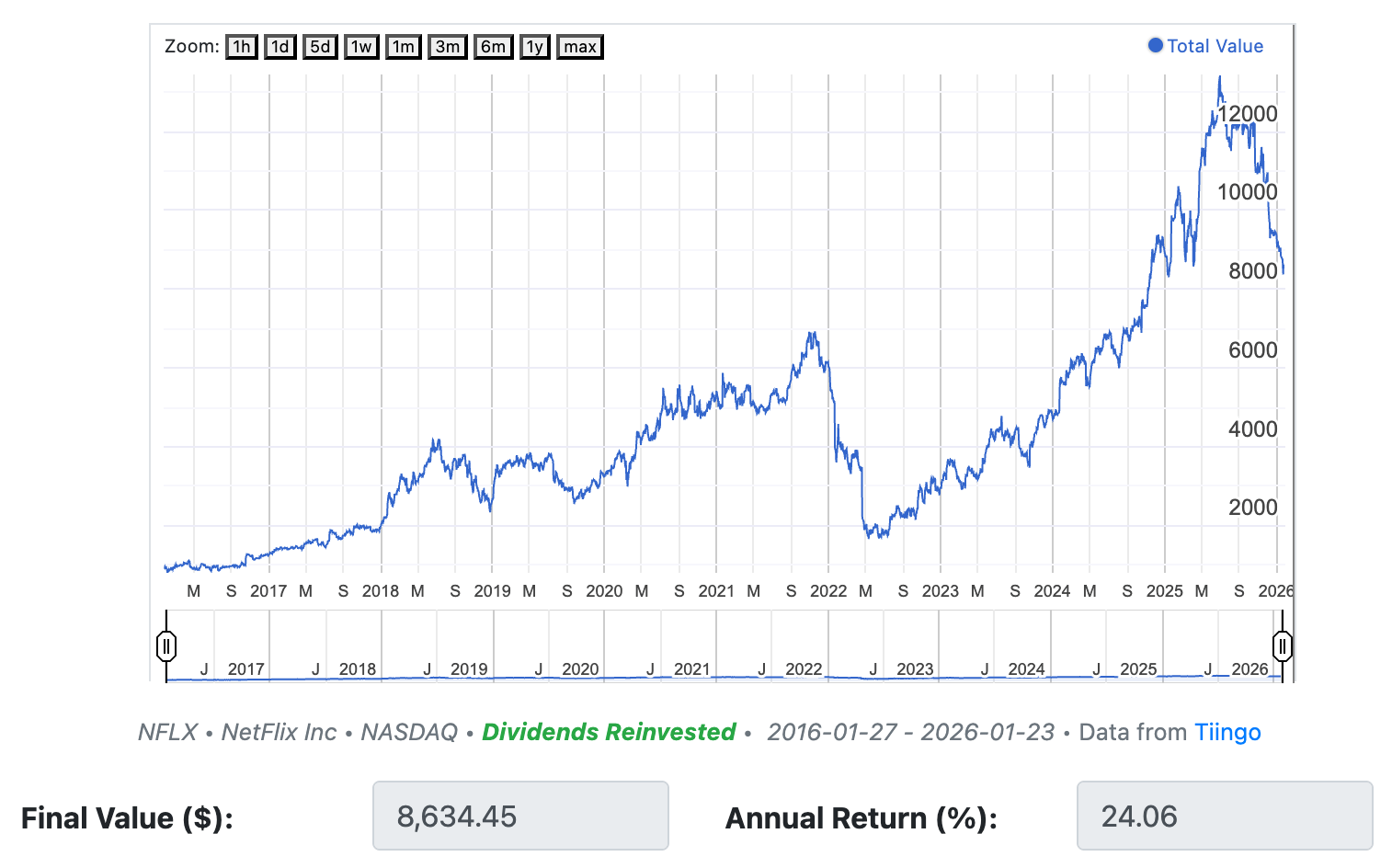

Reply: $8,634.45 (as of January 2026)

That comes out to a median 24% annual fee of return!

Questions:

- How would you describe the pattern in Netflix inventory costs over time?

- What components might need induced important modifications to Netflix’s inventory worth?

- Do you assume as an investor it could have been straightforward to purchase Netflix inventory 10 years in the past and maintain it over this time interval? Clarify your reply.

- Who do you assume are Netflix’s opponents at present?

Listed below are the ready-to-go slides for this Query of the Day that you should utilize in your classroom.

Behind the numbers (The Motley Idiot):

“Netflix’s inventory efficiency deserves a standing ovation. Over the previous decade, the streaming inventory has skyrocketed 721% (as of Jan. 15). A hypothetical $100 beginning sum can be value $821 at present.

That is what traders get when an organization constantly posts robust monetary outcomes. Netflix is projected to report $45.1 billion in income and $13.3 billion in working earnings in 2025, in line with analysts. These figures can be 16% and 28% greater, respectively, than what was registered the 12 months earlier than.”

————–

Take a look at the favored Investing exercise PROJECT: 5 Shares on Your Birthday!

About

the Writer

Kathryn Dawson

Kathryn (she/her) is worked up to affix the NGPF group after 9 years of expertise in training as a mentor, tutor, and particular training trainer. She is a graduate of Cornell College with a level in coverage evaluation and administration and has a grasp’s diploma in training from Brooklyn School. Kathryn is trying ahead to bringing her ardour for accessibility and academic justice into curriculum design at NGPF. Throughout her free time, Kathryn loves embarking on cooking tasks, strolling round her Seattle neighborhood along with her canine, or lounging in a hammock with a ebook.