Shares of Confluent (NASDAQ: CFLT) began 2024 on a optimistic notice. They shot up almost 50% within the first two months of 2024. However issues have since been going downhill for the info streaming supplier, because it has fallen 36% from its year-to-date excessive.

Confluent inventory is now down for the 12 months, underperforming the Nasdaq-100 Know-how Sector index. The inventory obtained one other hammering following the discharge of its second-quarter outcomes on July 31, dropping 18% in a single session.

Nonetheless, a more in-depth take a look at Confluent’s quarterly efficiency and the end-market alternative that it is sitting on signifies shopping for this tech inventory may change into a sensible long-term transfer.

Confluent is rising steadily regardless of headwinds

Confluent reported Q2 income of $235 million, up 24% 12 months over 12 months and exceeding administration’s steering of $229 million to $230 million. The corporate additionally reported $0.06 per share in adjusted earnings, additionally forward of the $0.04 per share to $0.05 per share steering.

The corporate supplies a cloud-based knowledge streaming platform that permits its prospects to attach and course of their knowledge streams in actual time. That is against the normal methodology of storing knowledge at relaxation in silos and batch processing it afterward.

Nonetheless, prospects utilizing Confluent’s real-time platform get extra worth out of their knowledge for varied purposes reminiscent of dynamic pricing, cargo monitoring, customer support, the Web of Issues, and synthetic intelligence, amongst others. Administration estimates its complete addressable market was price an estimated $60 billion in 2022, and it may develop to an estimated $100 billion by 2025.

So, the corporate is early in tapping this large income alternative, contemplating analysts anticipate full-year income to hit $955 million this 12 months, up 23%. Extra importantly, Confluent has been constructing a sturdy buyer base and can also be profitable a much bigger share of their wallets, even throughout what administration described within the earnings name as “a unbroken unstable macro setting.”

That is evident from the actual fact its general buyer base elevated 13% 12 months over 12 months to five,440. Nonetheless, the variety of prospects with annual recurring income (ARR) of greater than $1 million elevated at a sooner tempo of 20%. In the meantime, prospects with greater than $100,000 in ARR elevated 14%.

Confluent’s ARR refers back to the quantity of contractually dedicated income it is set to obtain over the subsequent 12 months from its platform prospects. It additionally refers back to the income Confluent expects to generate from prospects utilizing its cloud options over the subsequent 12 months, based mostly on their utilization prior to now three months. So, the rise within the ARR of its bigger prospects bodes effectively for the corporate because it factors towards a more healthy income pipeline.

The improved buyer spending can also be enabling margin positive aspects for Confluent. The corporate reported a non-GAAP working margin of 1% in Q2, in comparison with a adverse studying of 9% within the year-ago interval. In all, Confluent can enhance each its high and backside strains going ahead, and that ought to help the inventory in the long term.

Wholesome positive aspects on the horizon

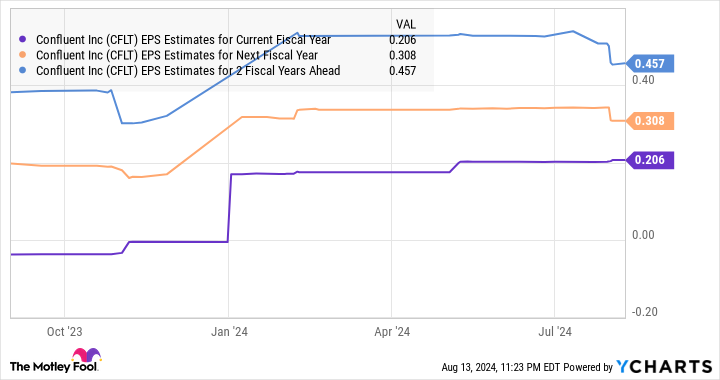

Confluent is anticipating its 2024 earnings to land at $0.20 per share. That will be an enormous enchancment over the $0.04 per share non-GAAP earnings it reported in 2023. Extra importantly, analysts are forecasting a big bottom-line acceleration in 2025 and 2026 as effectively, regardless of downward changes to their estimates of late.

Such excellent earnings development ought to ship sturdy returns for Confluent, which is why traders wanting so as to add a development inventory to their portfolios ought to contemplate shopping for it earlier than shares recuperate from their current sell-off.

Must you make investments $1,000 in Confluent proper now?

Before you purchase inventory in Confluent, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Confluent wasn’t one in all them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $763,374!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 12, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Confluent. The Motley Idiot has a disclosure coverage.

1 Development Inventory Down 36% to Purchase Hand Over Fist Earlier than It is Too Late was initially printed by The Motley Idiot